A blank Progressive Insurance card is a document that has not been filled out with policy details. It serves as proof of insurance.

When you receive a blank card, it is essential to complete it promptly to ensure you have the necessary information in case of an accident or other need for verification. Filling out the card accurately with your policy details will help you comply with legal requirements and provide the necessary information to others as needed.

It is crucial to keep this card in your vehicle at all times as proof of insurance coverage. Remember to update it whenever there are changes to your policy.

Credit: progressive-declarations-page.pdffiller.com

Introduction To Progressive Insurance Cards

Learn about the benefits of a blank Progressive insurance card. Progressive insurance cards offer convenience and flexibility for policyholders. With a blank card, you can easily access and provide essential insurance information whenever needed.

Introduction to Progressive Insurance Cards Carrying a valid insurance card is crucial for all drivers. Progressive Insurance Cards serve as proof of insurance coverage and provide essential information. It is essential to understand the significance of these cards and the legal obligations associated with them.

The Importance Of Carrying An Insurance Card

Having an insurance card readily available can help in situations where proof of insurance is required. In case of accidents or traffic stops, an insurance card provides necessary details to the parties involved. It ensures a smooth process and compliance with legal requirements.

Legal Requirements For Insurance Documentation

State laws mandate drivers to carry valid insurance documentation at all times. Failing to provide proof of insurance when requested by authorities can lead to penalties. It is essential to have an up-to-date insurance card to meet these legal obligations.

Blank Progressive Insurance Card Features

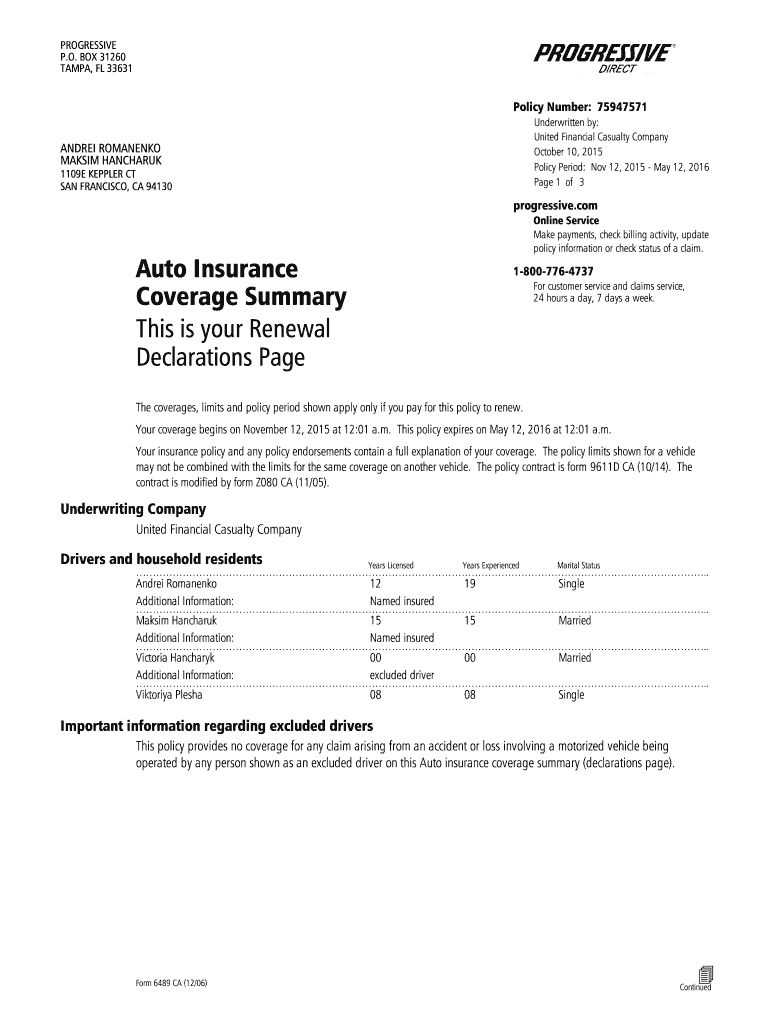

A blank Progressive insurance card is a vital document that serves as proof of insurance coverage. It is essential to possess an insurance card to avoid any legal complications in case of accidents. The blank Progressive insurance card features a variety of elements that make it unique and secure.

Key Information Displayed

The blank Progressive insurance card displays key information that is crucial for identification and insurance coverage. The card typically includes the policyholder’s name, policy number, and the effective and expiration dates of the policy. In addition, the card may also include the make and model of the insured vehicle, the vehicle identification number (VIN), and the name of the insurance company.

Security Elements To Prevent Fraud

Progressive insurance cards have several security features that prevent fraud and ensure the authenticity of the card. Some of these security features include:

- Microprint: The card contains microprint text that is too small to read with the naked eye, making it difficult to counterfeit.

- Watermarks: The card has a watermark that is visible when held up to the light, making it challenging to copy.

- UV Ink: The card has invisible ink that can only be seen under ultraviolet light, making it challenging to duplicate.

- Holograms: The card has a hologram that adds an extra layer of security and makes it challenging to counterfeit.

These security features ensure that the blank Progressive insurance card is not easily duplicated and is a reliable document for proof of insurance coverage.

Accessing Your Progressive Insurance Card

Online Portal

Log in to your Progressive account and navigate to the documents section to access your insurance card.

Mobile App Use

Download the Progressive app, sign in, and easily view and save your insurance card on your mobile device.

Requesting A Physical Copy

If you prefer a physical copy, contact Progressive customer service to request one to be mailed to you.

