Dscr Loan Utah offers competitive loan options. They provide reliable financing solutions for individuals and businesses in Utah.

With a focus on customer satisfaction, Dscr Loan Utah strives to meet the financial needs of their clients. Whether you are looking to purchase a new property or expand your business, Dscr Loan Utah can help you secure the funding you need.

Their team of experts is dedicated to providing personalized service and guidance throughout the loan process. By choosing Dscr Loan Utah, you can access flexible terms, competitive rates, and a seamless borrowing experience. Partner with Dscr Loan Utah for all your loan requirements in Utah.

Introduction To Dscr Loans In Utah

DSCR loans in Utah are an attractive financing option for real estate investors. Debt Service Coverage Ratio (DSCR) loans assess the property’s income potential to determine loan eligibility. Investors in Utah can leverage DSCR loans to secure funding for their investment properties, enabling them to grow their real estate portfolio.

What Is A Dscr Loan?

DSCR, or Debt Service Coverage Ratio, is a financial metric used to determine the ability of a borrower to pay back a loan. DSCR loans are a type of commercial real estate loan that use this ratio to assess the borrower’s ability to repay the loan. In simple terms, the ratio compares the net operating income of a property to its annual debt service.Why Utah Is A Prime Location For Investors

Utah is a booming state with a growing economy and a thriving real estate market. It’s no wonder that investors are flocking to Utah to invest in commercial real estate. With a low unemployment rate, strong job growth, and a diverse economy, Utah has become a prime location for investors looking to make a profit. Additionally, Utah’s business-friendly environment and low taxes make it an attractive location for businesses, which in turn drives demand for commercial real estate. If you’re considering investing in commercial real estate in Utah, a DSCR loan can be a great option. These loans provide a flexible financing solution that can help you take advantage of the opportunities available in Utah’s thriving real estate market. With a DSCR loan, you can finance the purchase of a property and have the peace of mind knowing that you have the ability to repay the loan thanks to the use of the Debt Service Coverage Ratio. In conclusion, if you’re looking to invest in commercial real estate in Utah, a DSCR loan can be a smart choice. By understanding what a DSCR loan is and why Utah is a prime location for investors, you can make an informed decision about your financing options. With the right loan and a smart investment strategy, you can take advantage of the opportunities available in Utah’s thriving real estate market and achieve your investment goals.

Credit: twitter.com

Eligibility Criteria For Dscr Loans

DSCR loans are a popular financing option for real estate investors looking to purchase or refinance income-producing properties. The debt-service coverage ratio (DSCR) is a key factor in determining eligibility for this type of loan. In this post, we’ll take a closer look at the eligibility criteria for DSCR loans, including key financial ratios and property types eligible for financing.

Key Financial Ratios

The debt-service coverage ratio (DSCR) is the most important financial ratio for DSCR loans. This ratio measures a property’s ability to generate enough income to cover its debt service payments. Lenders typically require a DSCR of 1.20 or higher to qualify for a DSCR loan. Other key financial ratios that lenders may consider include:

- Loan-to-value (LTV) ratio

- Loan-to-cost (LTC) ratio

- Debt-to-equity ratio

It’s important to note that each lender may have their own specific requirements for these ratios, and they may vary depending on the property type and location.

Property Types Eligible For Financing

DSCR loans are typically used to finance income-producing properties such as:

- Multi-family residential properties

- Office buildings

- Retail properties

- Industrial properties

It’s important to note that lenders may have specific requirements for each property type, such as occupancy rates and lease terms. Additionally, the property must be located in a market with strong economic fundamentals and a low risk of vacancy.

Overall, DSCR loans can be a great financing option for real estate investors looking to purchase or refinance income-producing properties. By understanding the eligibility criteria, including key financial ratios and eligible property types, investors can improve their chances of qualifying for a DSCR loan.

Benefits Of Opting For A Dscr Loan

Choosing a DSCR loan in Utah offers the benefit of using property income to qualify for financing, making it easier for investors to secure funding. This type of loan provides more flexibility and higher loan amounts, making it an attractive option for real estate investors in the area.

