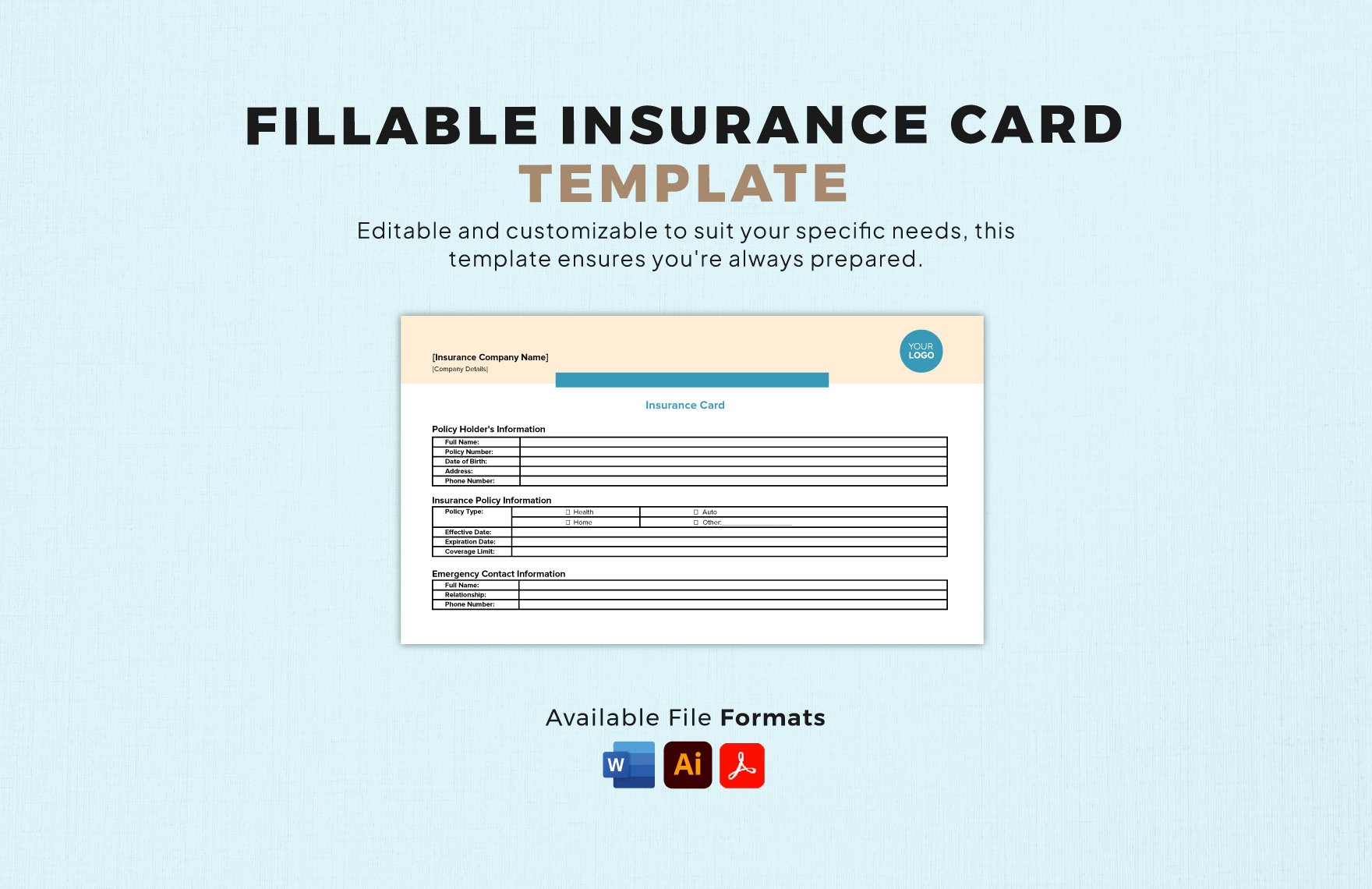

Looking for an insurance card template? You can easily find customizable templates online.

These templates allow you to create personalized insurance cards for your business or personal use. Whether you need a health insurance card, auto insurance card, or any other type of insurance identification, you can find a variety of options to suit your needs.

Creating a professional-looking insurance card is essential for providing accurate information and meeting legal requirements. In this blog, we will explore the importance of insurance cards, the key elements to include, and where to find customizable templates to make the process quick and easy. Whether you’re a business owner or an individual looking to create your own insurance cards, having access to customizable templates can streamline the process and ensure that your cards are accurate and professional.

