Calculate your Honda car loan online with the Honda car loan calculator. Estimate monthly payments easily.

Are you considering financing a new Honda car? Using the Honda car loan calculator can help you determine your monthly payments quickly and accurately. This tool is beneficial for planning your budget and making informed decisions when purchasing a Honda vehicle.

By entering specific details such as the car price, down payment, loan term, and interest rate, you can get an estimate of your monthly payments. Whether you’re interested in a Honda Civic, Accord, CR-V, or any other model, the Honda car loan calculator simplifies the process of understanding the financial commitment associated with buying a Honda car. Start using the calculator today to make your car buying experience smoother and more transparent.

Introduction To Honda Car Loan Calculator

Honda car loan calculator is a powerful tool that helps you estimate your monthly car loan payments and make informed decisions when purchasing a Honda vehicle. Whether you’re considering a new or used Honda car, this calculator can provide you with valuable insights into your potential loan terms, interest rates, and overall affordability. By entering a few key details, such as the vehicle price, down payment, loan term, and interest rate, you can quickly determine the financial implications of your car purchase.

Benefits Of Using A Dedicated Car Loan Calculator

Utilizing a dedicated car loan calculator offers several advantages, including:

- Accurate estimates of monthly payments

- Understanding the impact of interest rates

- Comparing different loan terms and down payment options

- Empowering informed decision-making

How It Simplifies The Car Buying Process

The Honda car loan calculator simplifies the car buying process by providing a clear understanding of the financial commitments associated with purchasing a Honda vehicle. It ensures that you can make well-informed decisions, aligning your purchase with your budget and financial goals. By inputting the necessary details, you can quickly assess various scenarios, empowering you to choose the most suitable loan terms and payment options for your individual circumstances.

Key Features Of The Honda Car Loan Calculator

The Honda Car Loan Calculator offers the convenience of inputting various interest rates to help you understand the impact on your monthly payments.

With the Honda Car Loan Calculator, you can easily adjust the loan terms to see how the duration of the loan affects your monthly payments and the overall interest paid.

Additionally, the calculator provides a tax and fees estimator, giving you a clear picture of the total cost of the loan, including any applicable taxes and fees.

How To Access And Use The Calculator

How to Access and Use the Honda Car Loan Calculator

Navigating Honda’s Official Website

1. Go to Honda’s official website.

2. Find the ‘Finance’ or ‘Tools’ section in the menu.

3. Look for the ‘Car Loan Calculator’ option.

Step-by-step Usage Guide

- Enter the car price.

- Input the loan term in months.

- Specify the interest rate.

- Include any down payment amount.

- Click ‘Calculate’ to see monthly payments.

Credit: www.germainhonda-annarbor.com

Understanding Your Financing Options

Understand your financing options when purchasing a Honda with the Honda Car Loan Calculator. This tool allows you to estimate monthly payments and interest rates to help make informed financing decisions.

Types Of Financing Available Through Honda

When purchasing a new Honda vehicle, there are various financing options available. Honda offers several types of financing to accommodate different financial situations and preferences. These options include traditional auto loans, lease agreements, and special financing programs. Each option has its own set of advantages and considerations, so it’s important to understand the differences before making a decision.Choosing Between Lease And Loan Options

When deciding between a lease and a loan, it’s essential to consider your individual needs and financial circumstances. Leasing a Honda offers lower monthly payments and the opportunity to drive a new vehicle every few years. On the other hand, an auto loan allows you to build equity in the vehicle and customize it to your liking. It’s crucial to weigh the pros and cons of each option to determine which aligns best with your lifestyle and budget. In terms of financing, Honda provides various options to cater to different financial situations. These include traditional auto loans, lease agreements, and special financing programs. Each option has its unique advantages and considerations, so it’s important to understand the differences before making a decision. When deciding between a lease and a loan, it’s essential to consider your individual needs and financial circumstances. Leasing a Honda offers lower monthly payments and the opportunity to drive a new vehicle every few years. On the other hand, an auto loan allows you to build equity in the vehicle and customize it to your liking. It’s crucial to weigh the pros and cons of each option to determine which aligns best with your lifestyle and budget.Calculating Your Monthly Payments

