Bounce house businesses need insurance to protect against liability claims and property damage. Insurance coverage is essential for safeguarding your assets and business operations.

As you establish your bounce house business, obtaining the right insurance coverage is crucial for mitigating risks and ensuring financial protection. Whether you are renting out bounce houses for events or operating a bounce house rental service, having the appropriate insurance in place can provide you with peace of mind.

Understanding the different insurance options available and selecting the most suitable coverage for your specific needs is vital for the long-term success and sustainability of your bounce house business. By investing in insurance, you can protect your business from potential legal and financial challenges that may arise.

Credit: www.cossioinsurance.com

Jumping Into Safety: Bounce House Business Insurance

Jumping into Safety: Bounce House Business Insurance is essential for any business owner who rents out bounce houses. Protect yourself, your employees, and your clients with comprehensive insurance coverage. Don’t take any chances when it comes to safety.

Jumping into Safety: Bounce House Business Insurance H3: The Necessity in Numbers When it comes to running a bounce house business, safety should always be the top priority. As an owner, you want to ensure that your customers have a fun and enjoyable experience while also being protected from any potential accidents or liabilities. That’s where bounce house business insurance comes in. Having the right insurance coverage for your bounce house business is not only a smart business decision, but it is also a legal requirement in many states. It provides financial protection against accidents, injuries, and property damage that may occur during the operation of your business. To understand the necessity of bounce house business insurance, let’s take a closer look at the numbers involved. According to the Consumer Product Safety Commission (CPSC), there were an estimated 18,000 injuries related to inflatable amusements in the United States in 2019 alone. These injuries ranged from minor cuts and bruises to more serious fractures and concussions. Without proper insurance coverage, your bounce house business could be held financially responsible for any medical expenses, legal fees, or property damage resulting from such incidents. This could lead to significant financial losses and potential lawsuits that could jeopardize the future of your business. H3: Types of Coverage Available When it comes to bounce house business insurance, there are several types of coverage available to protect your business and its assets. Here are some of the key types of insurance coverage you should consider: 1. General Liability Insurance: This coverage protects your business against third-party claims for bodily injury or property damage. It provides financial protection in case a customer gets injured while using your bounce house or if their property gets damaged during an event. 2. Product Liability Insurance: This type of coverage specifically protects your business against claims related to the products you sell or rent out, such as the inflatable bounce houses themselves. It provides financial protection in case a customer suffers an injury or damage due to a defect in the product. 3. Commercial Property Insurance: This coverage protects your business’s physical assets, including the bounce houses, office equipment, and storage facilities, against risks such as fire, theft, vandalism, or natural disasters. It helps cover the cost of repair or replacement if any of these assets are damaged or destroyed. 4. Business Interruption Insurance: This type of coverage provides financial protection in case your bounce house business is temporarily unable to operate due to a covered event, such as a fire or natural disaster. It helps cover the loss of income and ongoing expenses during the downtime. 5. Workers’ Compensation Insurance: If you have employees working for your bounce house business, workers’ compensation insurance is essential. It provides coverage for medical expenses and lost wages in case an employee gets injured or falls ill while on the job. By investing in the right insurance coverage for your bounce house business, you can ensure that you are well-prepared for any unforeseen circumstances that may arise. It not only protects your business and its assets but also provides peace of mind for both you and your customers. So, don’t overlook the importance of bounce house business insurance – jump into safety and safeguard your business today!Insurance Policies: A Closer Look

When running a bounce house business, it’s crucial to have the right insurance policies in place to protect your investment and mitigate potential risks. Let’s take a closer look at the essential insurance policies that every bounce house business owner should consider.

General Liability Insurance

General liability insurance is a fundamental policy that provides coverage for bodily injury, property damage, and personal injury claims that may arise during the operation of your bounce house business. It safeguards your business against lawsuits and medical expenses resulting from accidents or injuries that occur on your premises or as a result of your operations.

Property Insurance

Property insurance is designed to protect your physical assets, including bounce houses, inflatable slides, and other equipment, from risks such as fire, theft, vandalism, or natural disasters. This coverage ensures that your valuable business property is financially protected, enabling you to recover quickly in the event of unforeseen damage or loss.

Worker’s Compensation

Worker’s compensation insurance is essential if you have employees working for your bounce house business. It provides coverage for medical expenses, disability benefits, and lost wages in the event that an employee suffers a work-related injury or illness. This policy not only safeguards your employees but also shields your business from potential legal liabilities.

Risk Factors In The Bounce House Business

Operating a bounce house business can be a fun and profitable venture, but it also comes with its fair share of risks. Understanding and mitigating these risks is crucial to ensure the safety of both your customers and your business. In this blog post, we will explore the key risk factors involved in the bounce house business and discuss how proper insurance coverage can help protect your investment.

Injury Risks

Bounce houses are designed for children to jump and play in, but accidents can happen. From minor bumps and bruises to more serious injuries like sprains or fractures, there is always a risk of children getting hurt while using your bounce houses. Factors such as overcrowding, improper use, or equipment malfunctions can increase the likelihood of accidents.