Credit: www.template.net

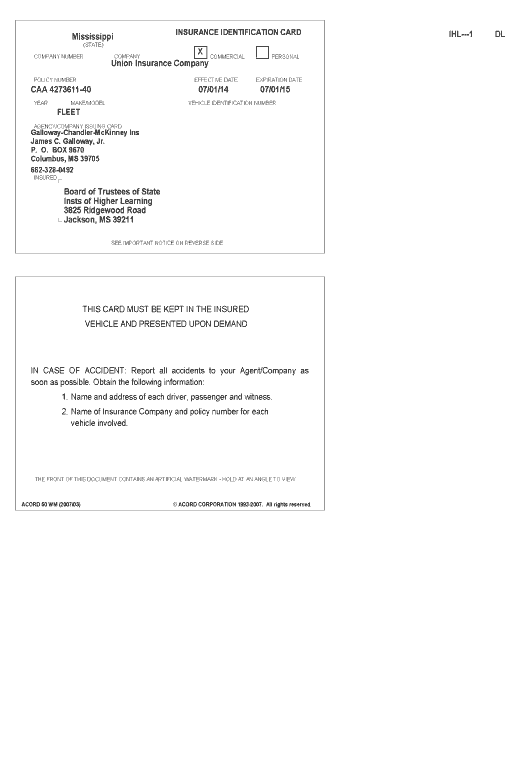

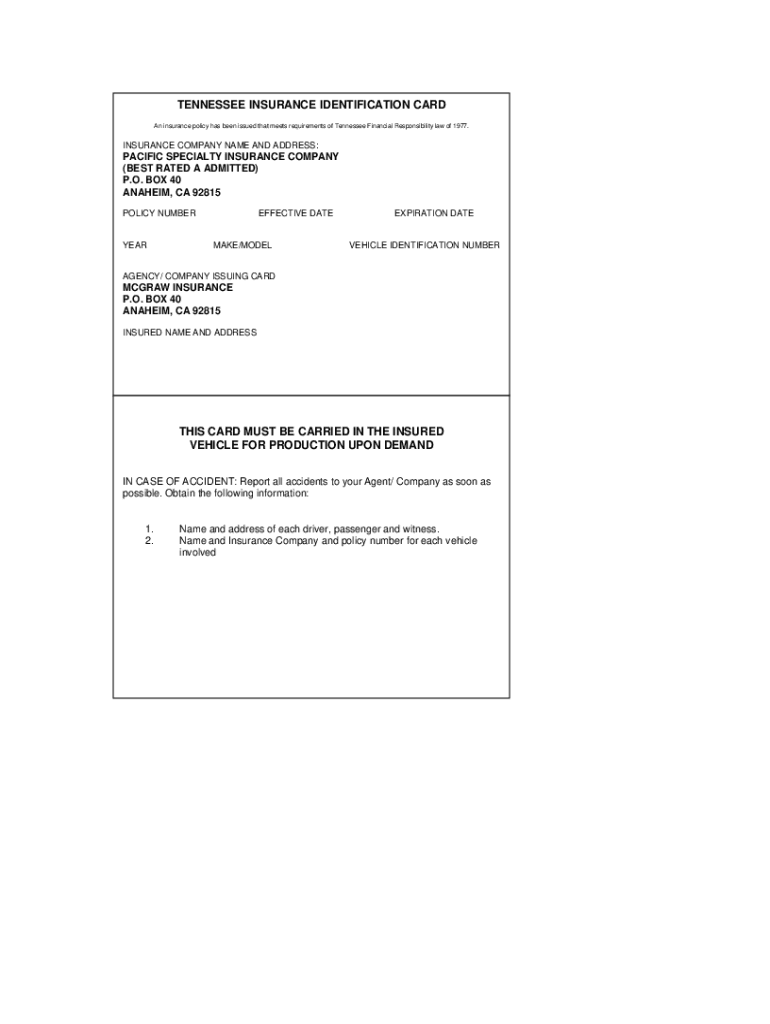

The Role Of Insurance Cards For Drivers

Insurance cards play a crucial role in the lives of drivers. These small pieces of documentation provide important information that is necessary in various situations. From legal requirements to quick access to policy information, insurance cards are essential for drivers to have on hand at all times.

Legal Requirements Across States

When it comes to driving, each state has its own set of legal requirements. Having a valid insurance card is one of the most important requirements in many states. It serves as proof that you have the necessary coverage to legally operate a vehicle. In case of a traffic stop or an accident, presenting your insurance card can help you avoid penalties and ensure compliance with the law.

Quick Access To Policy Information

Insurance cards also serve as a quick reference for policy information. They typically contain essential details such as the policy number, effective dates, and contact information of the insurance provider. In the event of an accident or when filing a claim, having this information readily available can expedite the process and help you provide accurate information to the involved parties.

Moreover, insurance cards often include important contact numbers for roadside assistance or emergency services. This ensures that drivers have quick access to the necessary help in case of an unforeseen event on the road.

