BFCU offers competitive car loan rates. Customers can easily check the current rates online.

Are you in the market for a new car and considering financing options? Brazosport Federal Credit Union (BFCU) provides attractive car loan rates to help you make your dream car a reality. With their user-friendly website, you can conveniently view the latest rates and find a deal that suits your budget.

Whether you’re purchasing a new or used vehicle, BFCU’s competitive rates and flexible terms make it a top choice for savvy borrowers. Read on to discover how BFCU can assist you in driving away with your ideal car without breaking the bank.

Bfcu Car Loan Rates: Your Key To Affordable Driving

Bfcu Car Loan Rates: Your Key to Affordable Driving

When it comes to purchasing a new or used car, finding the right financing solution is crucial. With BFCU car loan rates, you can unlock the key to affordable driving. Let’s explore how these competitive rates can benefit you and how they compare with the market.

Competitive Rates And How They Benefit You

BFCU offers competitive car loan rates that can significantly benefit you. With lower interest rates and favorable terms, you can save money on your car financing. This means more affordable monthly payments and overall cost savings, allowing you to drive the car of your dreams without breaking the bank.

Comparing Bfcu Rates With The Market

When comparing BFCU car loan rates with the market, it’s evident that BFCU offers some of the most competitive rates available. By choosing BFCU for your car financing, you can take advantage of lower interest rates and better terms, giving you a distinct edge in securing affordable and reliable transportation.

Eligibility Criteria For Bfcu Car Loans

When considering a car loan from BFCU, it’s essential to understand the eligibility criteria. Below are the requirements you need to meet to qualify for a BFCU car loan.

Membership Requirements

- Must be a member of BFCU.

- Open a savings account with a minimum deposit.

- Provide necessary identification documents.

Credit Score Considerations

- BFCU considers credit score for loan approval.

- Good credit history increases chances of approval.

- Higher scores may lead to lower interest rates.

Navigating The Loan Application Process

Applying for a car loan can be an overwhelming process, especially with the numerous options available. However, with a clear understanding of the steps involved and the necessary documents, you can navigate the loan application process with ease.

Step-by-step Guide To Applying

When applying for a car loan at BFCU, follow these simple steps to streamline the process:

- Visit the BFCU website or branch to access the car loan application form.

- Fill out the application form with accurate personal and financial information.

- Submit the completed application form along with the required documents.

- Wait for the loan approval notification from BFCU.

- Upon approval, review the terms and conditions of the loan before signing the agreement.

- Once the agreement is signed, the funds will be disbursed, and you can start shopping for your desired vehicle.

Documents You Need To Prepare

Before initiating the car loan application process, ensure you have the following documents ready:

- Valid identification such as a driver’s license or passport.

- Proof of income, such as recent pay stubs or tax returns.

- Details of the vehicle you intend to purchase, including the purchase price and VIN.

- Information about your current debts and financial obligations.

- Proof of residence, such as utility bills or a lease agreement.

Understanding Loan Terms And Conditions

Discover the ins and outs of BFCU car loan rates by delving into the loan terms and conditions. Understanding these details is crucial for making informed decisions and ensuring a smooth borrowing experience. Stay informed and empowered when navigating through BFCU’s car loan offerings.

Understanding Loan Terms and Conditions Interest Rates Explained Interest rates play a significant role in determining the overall cost of your car loan. It’s crucial to understand how interest rates can impact your monthly payments and the total amount you’ll pay over the life of the loan. Typically, interest rates are expressed as an annual percentage of the loan amount. The higher the interest rate, the more you’ll pay in interest over time. Conversely, a lower interest rate can help you save money on your car loan. Repayment Plan Options When it comes to repaying your car loan, you’ll have several options to choose from. These may include repayment plans such as fixed monthly payments, bi-weekly payments, or accelerated payments. Understanding the different repayment plan options can help you select the one that best fits your budget and financial goals. It’s essential to evaluate each option carefully to determine which plan aligns with your repayment capabilities and financial objectives. With a clear understanding of loan terms and conditions, including interest rates and repayment plan options, you can make informed decisions when obtaining a car loan. By comparing the various terms offered by lenders, you can select a loan that suits your needs and ensures a favorable financial outcome.Maximizing Savings With Bfcu Refinancing Options

When To Consider Refinancing

Refinancing your car loan with BFCU can be a smart move when you find yourself in a position to secure a lower interest rate than your current loan. This could be due to an improved credit score, favorable market rates, or a change in your financial situation. By refinancing at the right time, you can save money and reduce your monthly payments, making it a financially savvy decision.

