Notary Errors and Omissions Insurance is essential for notaries to protect themselves against errors, omissions or negligence that may occur during the notarization process. This type of insurance provides financial protection in case a claim is made against the notary for any mistakes or oversights made while performing their duties.

As a notary, it is important to understand the risks involved in your profession and take steps to protect yourself. Even the most careful and experienced notaries can make mistakes, and having Notary Errors and Omissions Insurance can provide peace of mind and protection against potential financial damages.

In this blog, we will discuss the importance of this insurance, what it covers, and how to obtain it.

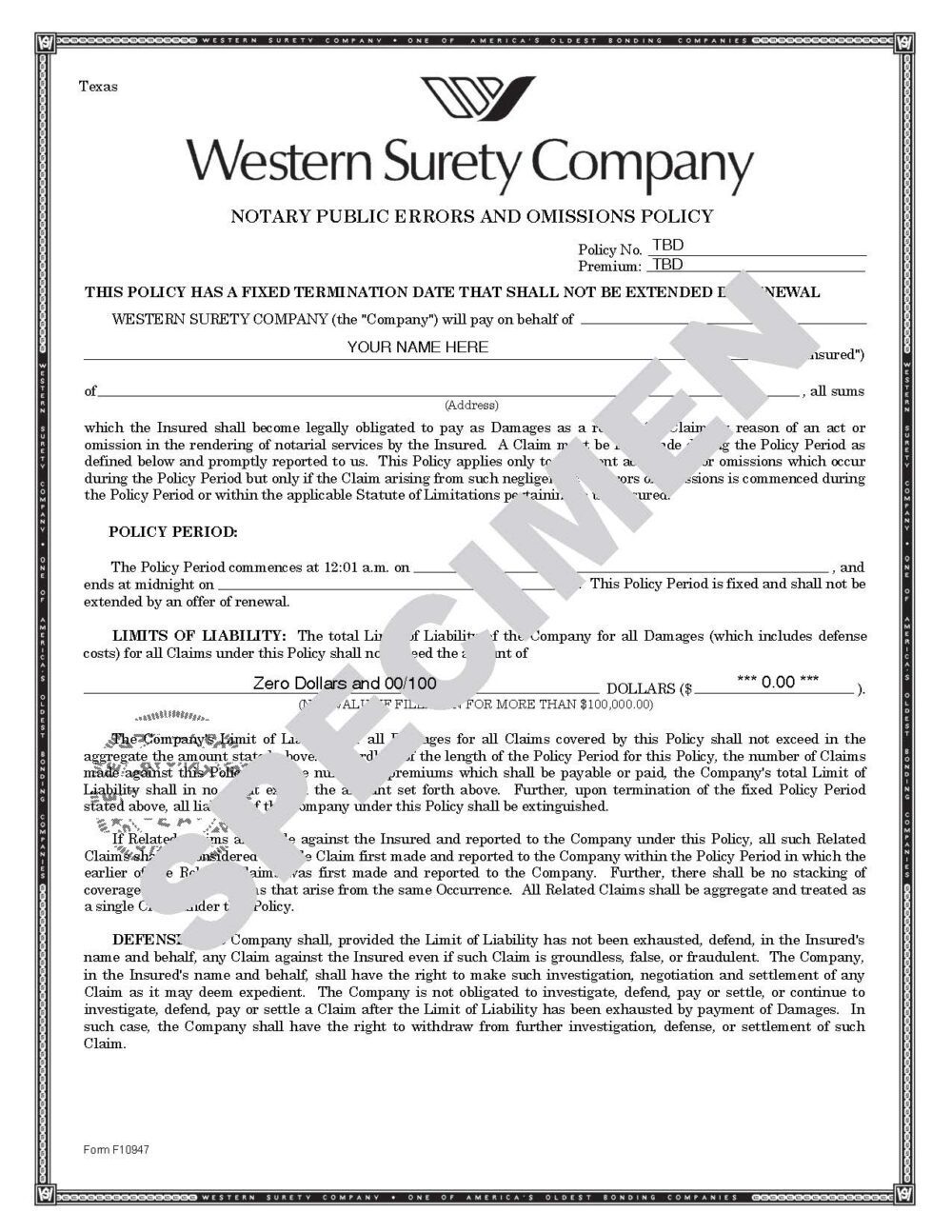

Credit: notary.net

Introduction To Notary E&o Insurance

Notary Errors and Omissions (E&O) Insurance is a vital protection for notaries public. It provides coverage for claims resulting from unintentional errors or omissions made during the notarization process. This insurance safeguards notaries from financial liabilities that may arise due to mistakes made while performing their official duties.

The Role Of A Notary Public

A notary public is authorized to witness and certify the signing of legal documents, administer oaths, and perform other duties permitted by law. Their role is crucial in ensuring the authenticity and legality of various transactions and contracts.

Risks Involved In Notarization

Notarizing documents involves potential risks, including errors in identifying signers, incomplete or inaccurate notarizations, and failure to follow proper procedures. These risks can lead to legal disputes and financial consequences for both the notary and the individuals involved in the notarized transactions.

Credit: notarypublicunderwriters.com

Basics Of Notary E&o Insurance

Notary Errors and Omissions (E&O) insurance is a crucial protection for notaries public. It provides coverage for legal fees and damages resulting from mistakes made during notarization.

What Is E&o Insurance?

E&O insurance, also known as professional liability insurance, safeguards notaries in the event of claims of negligence, errors, or omissions in their professional services. It provides financial protection and peace of mind.

Why Notaries Need E&o Insurance

Notaries need E&O insurance to shield themselves from potential financial losses and legal repercussions resulting from unintentional errors or omissions in their notarial acts. Without this protection, notaries could be personally liable for damages.