Additionally, insurance cards are useful when renting a car or using a car-sharing service. These companies typically require proof of insurance before allowing you to use their vehicles. Having your insurance card with you ensures a smooth and hassle-free experience when renting a car or utilizing car-sharing services.

Overall, insurance cards play a vital role in the lives of drivers. They provide legal compliance, quick access to policy information, and peace of mind while on the road. Remember to always keep your insurance card with you whenever you are driving to ensure you are prepared for any situation that may arise.

Key Elements Of An Insurance Card

When it comes to understanding an insurance card, it’s essential to know the key elements that make up this important document. The key elements of an insurance card provide vital information about the policy and the insured party. Let’s take a closer look at the essential components that make up an insurance card.

Policy Number And Expiry Date

The policy number is a unique identifier that links to the specific insurance policy. It’s crucial for referencing and tracking purposes. The expiry date indicates the end date of the policy’s coverage.

Vehicle And Policyholder Details

The insurance card includes specific details about the insured vehicle, such as the make, model, and year. Additionally, it provides information about the policyholder, including their name and contact details.

Designing Your Own Insurance Card Template

Create a personalized touch with your insurance card by designing your own template. Here’s how you can craft a unique and professional insurance card template tailored to your needs.

Software And Tools For Design

When designing your insurance card template, consider using graphic design software like Adobe Illustrator, Canva, or Photoshop.

Dos And Don’ts In Template Design

- Dos:

- Include all necessary information clearly.

- Ensure the text is legible and the design is clean.

- Use high-resolution images for a professional look.

- Don’ts:

- Avoid cluttered designs with too much information.

- Don’t use low-quality images or blurry logos.

- Avoid using too many different fonts or colors.

Digital Vs. Physical Insurance Cards

Digital insurance cards are becoming increasingly popular due to their convenience and accessibility. With an insurance card template, individuals can easily store their information on their mobile devices, eliminating the need for physical cards. This also allows for quick and easy access to important insurance details in case of emergencies.

When it comes to insurance cards, you have two options: digital or physical. Digital insurance cards are becoming increasingly popular, but physical cards still have their benefits. In this article, we’ll explore the advantages of both and help you decide which one is right for you.Benefits Of Going Digital

Going digital with your insurance card has many benefits. Here are a few:- Convenience: With a digital insurance card, you can access your information anytime, anywhere, as long as you have an internet connection.

- Environmentally friendly: By opting for a digital card, you’re helping to reduce paper waste and save trees.

- Easy to share: If you need to provide your insurance information to someone, you can easily share it via email or text message.

- Always up-to-date: Digital cards are automatically updated with the latest information, so you don’t have to worry about carrying around an outdated card.

When Physical Cards Come In Handy

While digital insurance cards have their advantages, physical cards still have their uses. Here are a few scenarios where a physical card might come in handy:- No internet connection: If you’re in an area with no internet connection, a physical card can be a lifesaver.

- Car accidents: If you’re involved in a car accident, it’s important to have a physical card on hand to provide to the other driver and the police.

- Verification: Some healthcare providers may require a physical card for verification purposes.

- Backup: It’s always a good idea to have a backup in case your phone dies or you lose access to your digital card.

Staying Updated: Renewing Your Insurance Card

Keeping your insurance card updated is crucial for ensuring continuous coverage. Renewing your insurance card on time helps avoid any gaps in protection.

Timelines And Reminders

Set reminders to renew your insurance card before the expiry date. Missing the renewal deadline could lead to policy lapses.

Automatic Updates Via Apps

Apps can send automatic reminders for insurance card renewals. Stay on top of your coverage with convenient mobile alerts.

Credit: www.airslate.com

Legal Implications Of Not Carrying An Insurance Card

Carrying an insurance card is an essential part of driving a vehicle. It not only protects you from unexpected accidents but also assures other drivers that you can cover any damages caused by you. However, not carrying an insurance card can have serious legal implications. In this section, we will discuss the fines, penalties, real-life cases, and consequences of not carrying an insurance card.

Fines And Penalties

In most states, it is mandatory to carry proof of insurance while driving a vehicle. Failure to provide an insurance card can result in hefty fines and penalties. The amount of fine varies from state to state, but it can range from $50 to $500. Moreover, the driver’s license can also be suspended or revoked in some cases.

Real-life Cases And Consequences

There are numerous cases where drivers were caught without an insurance card, and the consequences were severe. For instance, in 2019, a driver in California was fined $2,000 for not having valid insurance. Similarly, in Texas, a driver was fined $400 and had to spend five days in jail for not carrying proof of insurance. These cases show that not having an insurance card can have serious consequences.

Moreover, in case of an accident, not having an insurance card can put you in a vulnerable position. You may have to pay for the damages out of your pocket, which can be a considerable financial burden. Furthermore, if the other party involved in the accident decides to sue you, not having an insurance card can make things even worse.

