Veneers are typically not covered by insurance. The cost is usually out-of-pocket.

Veneers are a popular cosmetic dental procedure used to improve the appearance of teeth. They are thin, custom-made shells designed to cover the front surface of the teeth. While they can provide a significant enhancement to a person’s smile, the cost of veneers is a common concern for many individuals considering this treatment.

One of the frequently asked questions is whether veneers are covered by insurance. In general, most dental insurance plans do not cover the cost of veneers because they are considered a cosmetic procedure. However, there may be exceptions, and it’s always advisable to check with your insurance provider to understand your specific coverage. We will explore the typical insurance coverage for veneers and discuss alternative payment options for this popular dental treatment.

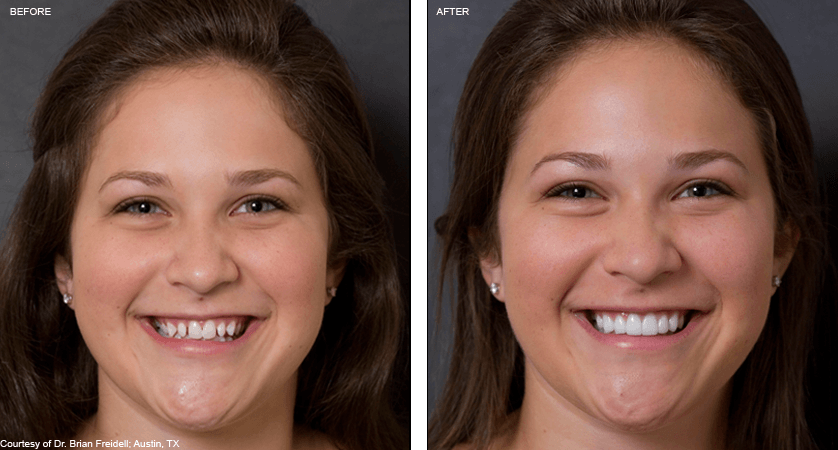

Credit: exquisitedentistryla.com

Introduction To Dental Veneers

Dental veneers are a popular cosmetic treatment that can fix a variety of dental imperfections. Unfortunately, most insurance plans do not cover the cost of veneers, as they are considered a cosmetic procedure. Patients should check with their insurance provider to confirm their coverage.

What Are Veneers?

Dental veneers are thin, custom-made shells that are designed to cover the front surface of your teeth. They are typically made from porcelain or composite resin materials and are bonded to the teeth to improve their appearance. Veneers can be used to correct a variety of dental imperfections, including discoloration, chipped or broken teeth, uneven spacing, and misalignment.

Why Choose Veneers?

Veneers offer a convenient and effective solution for individuals who want to enhance their smile. They provide a natural-looking and long-lasting result, making them a popular choice among those seeking cosmetic dental treatments. Additionally, veneers are stain-resistant, which means they can help maintain a bright and vibrant smile. With proper care and regular dental check-ups, veneers can last for many years, making them a worthwhile investment in your oral health and self-confidence.

The Cost Factor

When considering veneers, the cost factor is a crucial aspect to evaluate. Understanding the average cost of veneers and the factors influencing the price can help you make an informed decision about this dental procedure.

Average Cost Of Veneers

The average cost of veneers ranges from $925 to $2,500 per tooth. This cost may vary depending on the type of veneers, the location of the dental practice, and the experience of the dentist.

Factors Influencing The Price

- Type of Veneers: Porcelain veneers are typically more expensive than composite veneers due to their durability and natural appearance.

- Location: Dental practices in urban areas may charge higher fees compared to those in rural areas.

- Dentist’s Expertise: Experienced dentists may charge higher fees for their skill and precision in applying veneers.

- Additional Procedures: If preliminary dental work such as teeth whitening or gum contouring is required, it can add to the overall cost.

- Insurance Coverage: Dental insurance plans may partially cover the cost of veneers, reducing the financial burden on the patient.

Insurance And Cosmetic Dentistry

Cosmetic dentistry has gained popularity in recent years, with many people seeking to improve the appearance of their smiles through procedures like veneers. When it comes to insurance coverage, the topic of cosmetic dentistry can be a bit murky. Let’s delve into the relationship between insurance and cosmetic procedures.

General Stance Of Insurance On Cosmetic Procedures

Insurance typically does not cover elective cosmetic procedures like veneers. Most insurance plans consider cosmetic dentistry as optional and not essential for one’s health.

However, there are instances where insurance may provide partial coverage for cosmetic procedures if they are deemed medically necessary for functional or health reasons.

Exceptions To The Rule

Some exceptions exist where insurance may cover veneers. Situations where veneers are needed to restore function due to injury or certain medical conditions might be eligible for coverage.