Long-term Benefits Of Lower Interest Rates

Securing a lower interest rate through BFCU’s refinancing options can lead to significant long-term savings. A reduced interest rate means you’ll pay less over the life of the loan, resulting in more money staying in your pocket. Lower monthly payments also contribute to your financial well-being, allowing you to allocate those funds towards other priorities or savings goals.

Credit: www.bfcu.org

Additional Perks And Benefits Of Bfcu Car Loans

When it comes to car loans, BFCU offers more than just competitive interest rates. In addition to helping you finance your dream car, BFCU car loans come with a range of additional perks and benefits designed to give you peace of mind and protect your investment.

Insurance And Warranty Options

BFCU understands that protecting your vehicle is essential. That’s why they offer a variety of insurance and warranty options to safeguard your car against unexpected events. From comprehensive insurance coverage to extended warranty plans, BFCU provides a range of choices to suit your individual needs. By offering these options, BFCU ensures that you can drive with confidence, knowing that your investment is protected.

Loan Protection Plans

When you take out a car loan with BFCU, you can also benefit from their loan protection plans. These plans are designed to provide financial security in case of unforeseen circumstances such as disability, involuntary unemployment, or even the loss of life. With BFCU‘s loan protection plans, you can rest assured that you and your loved ones are safeguarded, and your financial commitments are taken care of.

Expert Tips On Choosing The Right Loan Package

Discover expert advice for selecting the ideal loan package, including valuable insights on BFCU car loan rates. Gain valuable tips to make informed financial decisions.

Assessing Your Financial Situation

Before applying for a car loan, evaluate your income, expenses, and credit score.

- Calculate your budget for monthly payments.

- Check your credit report for any errors.

Customizing Your Loan Features

Tailor the loan to fit your needs by considering the following:

- Choose between a fixed or variable interest rate.

- Select a suitable loan term based on your financial goals.

Compare BFCU car loan rates and terms to find the best option for you.

Credit: www.bfcu.org

Real Member Experiences: Testimonials And Success Stories

Explore real member testimonials and success stories showcasing the competitive BFCU car loan rates. Discover how members secured their dream vehicles with favorable rates and flexible terms, making their car ownership journey a smooth and affordable experience.

How Bfcu Car Loans Made A Difference

BFCU car loans have made a significant impact on the lives of our members, providing them with the means to achieve their automotive dreams. The competitive interest rates and flexible terms offered by BFCU have empowered individuals to purchase their desired vehicles without breaking the bank. Members have expressed their satisfaction with the seamless application process and the exceptional customer service provided by BFCU throughout the loan period. The simplicity and efficiency of the loan approval process have played a pivotal role in helping members secure their dream cars with ease.Members’ Advice For Prospective Borrowers

Our members have shared valuable insights and advice for those considering a car loan with BFCU. Many recommend diligently researching the available loan options and comparing rates to ensure that they secure the most favorable terms. They emphasize the importance of understanding the loan terms and conditions, including the repayment schedule and any associated fees. Moreover, members stress the significance of maintaining a healthy credit score to enhance their eligibility for competitive loan rates. Their experiences serve as a testament to the positive impact of BFCU car loans and provide valuable guidance for prospective borrowers.Staying Informed: Keeping Up With Rate Changes

When it comes to car loans, staying informed and up-to-date with rate changes is essential. By keeping a close eye on market trends and taking advantage of the resources and support offered by BFCU, you can ensure that you’re getting the best possible deal on your car loan. In this section, we’ll take a closer look at how you can stay informed and make the most of your car loan.

