Calculate your Georgia car loan with precision using the user-friendly online car loan calculator tool. In Georgia, accurately determine your monthly payments and total interest costs with ease.

Are you considering purchasing a car in Georgia but unsure about the financial implications? Utilizing a car loan calculator can provide you with valuable insights into your potential monthly payments and total loan costs. By simply inputting key details such as loan amount, interest rate, and loan term, you can swiftly obtain personalized financial information.

This enables you to make informed decisions and plan your budget effectively. Let’s delve into how a car loan calculator in Georgia can be a valuable tool in your car purchasing journey.

Introduction To Car Loan Calculators

When it comes to purchasing a new or used vehicle in Georgia, understanding the financial implications is crucial. This is where a car loan calculator can be immensely helpful. Car loan calculators are online tools that allow you to estimate your monthly loan payments, total interest, and overall cost of the loan based on factors such as the loan amount, interest rate, and loan term.

Purpose Of A Loan Calculator

A car loan calculator serves the purpose of providing you with a clear and accurate picture of the financial commitment associated with buying a car. By inputting specific details about the loan, such as the interest rate and loan term, you can quickly determine how much your monthly payments will be and how much interest you will pay over the life of the loan. This enables you to make informed decisions when it comes to choosing a loan that aligns with your budget and financial goals.

Benefits For Georgia Drivers

Georgia drivers can benefit from using a car loan calculator in several ways. Firstly, it allows them to compare different loan options and choose the one that best suits their financial situation. Secondly, it helps them to avoid any surprises by providing a clear understanding of the long-term costs associated with the loan. Lastly, it empowers Georgia drivers to negotiate better loan terms by having a thorough understanding of the financial aspects involved in car financing.

Credit: diminishedvalueofgeorgia.com

Key Features Of Car Loan Calculators

Discover the key features of car loan calculators in Georgia for accurate payment estimations. Easily compare rates and terms to make informed decisions when financing your next vehicle. Effortlessly plan your budget and find the best loan option tailored to your needs with a car loan calculator in Georgia.

Principal Amount Entry

Car loan calculators allow easy input of the desired principal amount.Interest Rate Input

Users can conveniently input the interest rate they expect to pay.Loan Term Adjustments

Car loan calculators offer the flexibility to adjust the loan term length.How To Use A Car Loan Calculator

When considering financing a new car, it’s crucial to have a clear understanding of the financial commitment involved. This is where a car loan calculator comes in handy. By using this tool, you can accurately estimate your monthly payments, total interest, and overall cost of the loan. Here’s a simple guide on how to effectively utilize a car loan calculator to make informed decisions about your auto financing.

Entering Your Loan Details

Step 1: To begin, input the loan amount you are seeking. This is the total amount of money you intend to borrow from the lender.

Step 2: Next, specify the annual interest rate provided by the lender. This figure directly impacts the total interest paid over the loan term.

Step 3: Then, enter the loan term in years. This is the duration over which you will repay the loan.

Step 4: Lastly, input any additional fees or charges, such as origination fees or documentation fees, if applicable.

Interpreting The Results

Monthly Payments: The calculator provides an estimate of your monthly payments based on the loan details entered. This figure encompasses both the principal and interest portions of your payment.

Total Interest: This section reveals the total interest you will pay over the entire loan term. It is essential to be aware of this amount to understand the true cost of borrowing.

Amortization Schedule: The calculator generates an amortization schedule, detailing the breakdown of each payment, including the amount that goes towards principal and interest.

Factors Affecting Car Loan Terms In Georgia

State Regulations And Taxes

Georgia’s state regulations and taxes play a significant role in determining car loan terms. The state’s specific laws and tax requirements can impact the overall cost of the loan, including the interest rates and additional fees.

Impact Of Credit Score

The credit score of an individual in Georgia is a crucial factor that affects car loan terms. Lenders consider the creditworthiness of the borrower to determine the interest rates, loan amount, and repayment terms.

Comparing Different Loan Offers

When it comes to securing a car loan in Georgia, comparing different loan offers is crucial to finding the most favorable terms. By analyzing interest rates and understanding repayment terms, you can make an informed decision that suits your financial situation. Let’s delve into the key factors to consider when comparing different loan offers.

