Notary E and O insurance protects notaries from financial losses due to errors or omissions. It is essential for notaries to have this insurance coverage to safeguard their professional practice and personal assets.

In today’s litigious society, having Notary E and O insurance provides peace of mind and ensures that notaries can conduct their duties confidently. This type of insurance covers legal fees, court costs, and settlements in case a notary is sued for making mistakes or omissions during the notarization process.

By investing in this insurance, notaries can protect themselves from potential financial risks and maintain their reputation as trusted professionals in the industry.

Introduction To Notary E&o Insurance

Notary Errors and Omissions (E&O) Insurance provides protection for notaries public against claims of negligence or errors while performing their official duties. This type of insurance is essential for notaries to safeguard their professional and financial well-being. Having Notary E&O Insurance offers peace of mind and ensures compliance with state regulations.

As a notary public, you play an essential role in the legal system by verifying the authenticity of documents and witnessing signatures. However, despite your best efforts, mistakes can happen. That’s where Notary E&O Insurance comes in. In this article, we will discuss the role of a notary public and why insurance is crucial.

The Role Of A Notary Public

A notary public is an official appointed by the state government to act as a witness in the signing of legal documents. The notary’s primary role is to verify the identity of the person signing the document, ensure they are signing willingly and understand the contents of the document. Notaries also certify that the document was signed in their presence, and they affix their seal and signature to the document.

Why Insurance Is Crucial

Even with the best intentions, notaries can make mistakes, and those errors can result in legal disputes and financial losses. Notary E&O Insurance provides protection for notaries against claims of negligence, errors, and omissions. It covers legal fees, court costs, and damages awarded to the claimant. Without this insurance, notaries would be personally liable for any mistakes made during the notarization process. In conclusion, Notary E&O Insurance is essential for notaries to protect themselves from legal and financial risks. By understanding the role of a notary public and the importance of insurance, notaries can ensure they are providing the best possible service to their clients.

What Is Notary E&o Insurance?

Notary Errors and Omissions (E&O) Insurance provides protection to notaries public in case of unintentional errors or omissions during the notarization process. This insurance is essential for notaries to safeguard themselves against potential legal claims.