Therefore, it is crucial to carry a valid insurance card while driving a vehicle. It not only protects you from fines and penalties but also assures other drivers that you are a responsible driver who can cover any damages caused by you.

Insurance Cards And Rental Cars

Discover the convenience of having an insurance card template readily available when renting a car. Easily provide proof of coverage without hassle or delays at the rental counter. Simplify the process and ensure peace of mind during your travels.

Insurance Cards and Rental Cars When it comes to renting a car, having the right insurance coverage is essential. Insurance cards play a crucial role in providing proof of insurance when renting a car, especially for international driving. In this section, we will explore what you need to know about insurance cards and rental cars, as well as the importance of insurance proof for international driving.What You Need To Know

When renting a car, it is important to understand the role of insurance cards. These cards serve as proof of insurance coverage and are typically provided by your insurance company. They contain important information such as your policy number, the effective dates of coverage, and the types of coverage included.Insurance Proof For International Driving

If you are planning to drive a rental car in a foreign country, having insurance proof is crucial. In some cases, your existing insurance coverage may extend to international driving, but it is essential to check with your insurance provider to confirm this. If your current policy does not provide coverage for international driving, you may need to purchase additional insurance or obtain an international driving permit. When driving in a foreign country, it is important to have insurance coverage that meets the requirements of that specific country. Some countries may have mandatory insurance requirements, and failure to comply with these requirements can result in legal consequences. Therefore, it is essential to have the necessary insurance proof to avoid any complications during your international driving experience. In conclusion, insurance cards are vital when renting a car, as they provide proof of insurance coverage. When driving internationally, it is crucial to have insurance proof that meets the requirements of the specific country. By understanding the importance of insurance cards and insurance proof for international driving, you can ensure a smooth and hassle-free rental car experience.Tips For Keeping Your Insurance Card Safe And Accessible

When it comes to your insurance card, it’s essential to keep it safe and easily accessible. Whether you have a physical card or a digital version, taking the necessary steps to protect it can save you time, money, and hassle in the event of an emergency. In this article, we will share some valuable tips on how to keep your insurance card secure and readily available.

Storage Ideas For Physical Cards

If you prefer to keep a physical insurance card, here are some storage ideas to consider:

- Carry a cardholder or wallet specifically designed to hold your insurance card. This will help protect it from damage and keep it easily accessible when needed.

- Consider making a photocopy or taking a clear picture of your insurance card. Store the copy in a safe place, such as a lockbox or a secure folder in your home, as a backup in case the original gets lost or damaged.

- Keep your insurance card separate from other cards, such as credit or debit cards, to prevent accidental misplacement.

- If you have multiple insurance cards, organize them by category or provider to quickly locate the one you need.

Security Tips For Digital Cards

If you have a digital insurance card, it’s crucial to ensure its security. Here are some tips to keep your digital card protected:

- Set up a strong password or PIN to access your digital insurance card on your smartphone or device. Avoid using easily guessable passwords and update them regularly.

- Consider using a secure digital wallet app that encrypts your insurance card information and requires authentication before accessing it.

- Regularly update your device’s operating system and security software to benefit from the latest security patches and protections.

- Be cautious when sharing your digital insurance card information with others. Only provide it to trusted healthcare providers and avoid sharing it over unsecured networks or platforms.

By following these tips, you can ensure that your insurance card remains safe and accessible whenever you need it. Whether you opt for a physical card or a digital version, taking proactive measures to protect it will give you peace of mind and help streamline any future insurance-related processes.

Credit: progressive-insurance-template.pdffiller.com

Frequently Asked Questions

What Is An Insurance Card Template?

An insurance card template is a pre-designed format for creating insurance cards, containing essential policy details such as the policyholder’s name, policy number, and coverage information. It provides a standardized layout for presenting insurance information in a clear and organized manner.

How To Customize An Insurance Card Template?

Customizing an insurance card template involves inputting specific policy details such as the policyholder’s name, insurance company information, policy number, and coverage details. Utilizing editing software, you can personalize the template to reflect the required information accurately, ensuring its relevance and accuracy for the policyholder.

What Are The Benefits Of Using An Insurance Card Template?

Using an insurance card template offers the advantage of presenting vital insurance details in a clear and professional format. It facilitates easy access to essential policy information, streamlines the process of verifying coverage, and enhances the overall efficiency of insurance-related transactions for both the policyholder and service providers.

Conclusion

In crafting an insurance card template, simplicity and accuracy are key. Ensure vital information is included, such as policy details. A well-designed template can expedite processes and provide clarity in times of need. Remember, a functional and clear insurance card template is a valuable asset for both insurers and policyholders.