Long Term Care Insurance in California offers coverage for long-term care services. It helps protect your assets and provides financial support when needed.

Long Term Care Insurance in California is a valuable investment for individuals looking to secure their future health and financial stability. This insurance offers coverage for a range of long-term care services, including nursing home care, assisted living facilities, and in-home care.

By obtaining this insurance, Californians can safeguard their assets and ensure they receive the necessary care in the event of illness or disability. Long Term Care Insurance in California is a proactive step towards financial security and peace of mind for individuals and their families.

Credit: www.thescanfoundation.org

Introduction To Long Term Care Insurance In California

Long Term Care Insurance in California is an essential consideration for individuals and families planning for future healthcare needs. This type of insurance provides coverage for long-term care services, offering financial protection and peace of mind for policyholders. As the cost of healthcare continues to rise and the population ages, the importance of long-term care insurance in California becomes increasingly evident.

Rising Costs Of Healthcare

The Rising Costs of Healthcare in California have made long-term care services more expensive, creating a significant financial burden for individuals and families. Long-term care insurance helps mitigate these costs, ensuring that policyholders have access to the care they need without depleting their savings or retirement funds.

Aging Population Demographics

California’s Aging Population Demographics highlight the growing need for long-term care services. As the population ages, the demand for quality long-term care continues to increase. Long-term care insurance offers a solution to address this growing need, providing individuals with the financial resources to access essential care and support.

Key Features Of Long Term Care Insurance

When considering long term care insurance, it’s essential to understand the key features that can greatly impact your coverage. From the basics of coverage to benefit periods and options, each aspect plays a crucial role in determining the effectiveness of your long term care plan.

Coverage Basics

Long term care insurance in California provides coverage for a range of services and support, including assistance with daily living activities such as bathing, dressing, and eating. It also encompasses skilled nursing care, rehabilitation, and even home health care services. These comprehensive coverage options ensure that policyholders receive the necessary support when faced with long term care needs.

Benefit Periods And Options

When selecting a long term care insurance policy in California, individuals have the flexibility to choose benefit periods that align with their specific requirements. Options include coverage for a set number of years or a lifetime benefit, allowing policyholders to tailor their plans to meet their long term care needs. Additionally, the availability of inflation protection ensures that benefits keep pace with rising costs, offering essential financial security.

Determining The Need For Long Term Care Coverage

When it comes to planning for long-term care in California, it’s crucial to assess the need for long-term care coverage. Long term care insurance can provide financial security and peace of mind for individuals and their families. Determining the need for coverage involves evaluating personal risk factors and considering family history and longevity.

Assessing Personal Risk

Assessing personal risk factors is essential in determining the need for long-term care coverage. Factors such as age, health status, and lifestyle can influence the likelihood of requiring long-term care services in the future. Individuals with chronic health conditions or a family history of certain illnesses may have a higher risk and could benefit from long-term care insurance.

Family History And Longevity

Family history and longevity play a significant role in assessing the need for long-term care coverage. Understanding the health and longevity of family members can provide insights into potential future care needs. Individuals with a family history of conditions requiring long-term care, or who have family members who have lived into advanced age, may consider long-term care insurance to safeguard against future care expenses.

Comparing Long Term Care Insurance Policies

Compare various Long Term Care Insurance policies available in California to find the best coverage that suits your needs. Analyze different providers, benefits, and costs to make an informed decision for your long-term care needs. Make sure to review the policy details carefully before making a choice.

Policy Comparison Strategies

When it comes to Long Term Care Insurance in California, comparing policies is crucial to find the right coverage for your needs. However, with so many providers and policies available, it can be overwhelming to make a decision. Here are some policy comparison strategies to help you choose the best long term care insurance policy in California.1. Understand Your Needs

Before comparing policies, it’s important to understand your needs. Consider factors such as your age, health status, family history, and budget. Knowing your needs will help you determine what coverage is necessary and what policy features are most important to you.2. Look for Comprehensive Coverage

When comparing policies, look for comprehensive coverage that includes a range of services such as nursing home care, in-home care, and adult day care. This will ensure that you have coverage for a variety of long term care needs.3. Compare Premiums and Benefits