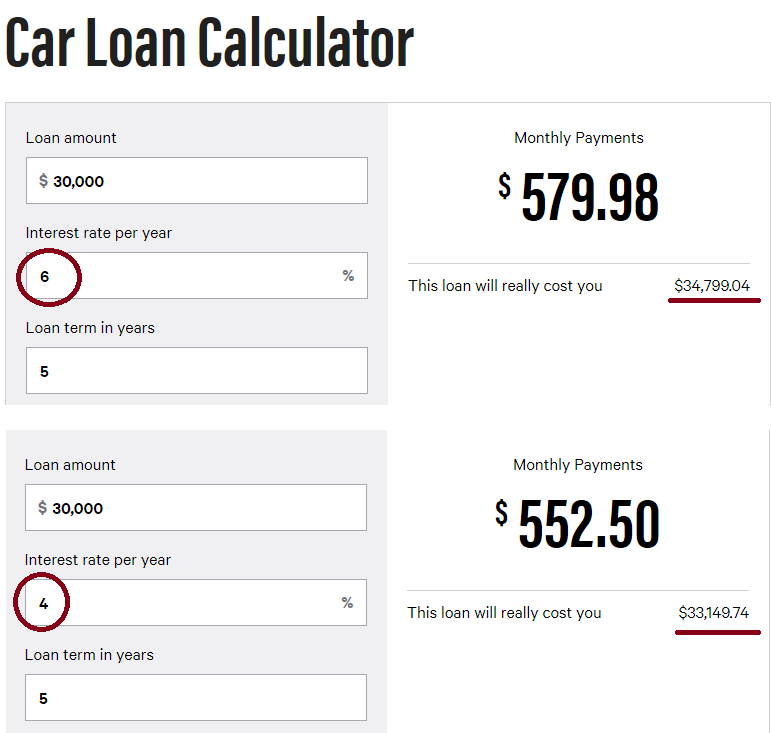

Analyzing Interest Rates

Interest rates play a pivotal role in determining the overall cost of a car loan. Comparing the annual percentage rates (APR) offered by various lenders allows you to gauge the total amount you’ll pay in interest over the loan term. Lower interest rates can result in significant long-term savings, making it essential to evaluate this aspect thoroughly.

Understanding Repayment Terms

Repayment terms encompass the duration of the loan and the monthly installment amount. Evaluating the length of the loan and the associated monthly payments enables you to assess the affordability and feasibility of each offer. Be sure to consider any prepayment penalties or fees that may impact your ability to settle the loan ahead of schedule.

Credit: www.fortpittcapital.com

Tips To Secure The Best Loan Deals

When it comes to securing the best car loan deals in Georgia, it’s essential to be well-informed and strategic. By employing the right tactics, you can ensure that you get the most favorable terms and interest rates. Here are some crucial tips to help you secure the best loan deals:

Shopping Around For Options

Before settling on a car loan, it’s important to explore your options extensively. Different lenders may offer varying interest rates and terms, so it’s wise to shop around. Utilize online car loan calculators to get an estimate of potential monthly payments based on different interest rates and loan terms. This will give you a clear picture of what to expect and enable you to make an informed decision.

Negotiating With Lenders

Don’t be afraid to negotiate with lenders to secure the best possible deal. Once you’ve compared offers from different financial institutions, use the information to your advantage when negotiating. Highlight competitive offers you’ve received and express your willingness to commit if the lender can match or improve upon those terms. Negotiating can potentially result in better interest rates or more favorable loan terms, saving you money in the long run.

Advanced Features Of Loan Calculators

Loan calculators are powerful tools that provide crucial insights into your financial commitments. Let’s explore the advanced functionalities that make these tools indispensable for anyone considering a car loan.

Amortization Schedules

Amortization schedules break down your loan payments, showing how much goes towards principal and interest over time. This feature helps you understand the payment structure and how much you’re actually paying towards the loan balance.

Early Payoff Calculations

By utilizing early payoff calculations, you can determine the impact of making extra payments on your loan. This feature allows you to see how additional payments can reduce the total interest paid and shorten the loan term significantly.

Real-life Examples Of Savings

Real-life examples of savings can be seen through the use of a car loan calculator in Georgia. By inputting various loan terms and interest rates, borrowers can see how much they can save over time. This tool is particularly useful for those looking to finance a car while staying within their budget.

Case Study From Atlanta

Meet Sarah, a hardworking professional from Atlanta who dreamed of owning a car without breaking the bank. Using the Car Loan Calculator Georgia, she discovered that by securing a lower interest rate, she could save up to $1,500 over the loan term. This tool provided Sarah with the insight she needed to negotiate a better deal with her lender, ultimately leading to significant savings.

Success Story From Savannah

In Savannah, Jason was determined to finance his dream car without compromising his financial stability. Through the Car Loan Calculator Georgia, he found that by adjusting the loan term from 60 to 48 months, he could save $800 on interest. This empowered Jason to tailor his loan to his budget, enabling him to achieve his goal while maximizing his savings.

Credit: georgiafirst.bank

Frequently Asked Questions

How Does A Car Loan Calculator Work?

A car loan calculator estimates monthly payments based on loan amount, interest rate, and loan term.

What Factors Affect Car Loan Interest Rates?

Car loan interest rates are influenced by credit score, loan term, down payment, and lender policies.

Why Is It Important To Use A Car Loan Calculator?

Using a car loan calculator helps you understand affordability, plan your budget, and compare financing options.

Can A Car Loan Calculator Show Total Cost?

Yes, a car loan calculator can display total cost including interest over the loan term.

Conclusion

After going through the benefits of using a car loan calculator in Georgia, it is evident that it is a valuable tool for anyone looking to buy a car. With the ability to determine monthly payments, interest rates, and total costs, it offers a clear picture of what one can afford.

By using this tool, individuals can make informed decisions about their car purchases, ensuring they stay within their budget. Therefore, if you are planning to buy a car, using a car loan calculator in Georgia is a wise move.