It’s essential to consult with your insurance provider to understand the specific details of your coverage and any potential exceptions that may apply.

Veneers: Cosmetic Or Necessary?

Insurance coverage for veneers varies; they are usually considered cosmetic and not medically necessary. Some insurance plans may offer partial coverage for veneers if they are deemed necessary for oral health reasons. It’s advisable to check with your insurance provider for specific details.

Cases Where Veneers Are Deemed Necessary

Veneers are often seen as a cosmetic treatment since they can improve the appearance of teeth by changing their color, shape, or size. However, there are cases where veneers are deemed necessary for functional reasons. For example, if a patient has chipped or cracked teeth, veneers can protect them from further damage. Veneers can also be used to fix misaligned teeth, which can cause bite problems and jaw pain.The Gray Area Of Coverage

Insurance coverage for veneers is often a gray area, as it depends on the reason for getting them. If veneers are being used strictly for cosmetic purposes, insurance is unlikely to cover the cost. However, if the veneers are deemed medically necessary, insurance may cover a portion of the cost. It’s important to check with your insurance provider to understand their specific policies and requirements. In conclusion, while veneers are often seen as a cosmetic treatment, they can also be necessary for functional reasons. Insurance coverage for veneers is a gray area and depends on the reason for getting them. Patients should consult with their insurance provider to understand their specific coverage policies.Navigating Insurance Policies

When it comes to dental insurance, understanding the coverage for veneers can be confusing. Navigating insurance policies requires clear communication with your provider.

Understanding Your Dental Insurance

Review your dental insurance plan to determine if veneers are covered. Pay attention to coverage limits and any pre-authorization requirements.

Questions To Ask Your Insurance Provider

- Are veneers considered a cosmetic or medically necessary procedure?

- What percentage of the cost will be covered by my insurance?

- Is there a waiting period before I can get veneers?

- Do I need a pre-authorization or referral from my dentist?

Credit: drstonedds.com

Alternative Financing Options

Veneers are a cosmetic dental procedure, therefore, they are usually not covered by insurance. However, there are alternative financing options available such as payment plans or financing through third-party companies that can make veneers more affordable.

Alternative Financing Options: If you’re considering getting veneers, you might be wondering if your insurance will cover the cost. Unfortunately, many dental insurance plans don’t cover cosmetic procedures like veneers. However, there are alternative financing options available to help you pay for your veneers. Here are some options you might consider: Dental Discount Plans: Dental discount plans are membership-based programs that offer discounted rates on dental procedures, including veneers. These plans can be a good option if you don’t have dental insurance or if your insurance doesn’t cover veneers. With a dental discount plan, you’ll pay an annual fee to become a member and then receive discounted rates on all dental procedures, including veneers. The discounts can range from 10% to 60% depending on the plan you choose. Payment Plans: Many dental offices offer payment plans to help patients pay for expensive procedures like veneers. With a payment plan, you’ll make monthly payments over a set period of time, usually 6-12 months. The payments are usually interest-free, but some offices may charge a small finance fee. Payment plans can be a good option if you can’t afford to pay for your veneers all at once. Healthcare Credit Cards: Healthcare credit cards are credit cards that are specifically designed to help you pay for healthcare expenses, including dental procedures like veneers. These cards usually offer interest-free financing for a set period of time, usually 6-12 months. After the interest-free period ends, you’ll be charged interest on any remaining balance. Healthcare credit cards can be a good option if you need to finance your veneers over a longer period of time. In conclusion, if your dental insurance doesn’t cover veneers, there are alternative financing options available to help you pay for them. Dental discount plans, payment plans, and healthcare credit cards can all be good options depending on your financial situation. Be sure to talk to your dentist about your options and choose the one that works best for you.Preparing For Out-of-pocket Expenses

Prepare for potential out-of-pocket expenses when considering veneers, as they are typically not covered by insurance. Veneers are often viewed as cosmetic procedures, so coverage may vary. It’s crucial to check with your insurance provider before proceeding with veneer treatment.

Saving For Veneers

When it comes to getting veneers, it’s important to be prepared for the out-of-pocket expenses that may arise. While some dental insurance plans may cover a portion of the cost, it’s common for veneers to be considered a cosmetic procedure and therefore not covered.

If you’re considering getting veneers and are concerned about the financial aspect, saving up for the procedure is a wise step to take. By setting aside a specific amount each month, you can gradually accumulate the funds needed to cover the cost of veneers. This proactive approach can help alleviate any financial stress and ensure you’re fully prepared when the time comes to undergo the procedure.