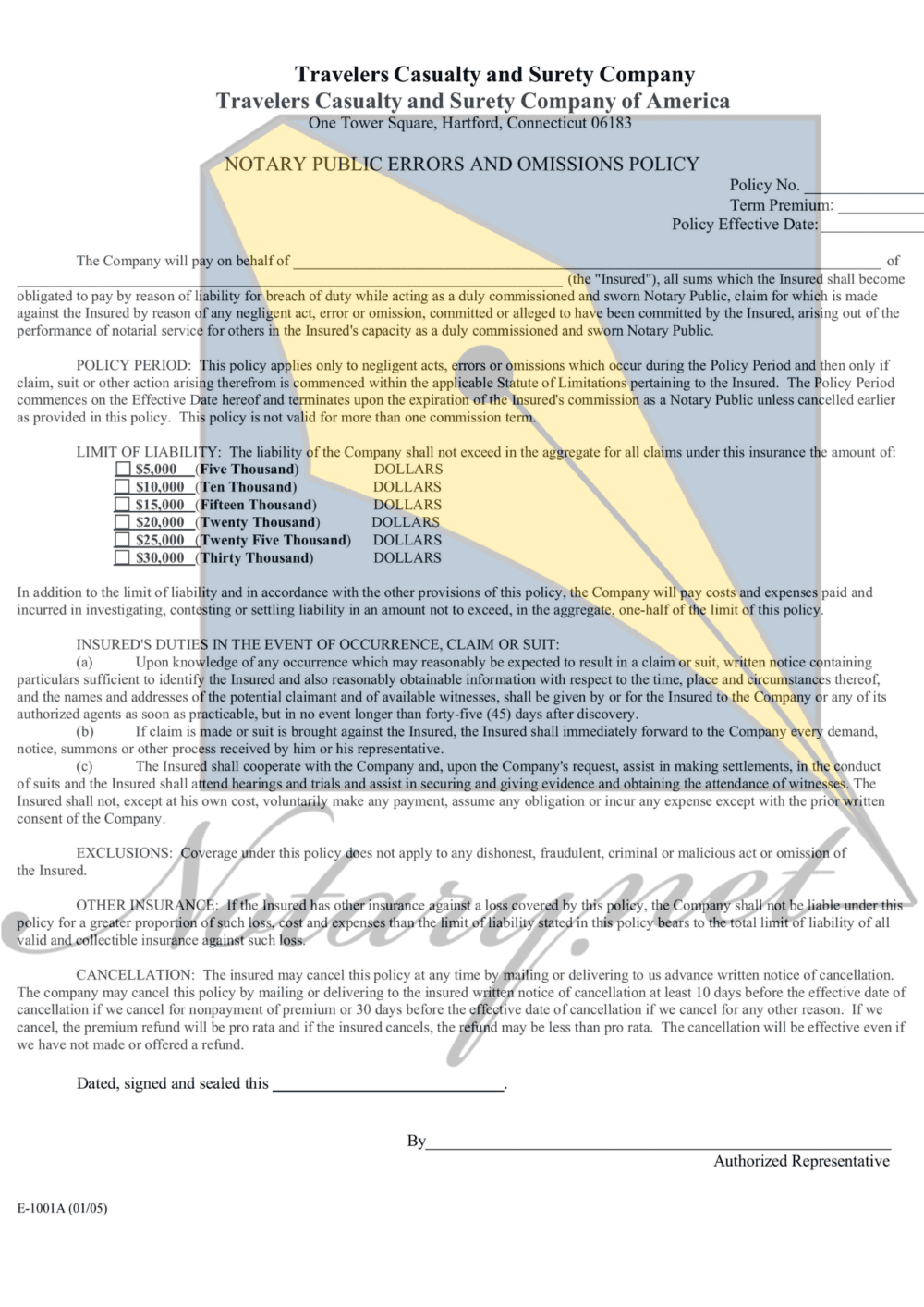

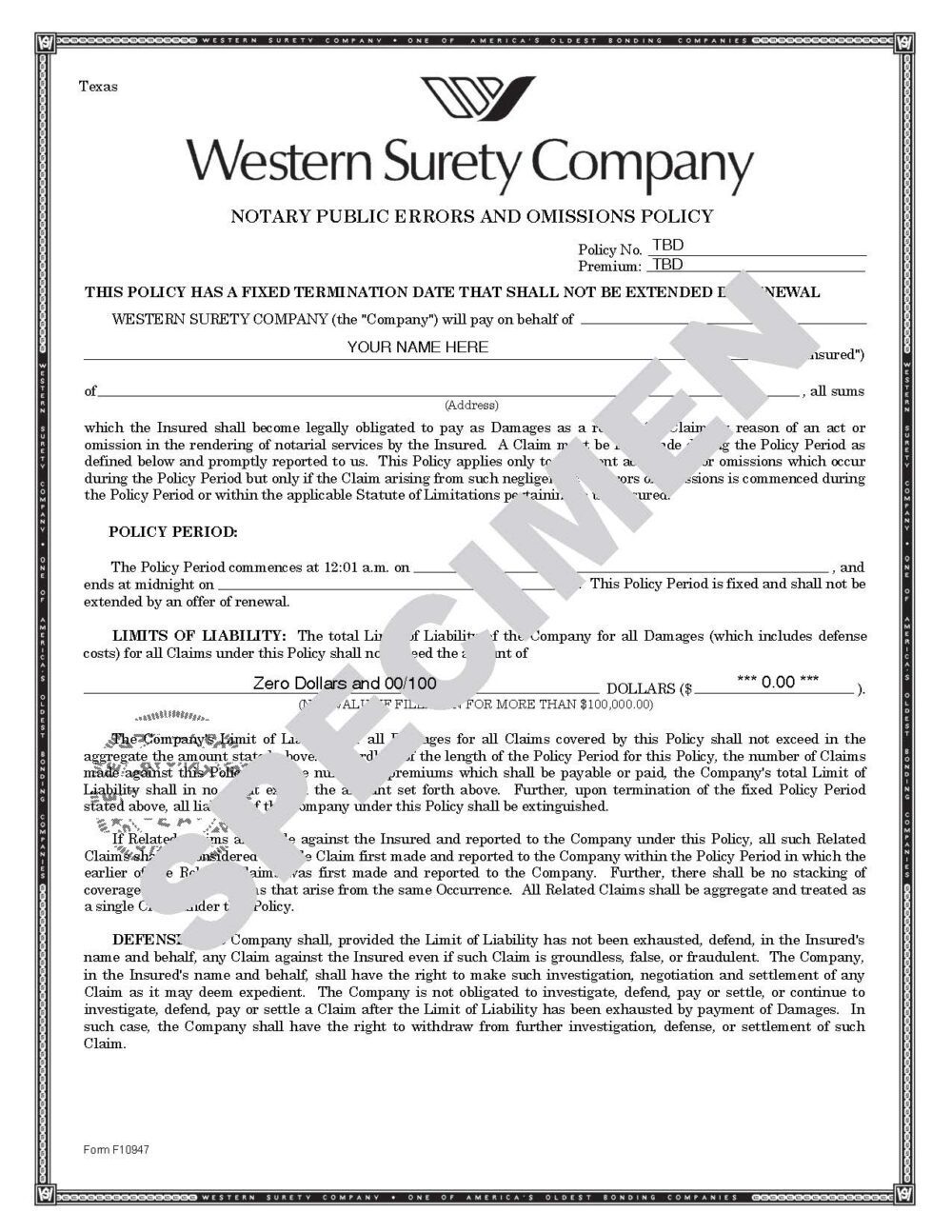

Definition And Coverage

Notary E&O Insurance offers coverage for mistakes such as incomplete forms, missing signatures, or incorrect notarization procedures. It helps cover legal expenses and settlements resulting from errors made by the notary.

Common Misconceptions

One common misconception is that Notary E&O Insurance is not necessary if you are careful. However, even the most diligent notaries can make mistakes, making insurance crucial for protection. Another misconception is that general liability insurance provides the same coverage as E&O insurance, which is not true.

Risks Faced By Notaries

Notaries play a crucial role in certifying and authenticating legal documents, but they also face various risks in their line of work. From unintentional errors to omissions, notaries encounter potential liabilities that can have significant consequences. Understanding the risks faced by notaries is essential for mitigating these liabilities and ensuring the smooth execution of their responsibilities.

Typical Errors And Omissions

Notaries are susceptible to a range of errors and omissions, including misidentification of signers, incomplete record-keeping, and improper notarial wording. Additionally, failure to confirm the signer’s willingness and understanding of the document can lead to discrepancies and potential legal disputes.

Consequences Of Notarial Mistakes

Mistakes made by notaries can result in severe consequences, such as invalidating the document, causing financial losses for involved parties, and even leading to legal actions. These errors can tarnish the notary’s professional reputation and incur hefty legal expenses.

Benefits Of E&o Insurance

Protection Against Lawsuits

Notary E&O Insurance provides protection against lawsuits arising from errors or omissions in notarized documents.

Peace Of Mind For Notaries

Having E&O Insurance ensures that notaries can carry out their duties with peace of mind, knowing that they are financially protected in case of legal claims.

