Insurance companies go after uninsured drivers by filing a claim against them and seeking compensation through legal action. They may also report the uninsured driver to the state’s Department of Motor Vehicles.

In cases where uninsured drivers cause accidents, insurance companies work diligently to recover their costs and hold the responsible parties accountable. By pursuing legal avenues and reporting the incident, insurance companies aim to protect their interests and ensure that uninsured drivers face consequences for their actions.

This proactive approach helps in upholding the integrity of the insurance system and discouraging uninsured driving practices. Let’s explore the strategies insurance companies employ to address the challenges posed by uninsured drivers and safeguard the rights of policyholders.

Credit: yoshalawfirm.com

Introduction To Insurance Claims Against Uninsured Drivers

Insurance companies pursue uninsured drivers by filing insurance claims to recoup losses. They may utilize legal action or collections to recover damages caused by uninsured drivers. Receiving compensation can be challenging, leading insurance companies to seek alternative methods for reimbursement.

The Prevalence Of Uninsured Drivers

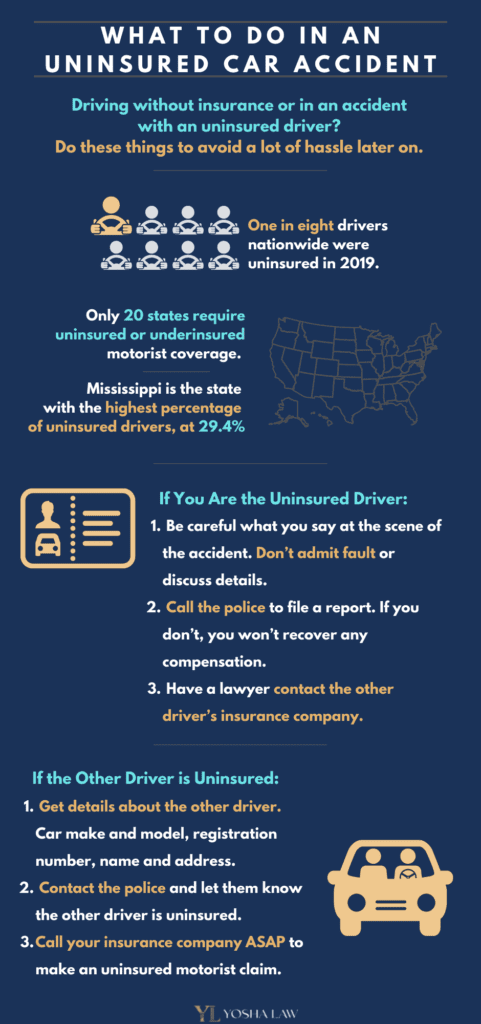

Uninsured drivers are a significant concern for insurance companies and law-abiding motorists. According to the Insurance Research Council, approximately 1 in 8 drivers in the United States is uninsured. This prevalence varies by state, with some regions experiencing higher rates of uninsured drivers than others. The prevalence of uninsured drivers poses a substantial financial risk to insured motorists and insurance companies, leading to increased premiums and potential out-of-pocket expenses.

Impact On Insured Drivers

Uninsured drivers can have a detrimental impact on insured drivers, causing financial and legal challenges. When uninsured drivers cause accidents, it can result in higher premiums for insured drivers. Additionally, insured drivers may be left to cover their own repair costs and medical expenses if the at-fault uninsured driver is unable to pay. This situation can lead to significant financial strain and frustration for responsible drivers who have diligently maintained insurance coverage.

Legal Framework Governing Uninsured Motorists

When it comes to uninsured motorists, the legal framework governing them involves a combination of state laws and regulations, as well as federal involvement and policies. Understanding these aspects is crucial for insurance companies when they go after uninsured drivers.

State Laws And Regulations

State laws play a significant role in addressing the issue of uninsured motorists. Each state has its own set of regulations that dictate the requirements for auto insurance coverage. Penalties for driving without insurance vary by state, ranging from fines to license suspension or vehicle impoundment.

Federal Involvement And Policies

Federal involvement in addressing uninsured motorists is primarily through the establishment of guidelines and requirements for minimum coverage. The Federal government sets standards for insurance companies, ensuring that they comply with certain criteria in providing coverage to drivers. Additionally, federal policies may also influence state laws regarding uninsured motorists.

Identification Of Uninsured Drivers

Law enforcement plays a crucial role in identifying uninsured drivers through routine checks and traffic stops.

Officers verify insurance coverage using databases, ensuring compliance with state laws.

Advanced technology like Automatic License Plate Readers (ALPR) helps track uninsured vehicles more efficiently.

ALPR scans license plates, instantly flagging uninsured vehicles for enforcement action.