Cost-benefit Analysis Of Veneers Without Insurance

If your dental insurance doesn’t cover veneers, it’s essential to conduct a cost-benefit analysis to determine if this cosmetic treatment is right for you. While veneers can provide significant aesthetic improvements, it’s important to consider the potential long-term costs and benefits.

On one hand, veneers can enhance your smile, boost your self-confidence, and improve your overall appearance. This can have a positive impact on various aspects of your life, from personal relationships to professional opportunities. However, it’s crucial to weigh these benefits against the cost of the procedure and the potential need for future maintenance or replacements.

Additionally, it’s important to consult with a reputable dentist who specializes in cosmetic dentistry to get an accurate understanding of the overall cost and potential risks involved. They can provide you with a detailed breakdown of the expenses, including any additional procedures or treatments that may be required before or after the veneer placement.

Ultimately, the decision to proceed with veneers without insurance coverage should be based on a thorough evaluation of your personal circumstances, financial capabilities, and desired outcomes. By carefully considering the cost-benefit analysis, you can make an informed decision that aligns with your goals and priorities.

Real Stories And Experiences

Looking for dental veneers covered by insurance? Real stories and experiences can shed light on the topic. Many insurance plans do not fully cover veneers, but some may offer partial coverage for medically necessary procedures. It’s important to check with your insurance provider to understand your specific coverage.

When it comes to dental procedures like veneers, one question that often arises is whether or not they are covered by insurance. To shed some light on this topic, let’s explore real stories and experiences of individuals who have undergone the veneers process.

Success Stories Of Veneers With Insurance

Many individuals have had successful experiences with veneers covered by insurance. Here are some inspiring stories:

- James: James had always been self-conscious about his stained and chipped teeth. After consulting with his dentist, he discovered that his insurance plan covered a portion of the cost for veneers. With the financial assistance, James was able to transform his smile and regain his confidence.

- Lisa: Lisa had misaligned teeth that affected her self-esteem. She researched different dental procedures and found that veneers were the best option for her. Thankfully, her insurance plan covered a significant portion of the cost, making it more affordable for her to achieve the smile she had always dreamed of.

- Michael: Michael had suffered from tooth discoloration due to medication he had taken as a child. He was hesitant to undergo any dental procedure due to the potential costs involved. However, his insurance plan covered veneers, allowing him to finally address his dental concerns and improve his overall oral health.

Navigating The Financial Challenge Without Insurance

While insurance coverage for veneers can be beneficial, not everyone has access to dental insurance. Here are some strategies individuals have used to navigate the financial challenge:

- Payment Plans: Some dental clinics offer flexible payment plans that allow patients to pay for veneers in installments. This option can make the procedure more affordable for those without insurance.

- Saving in Advance: Individuals who are planning to undergo veneers can start saving in advance to cover the costs. By setting aside a small amount each month, they can gradually accumulate the necessary funds.

- Exploring Financing Options: Another alternative is to explore financing options through third-party providers. These providers offer loans specifically for dental procedures, allowing individuals to receive the treatment they need and pay it off over time.

While insurance coverage for veneers can certainly make the process more accessible, there are options available for individuals without insurance to achieve their desired smile. By exploring different financial strategies, anyone can take the necessary steps towards improving their dental aesthetics and boosting their confidence.

Credit: wayzatadental.com

Frequently Asked Questions

Are Veneers Covered By Insurance?

Veneers may be partially covered by dental insurance depending on the plan. Some insurance companies may cover a portion of the cost if veneers are deemed medically necessary. It’s important to check with your insurance provider to understand the extent of coverage for veneers.

What Factors Determine Insurance Coverage For Veneers?

The extent of insurance coverage for veneers is influenced by factors such as the type of insurance plan, the reason for getting veneers, and any pre-existing dental conditions. The specific terms of your insurance policy and the recommended treatment plan from your dentist will also play a role.

How Can I Find Out If My Insurance Covers Veneers?

To determine if your insurance covers veneers, contact your insurance provider and inquire about the extent of coverage for cosmetic dental procedures. Your dentist may also assist by providing information about the treatment plan and submitting any necessary documentation to the insurance company on your behalf.

What If My Insurance Does Not Cover Veneers?

If your insurance does not cover veneers, there are alternative payment options available. Your dentist may offer financing plans or other arrangements to help make veneers more affordable. Additionally, it’s important to discuss the cost and payment options with your dental provider to explore potential solutions.

Conclusion

Understanding veneer coverage with insurance is crucial for dental patients. Research your plan’s specifics, consult your dentist, and clarify any uncertainties with your insurance provider. Being informed about coverage options can help you make confident decisions regarding your dental health and financial investment.