Credit: formspal.com

How To Fill Out A Blank Progressive Card

Filling out a blank Progressive insurance card may seem like a straightforward task, but it’s important to ensure the information is accurate and complete. Whether you’re a new policyholder or need to update your existing card, following the correct steps is crucial. In this guide, we’ll walk you through the process of filling out a blank Progressive insurance card, as well as highlight common mistakes to avoid.

Step-by-step Instructions

When filling out a blank Progressive insurance card, it’s essential to provide accurate and up-to-date information. The following step-by-step instructions will help you complete the card correctly:

- Policyholder Information: Fill in your full name, address, and contact details in the designated fields on the card.

- Policy Details: Enter your policy number and effective dates as specified in your insurance policy documents.

- Vehicle Information: Include the make, model, year, and vehicle identification number (VIN) of the insured vehicle.

- Authorized Drivers: List the names of all authorized drivers covered by the policy, if applicable.

- Agent Contact: If provided, enter the contact information for your Progressive insurance agent.

Common Mistakes To Avoid

When filling out a blank Progressive insurance card, it’s important to be mindful of potential errors that could impact the validity of the card. Here are some common mistakes to avoid:

- Incorrect Policy Information: Double-check that the policy number and effective dates match your current insurance policy to avoid discrepancies.

- Incomplete Vehicle Details: Ensure all relevant vehicle information, including the VIN, is accurately recorded on the card.

- Omitting Authorized Drivers: If there are additional authorized drivers, be sure to include their names to ensure coverage.

- Outdated Contact Information: Verify that your address and contact details are current and reflect the information on file with Progressive.

Printable Vs. Digital Insurance Cards

When it comes to managing your insurance information, you have the option of using either a printable or digital insurance card. Both formats have their own set of benefits and drawbacks, and choosing between them ultimately depends on your individual preferences and needs.

Pros And Cons Of Each Format

Let’s take a closer look at the advantages and disadvantages of printable and digital insurance cards.

How To Decide What’s Best For You

When deciding which format is best for you, consider your lifestyle and how you prefer to access and manage important documents.

Credit: documentplug.com

Using Your Progressive Card In Different Scenarios

Traffic Stops And Accidents

When you encounter a traffic stop or accident, having your Progressive insurance card readily available is crucial. It provides the necessary proof of insurance coverage to present to law enforcement officers or other involved parties.

In the event of an accident, the card also contains essential contact information for Progressive, making it easier to initiate the claims process as quickly as possible.

Car Rentals And Travel

When renting a car or traveling, your Progressive insurance card serves as proof of insurance coverage, enabling you to confidently drive or navigate various destinations.

In some cases, rental car companies may require additional verification, so it’s advisable to contact Progressive beforehand to ensure a smooth rental experience.

Lost Or Stolen Insurance Cards

Discovering that your insurance card has been lost or stolen can be a stressful experience. However, taking immediate action and implementing preventive measures for the future can help alleviate some of the anxiety associated with this situation.

Immediate Steps To Take

Upon realizing that your insurance card is lost or stolen, it’s crucial to take immediate action to safeguard yourself and your coverage. Follow these steps:

- Contact your insurance provider to report the loss or theft and request a replacement card.

- File a report with local law enforcement if the card was stolen, providing as much detail as possible.

- Monitor your insurance statements and credit reports for any unusual activity that may indicate fraudulent use of your insurance information.

- Consider placing a fraud alert or credit freeze with the major credit bureaus to protect against potential identity theft.

Preventive Measures For The Future

Implementing preventive measures can help minimize the risk of future incidents involving lost or stolen insurance cards. Consider the following tips:

- Make digital copies of your insurance card and store them securely on your electronic devices or in a cloud-based storage system.

- Regularly review your insurance statements to promptly identify any discrepancies or unauthorized charges.

- Avoid carrying your original insurance card unless necessary, opting instead for a photocopy or digital image when possible.

- Be cautious when sharing your insurance information and only provide it to trusted healthcare providers and authorized individuals.

Faqs About Progressive Insurance Cards

Learn about Blank Progressive Insurance Cards through these FAQs. Understand how to request, replace, or print a new card easily. Stay informed about the process and requirements for obtaining a replacement card.

Handling Expired Cards

If your Progressive Insurance card has expired, you can easily request a new one through your online account or by contacting Progressive customer service. It’s important to have an up-to-date insurance card with you at all times, as it serves as proof of insurance coverage in case of an accident or traffic stop.

Addressing Common Concerns

One common concern about Progressive Insurance cards is whether or not they are accepted by law enforcement. Rest assured, Progressive Insurance cards are considered valid proof of insurance in all 50 states. Another concern may be whether or not you need to carry a physical card with you at all times. While it’s not required by law, it’s always a good idea to have a physical copy of your insurance card in case your phone dies or you don’t have access to your online account. In conclusion, it’s important to keep your Progressive Insurance card up-to-date and with you at all times. If you have any concerns or questions about your insurance card, don’t hesitate to reach out to Progressive customer service for assistance.

Frequently Asked Questions

What Is The Progressive Font On Insurance Cards?

Progressive font on insurance cards is a unique feature displaying key information prominently for easy reading.

How Do I Find My Id Card On Progressive App?

To find your ID card on Progressive app, open the app, navigate to your policy, and select “View ID Card. “

Who Is Cheaper, Geico Or Progressive?

Geico and Progressive both offer competitive rates. Comparing quotes is the best way to determine which is cheaper for you.

What Cards Does Progressive Take?

Progressive accepts Visa, Mastercard, American Express, and Discover for insurance payments.

Conclusion

Having a blank Progressive insurance card can be a hassle. It’s crucial to have all necessary details filled in for emergencies. Keeping your card updated ensures seamless transactions and peace of mind. Remember, a complete insurance card is your safety net on the road.