Monitoring Market Trends

One of the best ways to stay informed about car loan rates is to monitor market trends. By keeping an eye on interest rates and other financial indicators, you can get a better sense of where rates are headed and whether it’s a good time to apply for a car loan. Some of the key factors to watch include:

- The Federal Reserve’s benchmark interest rate

- The Consumer Price Index (CPI)

- The unemployment rate

- The housing market

By paying attention to these and other indicators, you can get a sense of how the economy is performing and how it might impact car loan rates.

Bfcu Resources And Support

In addition to monitoring market trends, BFCU offers a range of resources and support to help you stay informed about car loan rates. These include:

- The BFCU website, where you can find information about current rates, as well as tips for getting the best possible deal on your car loan.

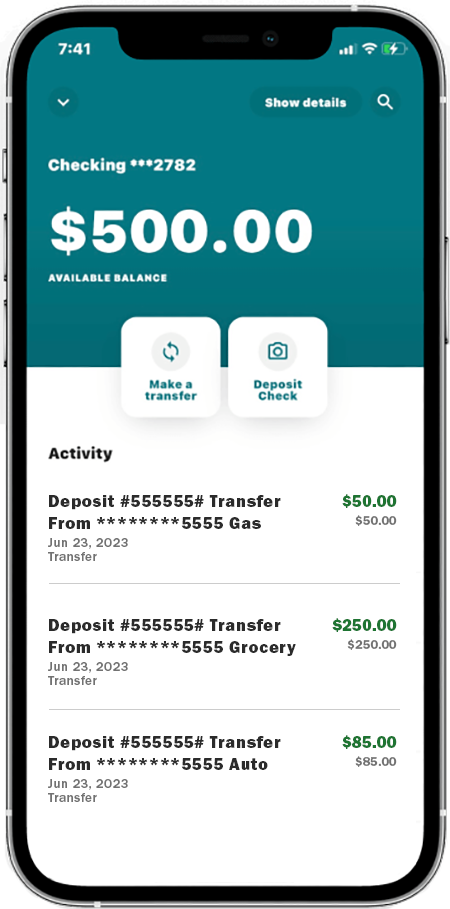

- The BFCU mobile app, which allows you to easily manage your car loan and stay up-to-date with rate changes.

- BFCU customer service, which is available to answer any questions you may have about car loans or other financial products.

By taking advantage of these resources and support, you can stay informed and make the most of your car loan.

Overall, staying informed about car loan rates is essential if you want to get the best possible deal on your car loan. By monitoring market trends and taking advantage of the resources and support offered by BFCU, you can ensure that you’re getting the best possible rate and making the most of your car loan.

Conclusion: Steering Towards Your New Car With Bfcu

Steer towards your dream car with BFCU’s competitive car loan rates. Get the best deals and flexible payment options tailored to your needs. Apply now and get on the road to your new ride!

Recap Of Bfcu Loan Advantages

BFCU car loan rates offer competitive terms and flexible repayment options.

- Low rates help you save money over the life of your loan.

- Quick approval process gets you behind the wheel faster.

- Personalized service ensures your needs are met.

Next Steps To Secure Your Loan

Ready to drive off in your dream car? Follow these steps:

- Contact BFCU to discuss your loan options.

- Submit your application and required documents.

- Receive approval and finalize your loan details.

- Get ready to hit the road in your new vehicle!

Credit: www.bethpagefcu.com

Frequently Asked Questions

What Is The Best Auto Loan Rate Right Now?

The best auto loan rate right now varies, but generally, rates around 2% to 3% are considered competitive. It’s important to shop around and compare offers from different lenders to find the best rate for your specific financial situation.

What Is The Interest Rate For Bethpage?

The interest rate for Bethpage varies based on the type of account you have. Contact Bethpage for current rates.

What Is Chase’s Current Auto Loan Rate?

Chase’s current auto loan rate varies based on factors like credit score and loan term. Contact Chase directly for the most accurate and up-to-date information.

What Is The Highest Auto Loan Interest Rate Allowed?

The highest auto loan interest rate allowed varies by lender, but it can range from 18% to 25% in most cases. It’s important to shop around for the best rates before committing to a loan.

Conclusion

With competitive rates and flexible terms, BFCU is your go-to for car loans. Don’t miss out on their low APRs and easy application process. Make your car buying experience stress-free with BFCU’s reliable financing options. Trust BFCU to help you hit the road in style.