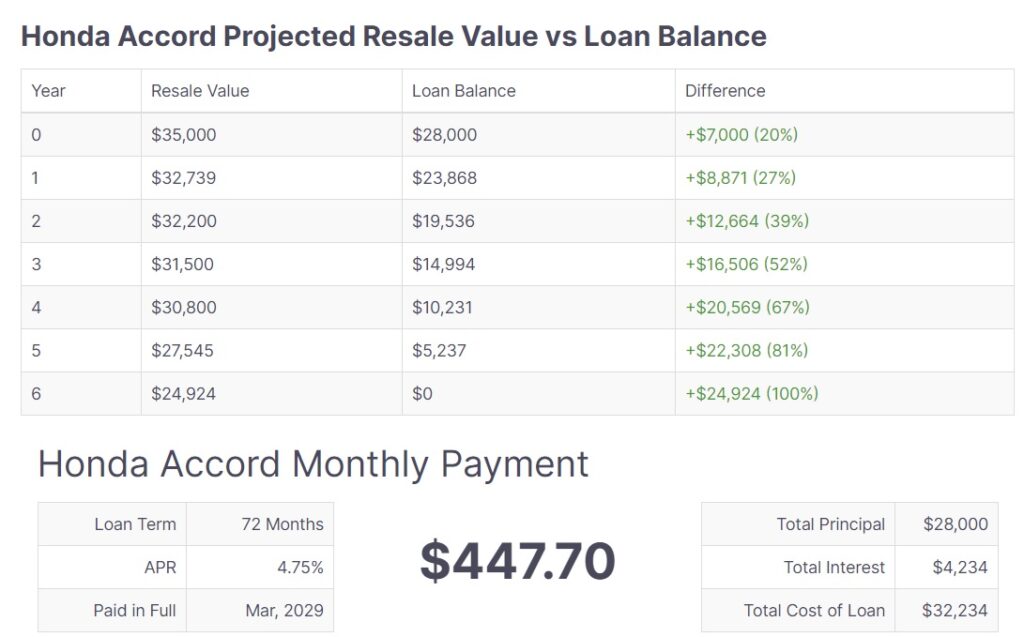

Calculating your monthly payments for a Honda car loan is a crucial step in the car-buying process. By understanding how different factors such as purchase price, down payment, and term length impact your payments, you can make informed decisions that align with your budget and financial goals.

Inputting Purchase Price And Down Payment

When using the Honda car loan calculator, inputting the purchase price and down payment directly impacts your monthly payments. By adjusting these figures, you can see how your monthly payments change in real time, allowing you to find the right balance that fits your budget.

How Term Length Affects Monthly Payments

The term length of your loan is another crucial factor that affects your monthly payments. A longer term may result in lower monthly payments, but you’ll end up paying more in interest over time. Conversely, a shorter term may lead to higher monthly payments but can save you money on interest in the long run.

Tips For Getting The Best Loan Terms

When you’re considering financing a Honda vehicle, getting the best loan terms can save you money. Here are some essential tips to help you secure favorable loan terms.

Improving Your Credit Score Before Applying

1. Check your credit report for any errors.

2. Pay down existing debts to decrease your credit utilization ratio.

3. Ensure all bills are paid on time to boost your credit score.

When To Negotiate For Better Rates

1. Compare loan offers from different lenders.

2. Timing matters – negotiate when interest rates are favorable.

3. Use your credit score to leverage better terms.

Impact Of Credit Score On Loan Approval

A good credit score can positively impact loan approval for a Honda car. Utilizing a Honda car loan calculator can help determine monthly payments based on credit score and loan terms. Understanding the importance of credit score can lead to a smoother loan approval process.

