A 108-month auto loan term is not a typical option offered by most lenders due to its extended duration. In general, the longest loan terms available are typically 72 months for new vehicles and 84 months for used vehicles.

Opting for such a lengthy loan term can result in significantly higher overall interest costs and may not be advisable for most borrowers. It is important to carefully consider the financial implications and explore shorter loan term options to save on interest and pay off the loan sooner.

Additionally, shorter loan terms can provide more flexibility and financial security in the long run.

Introduction To 108 Month Auto Loans

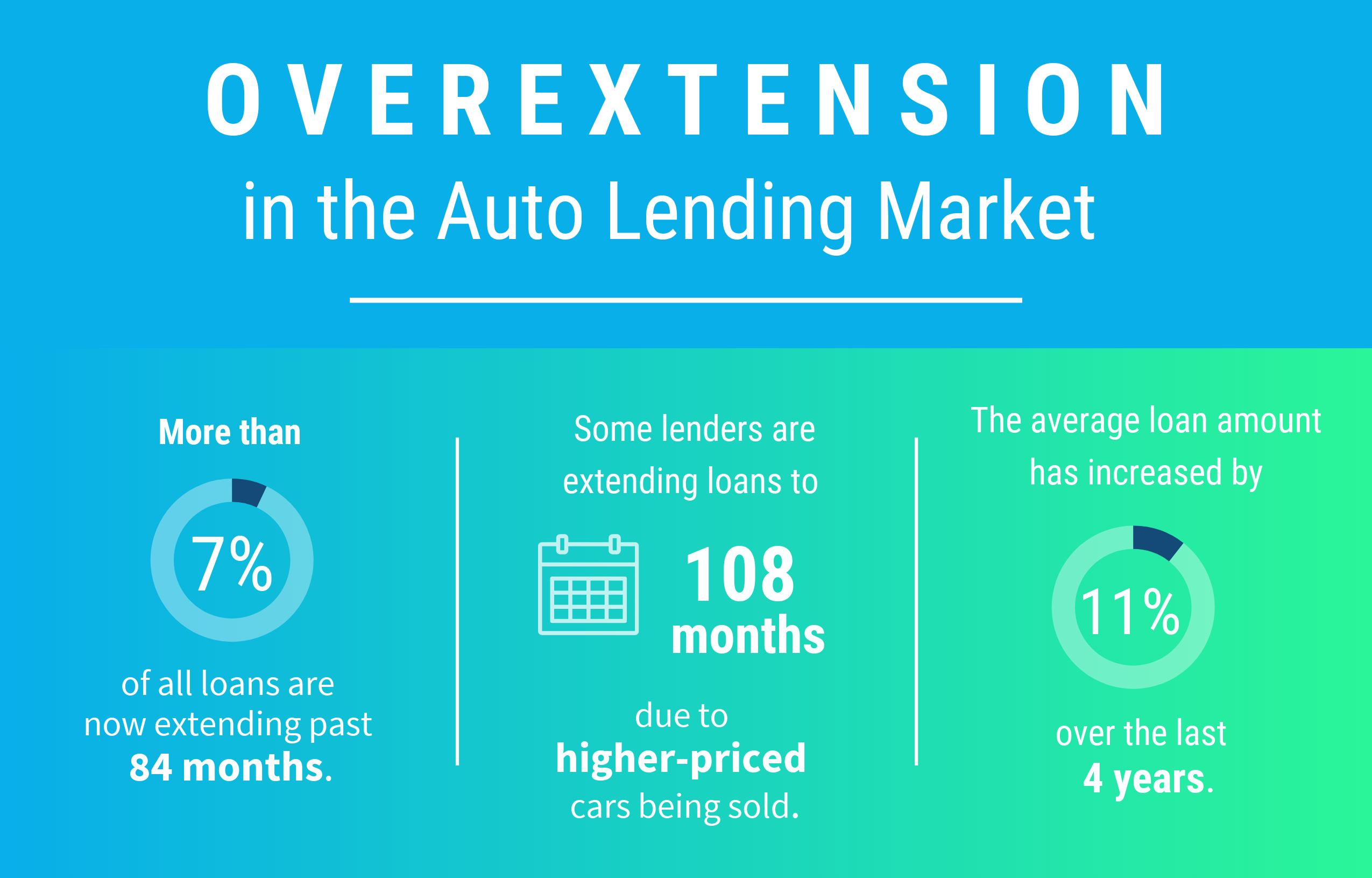

The 108 month auto loan is a type of long-term financing option that allows borrowers to spread their payments over an extended period of time. This type of loan is designed to make monthly payments more affordable by stretching out the repayment period. With rising vehicle prices, longer loan terms are becoming more popular as they offer lower monthly payments. However, it’s important for borrowers to carefully consider the total cost of the loan over the extended term, including the interest paid.

