An Asset Depletion Loan is a mortgage program where lenders consider a borrower’s assets as income. This type of loan is designed for borrowers who have a high net worth but may have limited income.

Asset Depletion Loans are a popular option for borrowers who have significant assets but may not have the income to qualify for a traditional mortgage. This type of loan allows lenders to consider a borrower’s assets as income, which can help them qualify for a larger loan amount.

With an Asset Depletion Loan, borrowers can use their assets, such as investments, retirement accounts, and savings, as a source of income to help them qualify for a mortgage. This type of loan is particularly useful for retirees or those with irregular income streams. However, it’s important to note that Asset Depletion Loans typically come with higher interest rates and fees than traditional mortgages.

Introduction To Asset Depletion Loans

An asset depletion loan is a type of mortgage that allows borrowers to use their assets as a means of income qualification. This type of loan considers the borrower’s assets, such as savings, investments, and retirement accounts, as a source of income, allowing them to secure a mortgage even if their traditional income may not meet the standard requirements.

The Basics Of Asset-based Borrowing

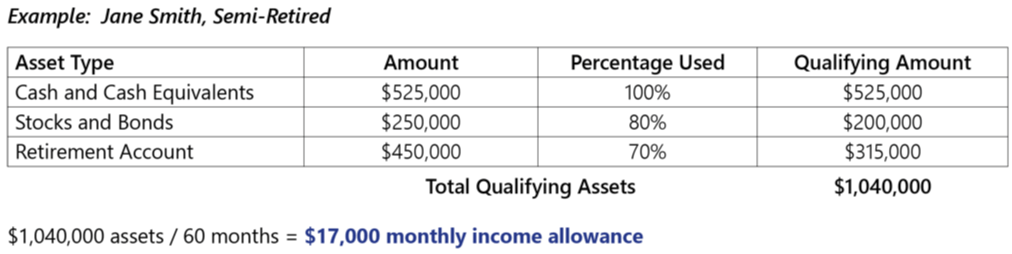

An asset depletion loan is based on the borrower’s liquid assets and typically calculates the available funds based on a percentage of the total. Lenders use a formula to determine the income generated by the assets, which is then added to the borrower’s traditional income to establish their overall qualification for the loan.

Potential Borrowers For This Loan Type

Asset depletion loans are suitable for individuals with significant assets but irregular income streams, such as retirees, entrepreneurs, or those with substantial investments. These borrowers may find it challenging to qualify for a traditional mortgage based on their income alone, making asset depletion loans a viable option to secure financing for a home purchase.

Credit: dreamhomefinancing.com

How Asset Depletion Loans Work

Asset Depletion Loans provide a unique borrowing option for individuals with substantial assets but limited income. These loans allow applicants to use their assets as a source of income, qualifying them for a loan based on their total asset value.

Calculating Loan Amounts

Loan amounts are calculated based on the borrower’s total assets, typically excluding retirement accounts. Lenders apply an annual depletion rate to the assets to determine the income stream that can be used for qualification purposes.

The Role Of Asset Liquidity

Asset liquidity plays a crucial role in the approval process for Asset Depletion Loans. Lenders assess the liquidity of assets to ensure that they can be easily converted into cash if needed to meet the loan obligations.

Benefits Of Asset Depletion Mortgages

Asset Depletion Mortgages offer various advantages to borrowers, making them a valuable financial tool. Let’s explore the key benefits:

Wealth Accessibility

Asset Depletion Loans provide accessibility to funds secured against one’s assets.

Credit Score Flexibility

These loans offer flexibility in credit score requirements, making them accessible to a wider range of borrowers.

Qualifying Assets For Depletion Loans

Qualifying assets for depletion loans are an essential aspect of securing financing for individuals who may have a substantial net worth but limited income. Asset depletion loans enable borrowers to use their assets as a basis for loan qualification, allowing them to tap into their wealth to secure a mortgage or other types of loans. When it comes to asset depletion loans, understanding the acceptable asset types, valuation, and documentation requirements is crucial to the loan approval process.

Acceptable Asset Types

When applying for an asset depletion loan, it’s important to know which types of assets are considered acceptable by lenders. Acceptable assets typically include cash, stocks, bonds, retirement accounts, real estate, and other investments. Lenders may have specific criteria regarding the type and liquidity of assets, so it’s essential to work with a knowledgeable loan officer who can guide you through the process.

Valuation And Documentation

Valuation and documentation of assets play a significant role in the approval of asset depletion loans. Lenders require accurate valuation of assets to determine the borrower’s eligibility and loan amount. Appraisals, account statements, and other documentation may be necessary to support the valuation of assets. It’s important to gather all required documentation and ensure that the valuation of assets meets the lender’s criteria.