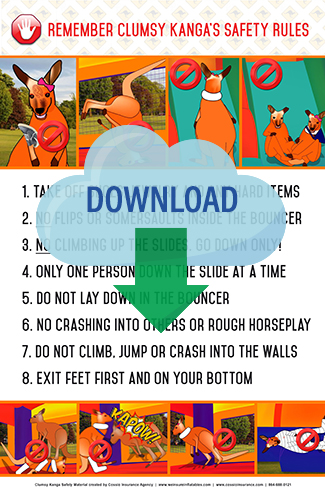

It is essential to have proper safety protocols in place to minimize the risk of injuries. This includes regular inspections of the bounce houses, ensuring they are set up correctly, and providing clear guidelines for safe use. Additionally, having liability insurance specifically tailored for bounce house businesses can provide financial protection in case of any unforeseen accidents.

Property Damage

While bounce houses are generally designed to withstand rough play, they are not indestructible. Over time, wear and tear can occur, increasing the risk of damage to the equipment. Additionally, extreme weather conditions or improper anchoring can lead to significant property damage.

Regular maintenance and inspections are crucial to identifying any potential issues with the bounce houses. This includes checking for tears, leaks, or weak spots in the structure. Investing in insurance coverage that includes property damage protection can help cover the costs of repairs or replacements in case of any unforeseen damage.

Weather-related Incidents

Weather conditions can pose a significant risk to bounce houses. Strong winds, heavy rain, or extreme temperatures can affect the stability and safety of the inflatable structures. It is essential to closely monitor weather forecasts and take appropriate action to protect your bounce houses and customers.

Having a clear understanding of weather-related risks and implementing safety measures, such as deflating and securing the bounce houses during adverse weather conditions, is crucial. Insurance coverage that includes weather-related incident protection can help cover the costs of any damage caused by unpredictable weather events.

Overall, being aware of the risk factors involved in the bounce house business is essential for ensuring the safety of everyone involved. By implementing proper safety protocols and investing in comprehensive insurance coverage, you can protect your business and provide peace of mind to your customers.

Credit: www.xinsurance.com

Cost Considerations For Insurance

When setting up a bounce house business, one crucial aspect to consider is insurance. Understanding the cost considerations for insurance can help you make informed decisions to protect your business. The expenses associated with insurance can vary based on several factors, so it’s essential to delve into the specifics to ensure you are adequately covered without breaking the bank.

Average Premium Costs

Insurance premiums for bounce house businesses typically range from $500 to $2000 annually. The exact cost depends on various elements such as coverage limits, location, business size, and claims history. It’s advisable to obtain quotes from multiple insurance providers to compare prices and coverage options.

Factors Influencing Insurance Rates

- Business Size: Larger bounce house businesses may face higher insurance premiums due to increased liability risks.

- Location: Operating in areas prone to accidents or natural disasters could lead to higher insurance rates.

- Claims History: A history of previous claims can result in elevated insurance costs for your bounce house business.

- Coverage Limits: Opting for higher coverage limits will generally lead to higher premiums but can provide greater protection.

Navigating Claims And Payouts

Navigating claims and payouts can be a complex process for bounce house business owners who have invested in insurance coverage. It is important to understand the policy details and requirements to ensure a smooth and timely payout in the event of a claim.

Filing A Claim

Filing a claim for your bounce house business insurance can be a stressful process if you don’t know what to expect. It’s important to file a claim as soon as possible after an incident occurs. The first step is to contact your insurance provider and provide them with all the necessary details about the incident. This includes the date, time, location, and any other relevant information that can help with the claim process. Once the claim is filed, the insurance company will assign an adjuster to investigate the incident and determine the extent of the damage. The adjuster will also review your policy to ensure that the incident is covered under your insurance. It’s important to be honest and provide as much information as possible during this process.Understanding Payout Processes

After the adjuster has completed their investigation, they will determine the payout amount for your claim. The payout amount will depend on the extent of the damage and the coverage outlined in your insurance policy. It’s important to review your policy and understand your coverage before filing a claim so that you know what to expect in terms of payouts. Once the payout amount has been determined, the insurance company will either send a check directly to you or to the vendor who is responsible for repairing the damage. It’s important to keep in mind that the insurance company may require you to pay a deductible before receiving the payout. In conclusion, navigating claims and payouts for your bounce house business insurance can be a complex process. However, by understanding the steps involved in filing a claim and the payout process, you can ensure that you are prepared in case of an incident. It’s important to review your policy regularly and work with a reputable insurance provider to ensure that you have the coverage you need to protect your business.Legal Requirements And Regulations

Securing appropriate insurance is crucial for a Bounce House Business to comply with legal requirements and regulations. This coverage shields the business from liability risks associated with injuries or accidents that may occur during operation. Meeting insurance obligations is key to protecting both the business and its clients.