Benefits Of 108 Month Auto Loans

Considering a 108 month auto loan can lead to lower monthly payments compared to shorter loan terms. This extended timeline allows for improved cash flow management and may be more manageable for individuals with fluctuating incomes. It also provides the flexibility to invest in other financial goals while maintaining a reliable mode of transportation. By spreading the cost of the vehicle over a longer period, borrowers can align their payment schedule with their financial capabilities, reducing the risk of default. Additionally, the extended term can make it easier to afford a higher-priced vehicle while staying within a comfortable budget.

Drawbacks Of Extended Auto Loans

Extended auto loans can lead to higher overall interest costs due to the extended repayment period. This can result in borrowers paying significantly more in interest over the life of the loan. Additionally, committing to such a long-term financial obligation may lead to depreciation and negative equity. The vehicle’s value may depreciate faster than the loan balance decreases, potentially resulting in owing more than the car is worth. This can limit flexibility in selling or trading in the vehicle, leading to financial strain.

Credit: www.nafcu.org

Comparing Loan Terms

When comparing loan terms, it’s essential to consider the implications of a 108-month auto loan. The longer term may result in lower monthly payments, but it also means paying more in interest over time. It’s important to weigh the pros and cons before making a decision.

| Loan Term | Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|---|

| 36 months | 3.5% | $2,930 | $589 |

| 108 months | 5.0% | $1,217 | $5,748 |

Credit Score Implications

Credit Score Implications:

Effects on Credit Utilization: Taking out a 108-month auto loan can have a significant impact on your credit utilization ratio. This ratio is the amount of credit you are currently using divided by the total amount of credit you have available. With such a long repayment term, your overall credit utilization could increase, which could negatively affect your credit score.

Long-term Credit Impact: Additionally, a 108-month auto loan could have a long-term impact on your credit score. With such a lengthy repayment term, it could take years to pay off the loan, which means the loan will remain on your credit report for an extended period. This could negatively impact your credit history and credit score, potentially making it harder to obtain credit in the future.

Smart Tips For Managing A 108 Month Auto Loan

When managing a 108 Month Auto Loan, it’s crucial to choose a vehicle that aligns with your needs and budget. Consider the vehicle’s fuel efficiency and maintenance costs to make an informed decision.

Planning for prepayments can significantly reduce the interest paid over the life of the loan. Prioritize extra payments towards the principal amount to shorten the loan term.

Regular financial reviews are essential to ensure that the auto loan fits within your overall financial strategy. Monitor your budget and make adjustments as needed to comfortably manage the extended loan term.

Alternatives To 108 Month Auto Loans

When considering alternatives to a 108 month auto loan, it’s important to explore shorter loan durations. Shorter loan terms can lead to lower interest rates and reduced overall costs. Additionally, leasing vs. buying is another alternative to consider. Leasing a vehicle often requires lower monthly payments and provides the flexibility to upgrade to a new car more frequently. On the other hand, buying a car allows for ownership and customization, but typically involves higher monthly payments and longer loan terms. Both options have their advantages, so it’s essential to weigh the pros and cons based on individual needs and financial situations.

Credit: www.nationwide.com

Credit: m.facebook.com

Frequently Asked Questions

What Is The Longest Car Loan Possible?

The longest car loan typically spans up to 84 months, or 7 years, for financing a vehicle.

Is A 96-month Car Loan Bad?

A 96-month car loan can be risky due to higher interest costs and potential depreciation. Consider shorter loan terms for better financial stability and savings.

What Is The Best Number Of Months For A Car Loan?

The best number of months for a car loan is typically between 36 to 60 months. Shorter terms save on interest, while longer terms offer lower monthly payments. Balancing affordability and interest costs is key when choosing the loan term.

How Many Months Is A 7 Year Car Loan?

A 7-year car loan typically spans 84 months, providing a longer repayment period for borrowers.

Conclusion

Explore the pros and cons carefully before committing to a 108-month auto loan. Consider your financial situation and long-term goals. Remember, flexibility and financial stability are key. Make an informed decision that aligns with your needs. Your future self will thank you.