Benefits of Opting for a DSCR Loan A Debt Service Coverage Ratio (DSCR) loan is a type of commercial loan that offers numerous advantages for borrowers. From no personal income verification to flexibility in property types, DSCR loans provide a range of benefits that make them an attractive option for individuals and businesses looking to secure financing for their real estate investments. No Personal Income Verification One of the key advantages of a DSCR loan is the absence of personal income verification. This means that borrowers can secure financing based solely on the income generated by the property being financed, rather than their personal income. This can be particularly beneficial for individuals who may not have a traditional source of income or who have difficulty providing the necessary documentation for personal income verification. Flexibility in Property Types Another significant benefit of opting for a DSCR loan is the flexibility it offers in terms of property types. Whether you’re looking to finance a multifamily property, a commercial building, or even a mixed-use development, a DSCR loan can accommodate a wide range of property types. This flexibility makes it easier for borrowers to find financing for their specific real estate investment needs without being limited by the type of property they wish to purchase.

Credit: gustancho.com

How To Calculate Your Dscr

To determine your Debt Service Coverage Ratio (DSCR), you need to understand the formula used for its calculation. The DSCR is a financial metric that helps lenders assess the ability of a borrower to repay their debt obligations. It is calculated by dividing the net operating income (NOI) by the total debt service (TDS). The formula can be expressed as:

Where:

- NOI stands for Net Operating Income, which is the income generated from a property after deducting operating expenses such as utilities, maintenance costs, and property taxes.

- TDS refers to Total Debt Service, which includes all the monthly debt payments, including principal and interest, associated with the property.

By calculating your DSCR, you can assess your ability to handle your debt obligations and determine if you meet the minimum requirements set by lenders.

Example 1: Residential Property

Let’s consider a scenario where you own a residential property that generates an NOI of $50,000 per year. The total debt service for the property, including mortgage payments, insurance, and property taxes, amounts to $40,000 per year.

Using the DSCR formula, we can calculate:

In this example, the DSCR is 1.25, indicating that the property’s net operating income is 1.25 times greater than its total debt service. This suggests a healthy financial position, as the income generated is sufficient to cover the debt obligations.

Example 2: Commercial Property

Now, let’s consider a commercial property with an NOI of $100,000 per year and a total debt service of $90,000 per year.

Using the DSCR formula:

In this case, the DSCR is 1.11, indicating that the property’s net operating income is 1.11 times greater than its total debt service. While still above 1, indicating the ability to cover the debt obligations, the ratio is lower compared to the previous example. Lenders may consider this a slightly riskier investment, as the income may be less robust relative to the debt service.

Calculating your DSCR is essential when seeking financing for real estate investments. It helps you understand your financial position and enables lenders to assess your creditworthiness. By ensuring a healthy DSCR, you increase your chances of securing favorable loan terms and successfully managing your debt obligations.

Applying For A Dscr Loan In Utah

Utah is a great place to invest in real estate, and one of the best ways to finance your property purchase is through a Debt-Service Coverage Ratio (DSCR) loan. If you’re considering applying for a DSCR loan in Utah, it’s essential to understand the process and the documents required to ensure a smooth and successful application.