Choosing The Right Policy

When it comes to safeguarding your notary business, choosing the right E&O insurance policy is crucial. With the myriad of coverage options, policy limits, and deductibles available, it’s essential to make an informed decision that aligns with your business needs.

Coverage Options

Understanding the coverage options available is the first step in choosing the right E&O insurance policy. Notary E&O insurance typically includes protection for errors or omissions, as well as coverage for legal fees and settlements in the event of a claim. Some policies may also offer coverage for cyber liability and identity theft protection, providing comprehensive protection for your notary business.

Policy Limits And Deductibles

When selecting an E&O insurance policy, it’s important to carefully consider the policy limits and deductibles. The policy limits determine the maximum amount the insurer will pay for a covered claim, while the deductible is the amount the insured is responsible for paying before the insurance coverage kicks in. Evaluating your business’s risk exposure and financial capabilities can help in determining the appropriate policy limits and deductibles for your notary business.

The Application Process

Applying for Notary Errors and Omissions (E&O) insurance involves several important steps and the submission of specific documentation. Understanding the application process is crucial for notaries seeking comprehensive coverage for their professional services.

Steps To Apply For E&o Insurance

When applying for Notary E&O insurance, it is important to follow these key steps:

- Research and compare insurance providers to find the most suitable coverage for your needs.

- Complete the application form provided by the chosen insurance company.

- Provide accurate information about your notary business and any previous claims or incidents.

- Review the terms and conditions of the insurance policy to ensure understanding of coverage and limitations.