Credit: www.youtube.com

Insurance Companies’ Initial Steps

Investigation Processes

Insurance companies initiate an investigation process to determine the status of the uninsured driver. This typically involves gathering information about the driver, the vehicle, and any relevant circumstances surrounding the incident.

Verification Of Insurance Status

After gathering the necessary information, the insurance company verifies the insurance status of the driver. This may involve contacting the state’s Department of Motor Vehicles, obtaining police reports, and reaching out to the driver directly to confirm their insurance coverage.

Tactics Employed By Insurance Companies

Insurance companies employ various tactics to pursue uninsured drivers and recover costs associated with accidents. From direct legal action to collaboration with law enforcement, these tactics are designed to protect the interests of the insured and hold irresponsible drivers accountable.

Direct Legal Action

Insurance companies may resort to direct legal action against uninsured drivers to recover costs incurred due to accidents. This involves pursuing civil litigation or filing lawsuits to compel the uninsured driver to compensate for damages and medical expenses. Through legal channels, insurance companies aim to hold the negligent driver financially accountable for their actions.

Collaboration With Law Enforcement

Insurance companies collaborate with law enforcement agencies to track down uninsured drivers. By sharing information and cooperating with authorities, insurers can identify and take action against those who drive without proper coverage. This collaboration may involve providing evidence and supporting law enforcement efforts to hold uninsured drivers accountable for their actions.

Credit: www.thebarnesfirmcareers.com

Financial Recovery Strategies

Insurance companies have several strategies to go after uninsured drivers. They can file a lawsuit, issue a demand letter, or even take the driver to court. The goal is to recover damages and hold the driver accountable for their actions.

Subrogation Process

Insurance companies initiate the subrogation process to recover costs from uninsured drivers.

This involves the insurer stepping into the shoes of the policyholder to pursue legal action.

The goal is to hold the at-fault party accountable for the damages caused in the accident.

Negotiating Settlements

Insurers often opt for negotiating settlements with uninsured drivers to expedite the recovery process.

This can involve reaching a mutual agreement on a payment plan or lump-sum settlement.

Settlement negotiations aim to ensure fair compensation for the damages incurred.

Impact On The Uninsured Driver

Insurance companies employ various strategies to pursue uninsured drivers, such as legal actions and collections. The uninsured driver may face penalties, license suspension, and difficulties obtaining future coverage, impacting their financial stability and driving privileges.

Impact on the Uninsured Driver Legal consequences Uninsured drivers face legal consequences for driving without insurance. They may receive fines, license suspension, or even legal action from the other party involved in the accident. Financial repercussions The financial repercussions of being an uninsured driver can be severe. In the event of an accident, the uninsured driver may be personally responsible for covering all medical and repair costs. Uninsured drivers are at risk of facing legal consequences and substantial financial repercussions. It’s crucial for all drivers to prioritize obtaining and maintaining proper insurance coverage to avoid these potential hardships.Preventive Measures And Future Outlook

Preventive measures and future outlook play a crucial role in addressing the issue of uninsured drivers. Insurance companies are actively pursuing educational programs, policy changes, and proposals to mitigate the risks associated with uninsured drivers.

Educational Programs

Insurance companies are spearheading educational programs aimed at raising awareness about the importance of having proper insurance coverage. These programs are designed to educate drivers about the potential consequences of driving without insurance, emphasizing the legal and financial repercussions.

Policy Changes And Proposals

Insurance companies are advocating for policy changes and proposals to address the issue of uninsured drivers. This includes supporting legislative measures to enforce stricter penalties for driving without insurance and proposing initiatives to make insurance more accessible and affordable for all drivers.

Frequently Asked Questions

What If I Was Hit By An Uninsured Driver In Texas?

You can file a claim through your uninsured motorist coverage if hit by an uninsured driver in Texas.

What Is The Uninsured Driver Promise?

Uninsured driver promise is an insurance policy that covers you if you’re hit by an uninsured driver. This policy ensures that you won’t have to pay for any damages caused by an uninsured driver. It’s included in most comprehensive car insurance policies.

What Happens If The Person At Fault In An Accident Has No Insurance In Il?

If the at-fault driver has no insurance in Illinois, uninsured motorist coverage can help cover costs.

What Happens If The Person At Fault In An Accident Has No Insurance In Sc?

If the at-fault driver has no insurance in SC, you may struggle to recover damages. You can file a lawsuit or seek compensation from your own insurance.

Conclusion

Insurance companies have several methods to go after uninsured drivers. They may file a lawsuit, seek wage garnishment, or even report the driver to the DMV. These consequences can be severe and long-lasting, impacting the driver’s financial stability and driving record.

It’s important for all drivers to carry adequate insurance coverage to protect themselves and others on the road. Driving uninsured is not worth the risk.