Compare the premiums and benefits of different policies to find the best value. Look for policies that offer the most benefits for the lowest premiums. Keep in mind that premiums may increase over time, so it’s important to factor in potential rate hikes when comparing policies.Top Providers In California

When it comes to long term care insurance in California, there are several top providers to consider. Here are some of the top providers in the state:| Provider | Rating | Policy Options |

|---|---|---|

| Genworth | A- | Comprehensive and Customizable Policies |

| Transamerica | A | Customizable Policies with Shared Care Option |

| John Hancock | A+ | Comprehensive Policies with Flexible Benefit Options |

Understanding Policy Costs

Understanding policy costs for Long Term Care Insurance in California is crucial. Evaluating premiums, deductibles, and coverage options is essential for making informed decisions. Comparing quotes from different providers can help find the most cost-effective solution.

Factors Influencing Premiums

Several factors can affect the cost of long term care insurance premiums in California. Here are some of the most important ones to keep in mind:| Factor | Description |

|---|---|

| Age | The younger you are when you purchase a policy, the lower your premiums will be. |

| Health Status | Your current health status and any pre-existing conditions will impact your premiums. |

| Gender | Women typically pay more than men because they tend to live longer and require more care. |

| Policy Features | The specific features you choose for your policy, such as the amount of coverage and length of coverage, will affect your premiums. |

| Insurance Company | The insurance company you choose can also impact your premiums, as different companies have different pricing models. |

Tips For Managing Insurance Costs

While long term care insurance premiums can be expensive, there are several ways to manage your costs and make this type of insurance more affordable. Here are some tips to help you do just that:- Start early – the younger you are when you purchase a policy, the lower your premiums will be.

- Choose a shorter benefit period – this can significantly lower your premiums.

- Choose a longer elimination period – this is the amount of time you need to wait before your benefits kick in, and choosing a longer period can reduce your premiums.

- Consider a shared policy – this is a policy that covers both you and your spouse, and can be more affordable than two separate policies.

- Compare quotes from multiple insurance companies – this can help you find the best rates.

State-specific Regulations And Incentives

When it comes to Long Term Care Insurance in California, it’s important to understand the state-specific regulations and incentives that can impact your coverage and financial planning. California has unique programs and tax qualifications in place to encourage individuals to plan for their long-term care needs.

California Partnership For Long-term Care

The California Partnership for Long-Term Care is a collaboration between the state and private insurance companies to provide long-term care coverage. It allows individuals to protect a portion of their assets while still qualifying for Medicaid if their long-term care needs extend beyond what their insurance covers.

Tax Qualifications And Incentives

California offers tax incentives to encourage residents to purchase long-term care insurance. Individuals may be eligible for state tax deductions on their long-term care insurance premiums, providing a valuable financial incentive to plan for their future care needs.

Alternatives To Traditional Long Term Care Insurance

When it comes to planning for long term care in California, traditional long term care insurance is not the only option. There are alternatives that individuals can consider to ensure they are adequately prepared for potential long term care needs. Let’s explore some of the alternatives to traditional long term care insurance.

Hybrid Insurance Products

Hybrid insurance products combine long term care coverage with another type of insurance, such as life insurance or an annuity. These products offer benefits for long term care expenses while also providing a death benefit or a guaranteed income stream. They can be appealing to individuals who are looking for a way to address long term care needs while also gaining other financial benefits.

Government Programs And Assistance

Government programs, such as Medicaid and Veterans Affairs benefits, can provide assistance with long term care costs for eligible individuals. Medicaid, in particular, is a joint federal and state program that offers coverage for long term care services for those who meet specific income and asset requirements. Veterans Affairs benefits may also provide support for veterans and their spouses who require long term care services.

Making An Informed Decision

When it comes to Making an Informed Decision about long-term care insurance in California, it’s crucial to consider various factors and plan ahead for potential healthcare needs. By understanding the importance of this decision, individuals can take proactive steps to secure their financial well-being and peace of mind.

Consulting Financial Advisors

Consulting with financial advisors can provide valuable insights into the different long-term care insurance options available in California. Advisors can assess individual financial situations and recommend appropriate coverage to ensure comprehensive protection.