Impact of Credit Score on Loan Approval Credit score requirements for Honda financing When applying for a car loan, your credit score plays a crucial role in the approval process. For Honda financing, the credit score requirements are typically stringent. To qualify for favorable terms and interest rates, it’s essential to have a credit score of 650 or higher. However, individuals with lower credit scores may still be eligible for financing, albeit with less favorable terms. How to improve your credit score for better terms Improving your credit score can significantly impact your ability to secure favorable terms for a Honda car loan. Here are some actionable steps to enhance your creditworthiness: – Pay bills on time: Timely bill payments contribute to a positive credit history. – Reduce outstanding debt: Lowering your debt-to-income ratio can improve your credit score. – Regularly check your credit report: Identifying and rectifying errors on your credit report can positively impact your score. By implementing these strategies, you can enhance your credit score, thereby increasing the likelihood of approval for a Honda car loan with more favorable terms.Real Examples: Using The Calculator Effectively

Effectively utilize the Honda Car Loan Calculator to accurately estimate monthly payments and total loan cost. Input desired loan amount, interest rate, and loan term for quick and convenient financial planning. Make informed decisions on car financing with real-time calculations for a seamless car buying experience.

Case Study Of A First-time Buyer

When purchasing a vehicle for the first time, understanding the financial implications is crucial. Let’s consider the scenario of a first-time car buyer, John, who is considering financing a Honda. Using the Honda car loan calculator, John can input the vehicle’s price, his desired down payment, and the loan term to estimate his monthly payments. This real-life example showcases how first-time buyers can leverage the calculator to make informed decisions about their car purchase.Scenario Analysis For Varying Down Payments And Terms

The Honda car loan calculator allows users to analyze different down payment amounts and loan terms. For instance, by inputting varying down payments such as 10%, 20%, or 30%, and adjusting the loan term to 36, 48, or 60 months, individuals can assess how these factors impact their monthly payments and overall loan costs. This hands-on approach empowers car buyers to tailor their financing options based on their financial circumstances and preferences. By utilizing the Honda car loan calculator, individuals can gain valuable insights into their potential car financing arrangements. Whether it’s a first-time buyer like John or someone exploring different down payment and term combinations, the calculator serves as a practical tool for making informed and strategic decisions.Faqs About Honda Car Loans

Honda Car Loan Calculator is a useful tool to calculate your monthly payments and interest rates. Some common FAQs regarding Honda Car Loans include eligibility criteria, documentation required, and repayment options. By using the calculator, you can easily determine the loan amount and the interest rate that suits your budget.

Common Concerns About Loans And Payments

Buying a Honda car is exciting, but financing it can be a daunting task. Let’s address common concerns:

- How much do I need to put down for a Honda car loan? Typically, a down payment of 10-20% is recommended.

- What factors influence my loan interest rate? Your credit score, loan term, and the lender’s rates are key factors.

- Can I customize the loan term? Yes, but keep in mind that longer terms may result in higher interest costs.

Advice On Handling Loan Rejections

If your Honda car loan application is rejected, follow these steps:

- Understand the reason: Get clarity on why your loan was denied.

- Improve your credit: Work on enhancing your credit score before reapplying.

- Explore other lenders: Different lenders have varied approval criteria.

Remember, being informed and proactive can help you navigate the Honda car loan process smoothly.

Credit: caredge.com

Credit: automobiles.honda.com

Frequently Asked Questions

How Much Is A $30,000 Car Loan A Month?

A $30,000 car loan could cost around $600 to $700 per month, depending on the interest rate and loan term.

What Is Honda Finance Interest Rate?

The interest rate for Honda Finance varies based on credit score and current promotions. Contact a Honda dealer for specific details.

What Is 6% Interest On A $30,000 Loan?

The 6% interest on a $30,000 loan amounts to $1,800 per year.

How Much Is A $400 A Month Car Payment?

A $400 a month car payment totals $4,800 annually. This amount covers the cost of the vehicle loan.

Conclusion

Calculating your Honda car loan is now easier than ever with Honda’s car loan calculator. This tool helps you estimate monthly payments, interest rates, and loan terms before you even step into the dealership. By using the calculator, you can have a better idea of what you can afford and avoid any surprises during the car-buying process.

So why wait? Start using Honda’s car loan calculator today and drive off in your dream car tomorrow!