Farmers Insurance settlement checks are being issued to eligible policyholders for their claims. Recipients should expect timely delivery.

Farmers Insurance customers involved in a settlement are receiving compensation through settlement checks. These checks serve as financial reimbursement for valid claims filed by policyholders. The issuance of these checks is part of the resolution process, ensuring that affected individuals are duly compensated for damages or losses incurred.

Recipients can anticipate the arrival of their settlement checks within a specific timeframe, providing them with the necessary closure and financial relief. It is essential for recipients to review the details of their settlement checks carefully and promptly address any concerns or discrepancies with the issuing authority.

Introduction To Farmers Insurance Settlement Checks

Farmers Insurance settlement checks play a crucial role in compensating policyholders for losses covered by their insurance policies. In the event of an accident, natural disaster, or other covered incident, Farmers Insurance may issue a settlement check to the policyholder to provide financial relief. Understanding the purpose and process of settlement checks is essential for policyholders navigating the aftermath of an unforeseen event.

What Are Settlement Checks?

A settlement check from Farmers Insurance represents the agreed-upon compensation for a covered claim. It serves as a financial resolution to the policyholder’s loss, providing the necessary funds to address damages, medical expenses, or other covered costs. Farmers Insurance settlement checks aim to alleviate the financial burden resulting from unforeseen events, enabling policyholders to recover and move forward.

Role Of Farmers Insurance In Settlements

Farmers Insurance plays a pivotal role in the settlements process, working to fairly assess claims and provide appropriate compensation to policyholders. The company’s commitment to customer service and satisfaction is reflected in its approach to issuing settlement checks, ensuring that policyholders receive the support they need during challenging times. By facilitating the settlement process and issuing timely checks, Farmers Insurance demonstrates its dedication to policyholder well-being.

Eligibility Criteria For Receiving A Settlement Check

Farmers Insurance settlement checks provide financial relief to policyholders who have experienced loss or damage covered by their insurance policy. Understanding the eligibility criteria for receiving a settlement check is essential for policyholders seeking compensation for their claims.

Policyholder Requirements

Policyholders are eligible to receive a settlement check if they have an active and valid insurance policy with Farmers Insurance at the time of the covered loss or damage. Additionally, the policyholder must have filed a claim in accordance with the terms and conditions of their policy.

Types Of Claims Covered

Settlement checks may be issued for various types of claims covered by Farmers Insurance, including property damage caused by natural disasters, auto accidents, personal liability, and injuries sustained on the policyholder’s property. It’s important for policyholders to review their insurance policy to ensure that their specific claim falls within the covered categories.

Steps To Process Your Settlement Check

When it comes to Farmers Insurance settlement checks, understanding the process to receive your compensation is crucial. Follow these steps to process your settlement check smoothly.

Initiating A Claim

- Contact Farmers Insurance to start your settlement claim.

- Provide details of the incident and your policy information.

- Wait for a claims adjuster to assess your claim.

Documentation Needed

- Submit a copy of the police report, if applicable.

- Provide medical records and bills for injury claims.

- Include repair estimates for property damage claims.

Timeline For Processing

- Claims are typically processed within 30-60 days.

- Review and sign the settlement offer once received.

- Expect your settlement check shortly after accepting the offer.

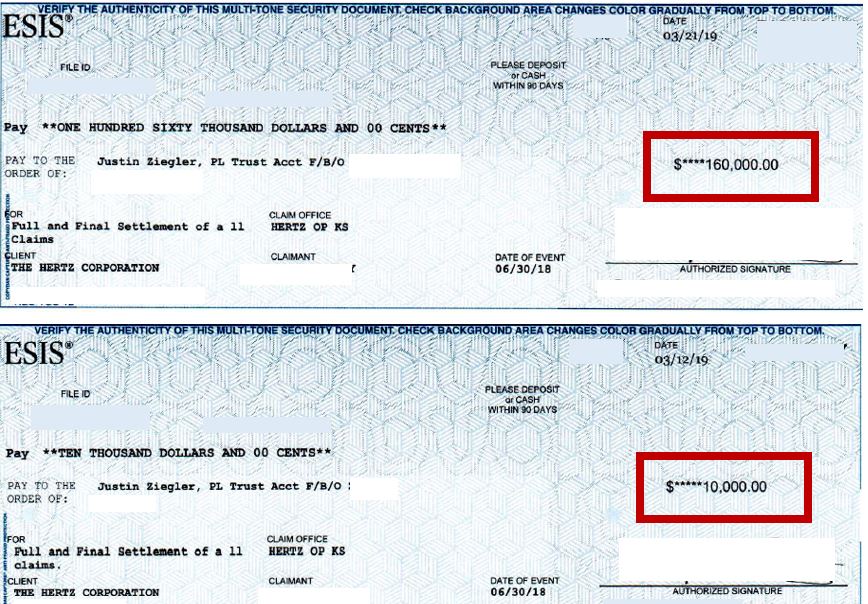

Credit: www.justinziegler.net

Common Reasons For Delays In Settlement Checks

Delays in receiving settlement checks from Farmers Insurance can be frustrating for policyholders. Understanding the common reasons for these delays can help to manage expectations and navigate the process more effectively. Here are some of the most frequent causes of delays in settlement checks:

Incomplete Claim Forms

One of the primary reasons for delays in receiving settlement checks is incomplete claim forms. Policyholders should ensure that all required fields are accurately filled out and all necessary documentation is provided to avoid processing delays.

Disputed Claim Details

Disputes over claim details can also lead to delays in receiving settlement checks. It is essential for policyholders to communicate effectively with Farmers Insurance and promptly address any discrepancies or disputes to facilitate the timely processing of their settlements.