Comparing Asset Depletion To Traditional Loans

When comparing Asset Depletion to traditional loans, it’s important to consider the differences in interest rates and terms. Asset Depletion loans may have slightly higher interest rates due to the unique nature of the collateral being considered. However, the terms of the loan can be more flexible, allowing for a tailored repayment schedule based on the borrower’s specific financial situation.

Asset Depletion loans and traditional loans differ in their approval processes. Traditional loans often focus heavily on credit scores and income verification, whereas Asset Depletion loans prioritize the value of the borrower’s assets. This can make the approval process more accessible for individuals with substantial assets but unconventional income sources.

Credit: lendsure.com

Strategies For Maximizing Loan Potential

When considering an Asset Depletion Loan, it’s crucial to maximize the potential of your assets. Here are some effective strategies to help you make the most of this financial opportunity:

Diversifying Assets

Diversification is key to optimizing your asset portfolio for an Asset Depletion Loan. Ensure you have a mix of liquid assets like cash, stocks, and bonds, as well as illiquid assets such as real estate and retirement accounts.

Asset Management Best Practices

Implement proactive asset management strategies to showcase the full value of your assets. Regularly review and update your asset portfolio to maintain optimal liquidity and value appreciation.

Risks And Considerations

Asset Volatility Impact

Asset depletion loans are subject to fluctuations in the value of assets used as collateral.

Tax Implications

There are potential tax consequences associated with asset depletion loans.

Credit: fastercapital.com

Real-world Applications

Asset depletion loans have a wide range of real-world applications across various industries and scenarios. Let’s explore some examples of how this financial tool is utilized in practice.

Case Studies

Asset depletion loans have been particularly beneficial in enabling individuals with substantial assets but limited income to qualify for mortgages. For instance, a retired couple with significant savings but minimal monthly income may use asset depletion to secure a home loan.

Industry-specific Uses

Real estate developers often leverage asset depletion loans to finance new projects without having to liquidate existing assets. Additionally, entrepreneurs in the hospitality industry have utilized this financial strategy to secure funding for property acquisitions without compromising their liquidity.

Navigating The Application Process

Navigating the application process for an Asset Depletion Loan can seem daunting at first, but breaking it down into manageable steps can simplify the journey.

Required Documentation

When applying for an Asset Depletion Loan, gathering the necessary documentation is crucial. Ensure you have recent bank statements, tax returns, and proof of assets ready.

Choosing The Right Lender

Selecting the right lender is key to a successful loan application. Research potential lenders, compare interest rates, and consider their experience with Asset Depletion Loans.

Future Of Asset Depletion Loans

The future of Asset Depletion Loans is poised for significant evolution, driven by market trends and regulatory changes. As the lending landscape continues to adapt to the needs of borrowers, Asset Depletion Loans are likely to undergo transformative shifts, offering new opportunities and challenges for both lenders and borrowers.

Market Trends

The market trends for Asset Depletion Loans are witnessing a shift towards greater flexibility and inclusivity. Lenders are increasingly recognizing the value of considering a borrower’s overall financial picture, including assets that may not traditionally be included in loan qualification assessments. This trend is paving the way for a more holistic approach to lending, where individuals with substantial assets but limited income can still access financing based on their overall financial position.

Regulatory Changes

Regulatory changes in the lending industry are playing a pivotal role in shaping the future of Asset Depletion Loans. With a focus on consumer protection and fair lending practices, regulatory bodies are reevaluating the criteria for loan eligibility to ensure that borrowers are not unduly disadvantaged due to unconventional income sources or asset portfolios. These changes are likely to contribute to a more inclusive lending environment, opening doors for individuals with diverse financial profiles to access financing options.

Frequently Asked Questions

What Is An Asset Depletion Loan?

An asset depletion loan is a type of mortgage where lenders consider the borrower’s assets, such as savings and investments, as income. This allows borrowers with a low income to qualify for a higher loan amount. However, not all lenders offer this type of loan, and it may come with higher interest rates and fees.

How Does Fannie Mae Calculate Asset Depletion?

Fannie Mae calculates asset depletion by dividing the total amount of assets by the number of months in the loan term. The resulting figure is then multiplied by 70% to determine the amount of monthly income that can be considered for underwriting purposes.

This is known as the asset depletion income calculation.

Can I Get A Loan Based On My Assets?

Yes, you can obtain a loan using your assets as collateral. This type of loan is known as a secured loan and typically offers lower interest rates. It’s important to carefully consider the risks involved with using your assets as collateral before proceeding.

What Is Asset Depletion Income For Fha Loan?

Asset depletion income for FHA loan is a method where assets are used to calculate income.

Conclusion

Asset depletion loans offer a valuable solution for individuals with high-value assets but limited income. By leveraging their assets, borrowers can access funds for various needs, without liquidating their investments. This flexible financing option provides an alternative to traditional loans, catering to a diverse range of financial situations.