- Submit the application and await approval from the insurance provider.

Required Documentation

When applying for Notary E&O insurance, the following documentation is typically required:

- Proof of notary commission or license

- Details of any previous claims or incidents

- Information about the nature of your notary business

- Personal identification documents

- Business registration or certification documents (if applicable)

Maintaining Your E&o Insurance

It is crucial to renew your E&O Insurance before the expiration date.

Keep your policy updated to ensure continuous coverage.

What happens if you lapse?

If your insurance lapses, you risk being uncovered for any claims made during that period.

It is essential to avoid gaps in your coverage to protect your business.

Credit: notary.net

Real-world Scenarios

Explore real-world scenarios where Notary E and O Insurance protects notaries from legal claims and financial losses. Safeguard your career with comprehensive coverage tailored to your profession’s unique risks.

Notary E and O Insurance is a crucial investment for notaries who want to protect themselves from potential claims and lawsuits. While the hope is that you never have to use your insurance, it’s important to understand the real-world scenarios where it can come in handy. In this section, we’ll explore some case studies and learn from others’ experiences.

Case Studies

One notary mistakenly notarized a document that was incomplete. The client later claimed that the notary had notarized a forged signature, and the notary was sued for negligence. Fortunately, the notary had Notary E and O Insurance and was covered for the cost of the claim. Another notary was accused of notarizing a document without properly identifying the signer. The client claimed that the notary had notarized a signature of someone who was not present. The notary was also sued for negligence, but because they had Notary E and O Insurance, they were able to pay for the legal fees and settlement.

Learning From Others’ Experiences

These case studies highlight the importance of having Notary E and O Insurance. Notaries can learn from others’ experiences and understand the risks associated with their profession. It’s important to always follow proper protocol and procedures when notarizing documents, and to keep a detailed record of all transactions. By investing in Notary E and O Insurance, notaries can protect themselves from potential claims and lawsuits. In conclusion, Notary E and O Insurance is an investment every notary should consider. By understanding the real-world scenarios where it can come in handy, notaries can make an informed decision about their insurance needs. Remember, prevention is key – always follow proper protocol and procedures to avoid potential claims and lawsuits.

Faqs About Notary E&o Insurance

Notary E&O Insurance FAQs address common queries about coverage and benefits for notaries. Understanding this insurance is crucial for protecting notaries from potential errors and omissions. Key information includes coverage limits, renewal process, and how to file a claim.

Addressing Common Questions

What is Notary E&O Insurance? Notary Errors and Omissions (E&O) Insurance protects notaries from liability for unintentional mistakes or omissions.

Why is Notary E&O Insurance essential? It provides financial protection in case a notary is sued for errors or omissions in their notarization services.

Who needs Notary E&O Insurance? Notaries, signing agents, and mobile notaries should consider obtaining E&O Insurance to safeguard their business.

Expert Advice

How much coverage should a notary consider? Notaries should assess their risk exposure and opt for coverage that adequately protects them in case of a claim.

What are common errors covered by E&O Insurance? Errors such as missing signatures, incorrect notarizations, or document tampering are typically included in coverage.

Where can notaries purchase E&O Insurance? Many insurance providers offer E&O Insurance specifically tailored for notaries and their unique needs.

Credit: notary.net

Credit: www.becomeanohionotary.com

Frequently Asked Questions

How Much E&o Insurance Does A Notary Need In Texas?

A notary in Texas should have Errors and Omissions (E&O) insurance, with coverage typically ranging from $15,000 to $25,000.

Who Or What Is Required To Carry E&o Insurance?

Professionals in certain industries, like real estate agents or lawyers, are required to carry E&O insurance.

What Does E&o Insurance Pay For?

E&O insurance, also known as professional liability insurance, pays for legal fees and damages in case a client sues you for a mistake or negligence in your professional services. It covers claims related to errors, omissions, or mistakes that result in financial loss for the client.

How Much E&o Insurance Is Required By Trec?

Real estate license holders in Texas are required to carry a minimum of $1 million in Errors and Omissions (E&O) insurance as mandated by TREC.

Conclusion

Notary E and O insurance is crucial for protecting notaries from potential financial risks. By providing coverage for errors and omissions, this insurance offers peace of mind and safeguards the notary’s professional reputation. It’s a smart investment for any notary public seeking to mitigate potential liabilities and ensure long-term success.