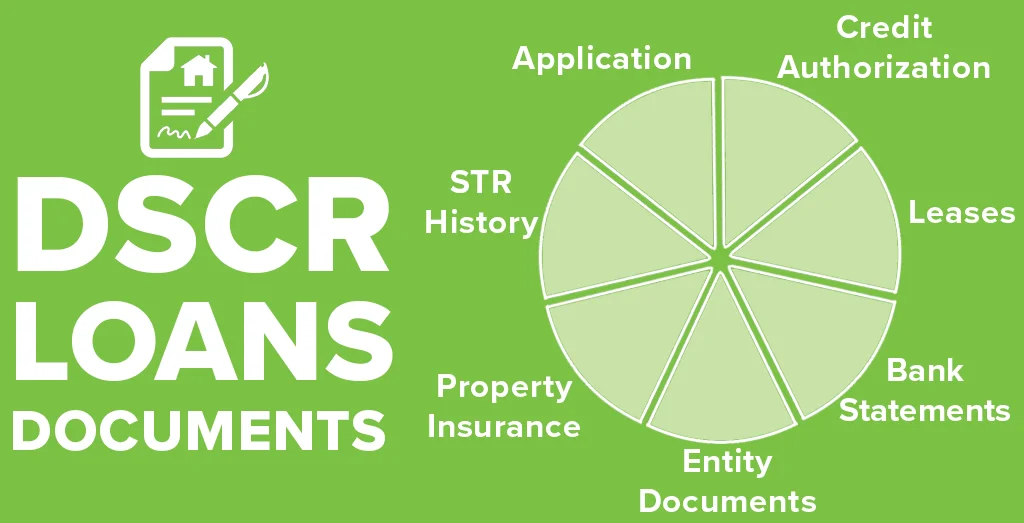

Documents Required

When applying for a DSCR loan in Utah, you’ll need to provide several documents to support your application. These may include:

- Personal identification such as driver’s license or passport

- Proof of income and employment

- Property appraisal and title documents

- Business financial statements

- Personal and business tax returns

Step-by-step Application Process

The application process for a DSCR loan in Utah involves several key steps, including:

- Preparation of required documents

- Submission of the loan application

- Review and approval process by the lender

- Closing and funding of the loan

It’s important to work closely with your lender and provide all necessary information and documentation in a timely manner to expedite the application process and secure your DSCR loan in Utah.

Case Studies: Success Stories In Utah

Residential Investments

Investing in residential properties in Utah has proven to be a lucrative endeavor for many individuals and families. One success story comes from a couple in Salt Lake City who purchased a distressed property and renovated it with sustainable features. The property’s value increased significantly, allowing them to profitably sell it within a year.

Commercial Property Success

Utah’s thriving commercial real estate market has provided numerous success stories. One such case involves a local business owner who strategically purchased a commercial property in downtown Provo. By leveraging strategic renovations and securing long-term tenants, the property’s value soared, resulting in substantial returns on the initial investment.

Potential Pitfalls And How To Avoid Them

When considering a Dscr Loan in Utah, it’s important to be aware of potential pitfalls that can arise. By understanding common mistakes borrowers make and implementing mitigation strategies, you can navigate the loan process successfully.

Common Mistakes

- Not thoroughly researching loan terms and conditions.

- Underestimating future cash flow projections.

- Ignoring potential interest rate fluctuations.

Mitigation Strategies

- Conduct detailed research on loan terms and conditions.

- Create conservative cash flow projections.

- Consider fixed-rate loans to mitigate interest rate risks.

Future Of Dscr Loans In Utah’s Real Estate Market

The Future of DSCR Loans in Utah’s Real Estate Market

Market Trends

DSCR loans in Utah’s real estate market are experiencing a surge.

Investors are drawn to the stability and potential returns these loans offer.

Investment Opportunities

Utah’s real estate market provides fertile ground for DSCR loan investment.

Low vacancy rates and steady property appreciation make it an attractive option.

Credit: www.easystreetcap.com

Frequently Asked Questions

How Much Do You Need To Put Down On A Dscr Loan?

Typically, a DSCR loan requires a down payment of 15-20% of the property’s value.

What Are The Downsides Of A Dscr Loan?

The downsides of a DSCR loan include higher interest rates and stricter eligibility requirements. Additionally, the loan may require a larger down payment and provide less flexibility in terms of property use.

What Is A Dscr Loan In Utah?

A DSCR loan in Utah is a type of loan that is based on the debt service coverage ratio (DSCR), which is the ratio of a borrower’s income to their debt payments. It is commonly used for commercial real estate investments and requires a higher DSCR ratio than traditional loans.

Is Dscr A Hard Money Loan?

No, DSCR (Debt Service Coverage Ratio) is not a hard money loan. It is a financial metric that lenders use to determine the borrower’s ability to repay a loan. DSCR calculates the cash flow available to meet the debt obligations, including principal and interest payments.

Hard money loans are typically short-term loans that are secured by real estate and have higher interest rates and fees.

Conclusion

To sum up, Dscr loans in Utah offer a viable financing solution for businesses. With their low rates and flexible terms, they can support growth and expansion. Understanding the intricacies of Dscr loans is essential for making informed financial decisions.

Consider these options for your business’s financial needs.