Planning For Future Healthcare Needs

When planning for future healthcare needs, individuals should carefully evaluate their current health status and consider potential risks as they age. This proactive approach allows for adequate preparation and the selection of a suitable long-term care insurance policy.

Application Process And Underwriting

When applying for Long Term Care Insurance in California, understanding the Application Process and Underwriting is crucial. These steps determine eligibility and coverage.

Steps To Apply

- 1. Gather Information: Collect personal, medical, and financial details.

- 2. Contact Insurer: Reach out to a reputable insurance company in California.

- 3. Submit Application: Fill out the application form accurately.

- 4. Undergo Assessment: Expect a health assessment by a medical professional.

Underwriting Considerations

- 1. Health History: Insurers evaluate medical records and pre-existing conditions.

- 2. Age and Gender: Factors influencing premiums and coverage.

- 3. Lifestyle Habits: Smoking, alcohol consumption, and weight may impact underwriting.

- 4. Financial Status: Assessing income and assets to determine coverage limits.

Credit: woodruffsawyer.com

Claim Filing And Reimbursement

When it comes to Long Term Care Insurance in California, understanding Claim Filing and Reimbursement Procedures is essential.

Filing A Claim

To file a claim, submit the required forms and documents to the insurance provider promptly.

Include details such as patient information, treatment received, and healthcare provider invoices.

Understanding Reimbursement Procedures

Reimbursement procedures vary, so it’s crucial to comprehend the specific guidelines of your policy.

Ensure that you meet all the criteria for reimbursement before submitting any claims.

Consumer Stories And Experiences

Consumer stories and experiences are powerful tools that help individuals understand the real-world impact of long term care insurance in California.

Success Stories

From families finding peace of mind to individuals accessing quality care, success stories highlight the importance of long term care insurance.

Challenges Faced

Despite the benefits, some individuals may face challenges such as navigating policy details or understanding coverage limitations.

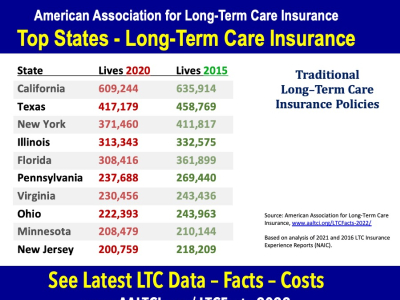

Credit: www.aaltci.org

Future Of Long Term Care Insurance In California

The Future of Long Term Care Insurance in California

As the landscape of long term care insurance evolves in California, it is essential to stay informed about the industry trends and legislative changes shaping the future.

Industry Trends

- Increased demand for long term care insurance due to an aging population.

- Focus on innovative policy options to cater to diverse needs of consumers.

- Integration of technology to streamline processes and enhance customer experience.

Legislative Changes

- Introduction of new regulations to ensure consumer protection and transparency.

- Efforts to make long term care insurance more affordable and accessible for Californians.

- Collaboration with healthcare providers to improve care coordination and quality of services.

Frequently Asked Questions

How Much Does Long-term Care Cost In California?

Long-term care costs in California vary but can be expensive. On average, a private room in a nursing home costs about $10,646 per month. In-home care services can range from $25 to $35 per hour. These costs can add up quickly, so it’s important to plan ahead.

What Is The Biggest Drawback Of Long-term Care Insurance?

The biggest drawback of long-term care insurance is the cost, which can be high. Premiums may increase over time, making it challenging for some individuals to afford.

What Is The Best Age To Buy Long-term Care Insurance?

The best age to buy long-term care insurance is in your mid-50s to early 60s. It’s when premiums are lower and you’re more likely to qualify without health issues. Buying earlier ensures better coverage and can save you money in the long run.

What Is Long-term Care Insurance In California?

Long-term care insurance in California is a type of insurance policy that covers the costs of care received in a nursing home, assisted living facility, or in-home care. It is designed to provide financial assistance for those who need long-term care due to chronic illness, disability, or aging.

Conclusion

As you plan for the future, Long Term Care Insurance in California offers peace of mind. Protect your assets and well-being with a reliable insurance policy. Explore the options available to secure your long-term care needs and ensure a financially stable future.

Choose wisely and plan ahead.