As a bounce house business owner, it is crucial to understand the legal requirements and regulations you need to comply with to operate your business. Failure to adhere to these regulations can result in hefty fines, legal battles, and even the closure of your business.State And Local Laws

Each state and local government has its own set of laws and regulations that govern the operation of bounce house businesses. These laws cover various aspects of the business, including insurance, safety, and zoning. One of the legal requirements for bounce house businesses is to obtain liability insurance. This insurance is essential as it covers you in case of accidents and injuries that occur while using your bounce houses. Without liability insurance, you risk losing your business if someone gets injured while using your equipment. Additionally, you need to comply with zoning laws that determine where you can set up your bounce houses. Some areas may have restrictions on where you can operate, while others may require permits or licenses to operate your business.Compliance And Inspections

To operate a bounce house business, you need to comply with safety regulations set by state and local governments. These regulations ensure that your equipment is safe to use and that you are operating your business in a safe manner. One of the safety regulations is to have your equipment inspected regularly by a qualified inspector. The inspector checks the equipment for any damages, wear and tear, and makes sure that it is safe to use. It is crucial to keep records of these inspections as they may be required by your insurance company or local government. In conclusion, understanding the legal requirements and regulations of bounce house businesses is crucial to operating a successful and profitable business. Complying with these regulations ensures that your equipment is safe to use, and your business is operating within the law.Choosing The Right Insurance Provider

When it comes to operating a bounce house business, securing the right insurance coverage is paramount. Choosing the right insurance provider can make a significant difference in protecting your business from potential liabilities. Here are some important considerations to keep in mind when selecting the ideal insurance provider for your bounce house business.

Criteria For Selection

When evaluating insurance providers for your bounce house business, it’s essential to consider several key criteria to ensure that you are choosing a reliable and comprehensive coverage option. Some crucial factors to take into account include:

- Experience: Look for an insurance provider with extensive experience in the specific needs of bounce house businesses.

- Reputation: Choose a provider with a solid reputation for reliability and customer service.

- Customized Policies: Seek insurers that offer tailored insurance packages designed to address the unique risks associated with bounce house operations.

- Claims Process: Evaluate the efficiency and transparency of the claims process to ensure a hassle-free experience when filing claims.

- Financial Stability: Opt for an insurance company with a strong financial standing to guarantee the ability to fulfill claims and obligations.

Comparing Quotes

Once you have identified potential insurance providers that meet your criteria, the next step is to obtain quotes from each of them. Comparing quotes from different providers can help you make an informed decision based on the coverage options and premiums offered. When comparing quotes, it’s important to consider:

- Coverage Limits: Assess the coverage limits and exclusions to ensure they align with your business’s needs and potential risks.

- Premium Costs: Compare the premiums for the coverage offered by each provider to determine the most cost-effective option without compromising on essential protections.

- Deductibles: Understand the deductibles associated with each policy, as they can impact the overall cost and claims process.

- Add-On Options: Evaluate any additional coverage options or endorsements that may be beneficial for your bounce house business.

Future-proofing Your Bounce House Business

Future-proofing your bounce house business is essential for ensuring its long-term success and sustainability. One crucial aspect of safeguarding your business is securing the right insurance coverage. As a bounce house business owner, investing in comprehensive insurance can protect you from potential risks and liabilities, providing you with peace of mind and financial security.

Regular Insurance Reviews

Regular insurance reviews are vital to ensuring that your bounce house business is adequately protected against potential risks and liabilities. By conducting periodic reviews of your insurance policies, you can identify any gaps in coverage and make necessary adjustments to mitigate potential risks. Whether it’s liability coverage, property insurance, or business interruption insurance, staying on top of your insurance needs is essential for safeguarding your business.

Staying Updated On Industry Standards

Staying abreast of industry standards is crucial for ensuring that your bounce house business is compliant with the latest safety regulations and guidelines. As the industry evolves, so do the safety standards and regulations governing bounce house operations. By staying informed about the latest industry developments, you can proactively update your safety protocols, equipment, and operational practices to align with the current standards, thereby reducing the risk of accidents and liabilities.

Credit: www.outdoorplaystore.com

Frequently Asked Questions

What Insurance Do You Need For A Bouncy Castle?

To protect yourself and your business, you need liability insurance for a bouncy castle. This insurance covers any potential injuries or damages that may occur during its use. Stay safe and secure with the right insurance coverage.

What Insurance Do You Need For An Inflatable?

You need liability insurance for an inflatable to protect against accidents and injuries. It’s crucial for your safety.

Is A Bounce House Business Profitable?

Yes, a bounce house business can be profitable. With high demand for party rentals and events, bounce houses are popular attractions. By providing quality and diverse options, marketing effectively, and managing costs, you can generate steady income and potentially expand your business.

What Is Bouncing Insurance?

Bouncing insurance covers the cost of bounced checks or electronic payments. It provides financial protection for businesses.

Conclusion

Ensuring your bounce house business has proper insurance coverage is crucial for protecting your investment. Be proactive and research the best insurance options that suit your specific needs. With the right insurance in place, you can focus on growing your business confidently.

Protect your bounce house business today.