How To Endorse And Deposit Your Settlement Check

When you receive a Farmers Insurance settlement check, knowing how to properly endorse and deposit it is crucial. By following the correct procedures, you can ensure a smooth and efficient processing of your settlement funds.

Proper Endorsement Procedures

Ensure a smooth endorsement process by following these steps:

- Sign your full name exactly as it appears on the front of the check.

- Write “For Deposit Only” followed by your account number on the back of the check.

- Include any necessary additional endorsements if the check is payable to multiple parties.

Banking Tips For Quick Processing

Optimize the deposit process with these banking tips:

- Visit the bank during off-peak hours to reduce wait times.

- Ensure all account holders are present if the check is payable to multiple parties.

- Provide a valid photo ID to the bank when depositing the check.

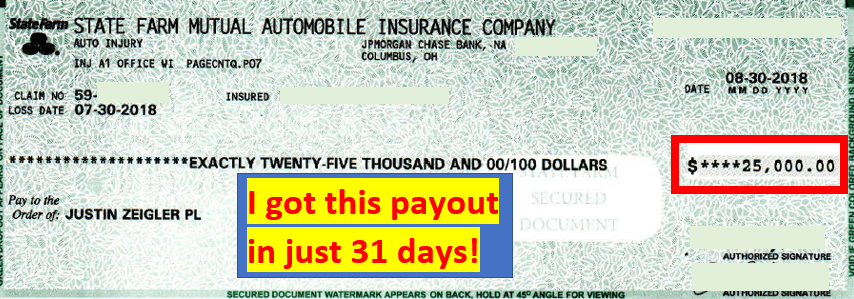

Credit: www.justinziegler.net

Tax Implications Of Settlement Checks

When receiving a Farmers Insurance settlement check, it’s crucial to understand the tax implications involved. Let’s delve into the key aspects of the Tax Implications of Settlement Checks, particularly focusing on Taxable vs. Non-Taxable Settlements and Reporting Settlements on Tax Returns.

Taxable Vs. Non-taxable Settlements

A Farmers Insurance settlement may be taxable or non-taxable depending on the nature of the compensation:

- Taxable Settlements: Compensation for lost wages, punitive damages.

- Non-Taxable Settlements: Personal physical injury or sickness claims.

Reporting Settlements On Tax Returns

It’s important to accurately report your settlement on your tax return:

- Form 1099: If the settlement is taxable, you may receive a Form 1099 from Farmers Insurance.

- IRS Reporting: Follow IRS guidelines on reporting taxable settlements on Schedule 1 (Form 1040).

Dispute Resolution For Settlement Issues

Farmers Insurance settlement checks can sometimes lead to disputes, creating a need for effective resolution processes. Understanding the options available for dispute resolution can help policyholders navigate settlement issues efficiently.

When And How To File A Dispute

Policyholders should file a dispute regarding settlement issues promptly. To initiate the process, contact your Farmers Insurance agent or customer service to inquire about the appropriate forms or procedures for disputing a settlement.

Keep all relevant documentation and communication related to the settlement issue handy as evidence to support your dispute. The sooner the dispute is filed, the quicker the resolution process can begin.

Mediation And Legal Options Available

Mediation is often an effective way to resolve settlement disputes without resorting to litigation. Farmers Insurance may offer mediation services to help both parties come to a mutually agreeable resolution. This can be a less time-consuming and costly option compared to pursuing legal action.

If mediation does not produce a satisfactory outcome, policyholders may explore legal options. It’s advisable to seek legal counsel to understand the available courses of action and potential outcomes when disputes cannot be resolved through mediation.

Credit: milberg.com

Future Of Digital Payments In Insurance Settlements

The future of digital payments in insurance settlements is rapidly evolving, transforming the way claimants receive their compensation. With the advent of advanced digital payment solutions, insurance companies are increasingly embracing electronic settlements to streamline the disbursement process. This shift not only enhances efficiency but also offers numerous benefits to both the insurers and the recipients.

Trends In Digital Payment Solutions

Digital payment solutions are revolutionizing the insurance industry, providing a secure and convenient method for disbursing settlements. The emergence of innovative platforms and technologies is enabling insurers to transfer funds electronically, eliminating the need for traditional paper checks. Moreover, the integration of mobile payment applications and online portals has facilitated seamless and instantaneous transactions, catering to the evolving preferences of recipients.

Benefits Of Electronic Settlements

The adoption of electronic settlements offers an array of advantages, including enhanced speed and accessibility. Claimants can receive their funds promptly, without the delays associated with physical mail. Additionally, electronic payments minimize the risks associated with lost or stolen checks, ensuring the security of the settlement amount. Furthermore, this digital approach contributes to environmental sustainability by reducing paper usage and waste.

Frequently Asked Questions

How Does Farmers Insurance Calculate Pain And Suffering?

Farmers insurance calculates pain and suffering by considering various factors such as the severity of injuries, medical bills, and lost wages. They may also take into account the emotional distress caused by the accident and the impact on the victim’s quality of life.

Each case is evaluated on an individual basis to determine an appropriate amount of compensation.

Is Farmers Good At Paying Home Claims?

Farmers is known for promptly and fairly settling home claims, providing reliable and efficient service to policyholders.

What Company Owns Farmers Insurance?

Zurich Insurance Group owns Farmers Insurance. It is a Swiss multinational company with headquarters in Zurich, Switzerland.

What Is The 800 Number For Farmers Insurance?

The 800 number for Farmers Insurance is 1-888-327-6335. You can reach them for insurance inquiries and assistance.

Conclusion

As Farmers Insurance Settlement Checks bring relief, timely compensation benefits policyholders affected by natural disasters. It’s crucial to understand the process and requirements to ensure a smooth claims experience. Stay informed and proactive to maximize your settlement amount and protect your assets.