Common Notarial Mistakes

Incorrectly filled forms: Notaries must accurately complete all fields in the forms.

Failure to verify identity: Notaries must ensure proper identification of all signers.

Claims Covered By E&o Insurance

Document Errors And Omissions

Errors and omissions (E&O) insurance provides coverage for claims related to document errors and omissions. This includes mistakes made in notarized documents, such as missing signatures, incorrect dates, or other errors that could potentially invalidate the document. In the event of a claim, E&O insurance can help cover the associated costs, providing peace of mind for notaries and their clients.

Legal Defense Costs

Another important aspect of E&O insurance is the coverage it provides for legal defense costs. In the event of a claim, the policy can cover expenses related to defending against allegations of negligence, errors, or omissions in notarization. This can include legal fees, court costs, and other expenses incurred in the defense process, ensuring that notaries have the necessary support to address claims made against them.

Choosing The Right E&o Policy

When it comes to protecting your notary business, choosing the right Errors and Omissions (E&O) insurance policy is crucial. Selecting the appropriate policy can provide you with the necessary coverage to safeguard your business from potential legal claims and financial losses. Understanding the key factors to consider when choosing an E&O policy can help you make an informed decision.

Policy Limits And Coverage

Before purchasing an E&O policy, it’s essential to carefully review the policy limits and coverage. Policy limits determine the maximum amount the insurance company will pay for a claim, while coverage outlines the specific protections offered by the policy. Ensure the policy’s limits align with the potential risks your notary business may face. Look for comprehensive coverage that includes protection for errors, omissions, and negligence in the performance of notarial acts.

Comparing Insurance Providers

When comparing insurance providers, it’s important to evaluate several key aspects. Look for providers with a strong reputation for reliable and efficient claims processing. Consider the financial stability of the insurance company, as well as their experience in handling claims related to notary errors and omissions. Additionally, compare the cost of premiums and any additional fees associated with the policy to ensure you are getting the best value for your coverage.

E&o Insurance Policy Exclusions

Notary Errors and Omissions Insurance policies typically exclude intentional wrongdoing, criminal acts, and fraud. Other exclusions may include services not performed within the scope of the notary’s duties, claims arising from acts committed before or after the policy period, and claims resulting from the notary’s failure to obtain proper authorization.

What Is Not Covered?

Notary Errors and Omissions Insurance provides valuable protection, but it’s crucial to understand the policy exclusions to avoid surprises.

Understanding Policy Exclusions

Policy exclusions outline scenarios where your coverage may not apply, so it’s vital to grasp these limitations.

What Is Not Covered?

- Fraudulent Acts – Intentional wrongdoing is typically excluded from E&O coverage.

- Criminal Activities – Illegal actions are not protected under the policy.

- Property Damage – Damage to physical property may fall outside the scope of coverage.

Impact Of Not Having E&o Insurance

Notary Errors and Omissions (E&O) Insurance is a vital protection for notaries. It covers them in case of errors or omissions in their notarial acts. Not having E&O insurance can have serious consequences, both financially and reputationally.

Personal Financial Risk

Without E&O insurance, notaries are exposed to significant personal financial risk. In the event of a lawsuit due to a mistake or omission in their notarization, they could be held personally liable for damages. This could lead to severe financial strain, potentially impacting their personal assets and financial stability.

Reputational Damage

The absence of E&O insurance exposes notaries to the risk of reputational damage. In the event of an error or omission, notaries may lose the trust and confidence of their clients and the community. This damage to their professional reputation can have long-lasting effects, impacting their ability to attract new clients and maintain existing relationships.

Real-world Scenarios

Case Studies

Notary errors and omissions insurance is a crucial safeguard for notaries public, protecting them from potential financial losses due to errors or omissions in their notarial acts. Let’s delve into some real-world scenarios where this insurance has played a pivotal role in mitigating risks and protecting notaries.

Learning From Past Claims

Case 1: In a real estate transaction, a notary mistakenly omitted a signature on a crucial document. The omission was discovered after the deal had closed, leading to legal disputes and financial losses for all parties involved. Thankfully, the notary had errors and omissions insurance, which covered the legal costs and compensation for the affected parties.

Case 2: During a loan closing, a notary unintentionally failed to properly identify one of the signers, resulting in the loan being declared invalid. The affected parties pursued legal action, and the notary’s errors and omissions insurance provided the necessary coverage for legal defense and settlement costs.

Maintaining Proper Notary Practices

Notaries play a crucial role in legal and business transactions. To avoid costly errors, it’s essential to follow best practices.

Continuous Education

Regularly updating knowledge through seminars and workshops enhances notarial skills.

Staying informed on industry developments prevents mistakes and ensures compliance.

Adhering To State Laws And Guidelines

Understanding and following specific state requirements minimizes errors and omissions.

Comprehensive knowledge of regulations safeguards against legal complications.

Credit: notary.net

Conclusion: Protecting Your Notary Business

Summarizing The Importance Of E&o Insurance

Errors and Omissions (E&O) insurance is crucial for notaries to protect against potential legal claims.

It provides financial coverage in case of unintentional errors or omissions during notarization services.

Next Steps For Notaries

Secure a comprehensive E&O insurance policy to safeguard your notary business and personal assets.

Regularly review and update your insurance coverage to adapt to changing business needs.

Frequently Asked Questions

What Does Errors And Omissions Insurance Cover?

Errors and omissions insurance, also known as professional liability insurance, covers businesses and individuals from claims of inadequate work or negligence. It protects against financial loss due to legal expenses and damages awarded in lawsuits related to errors or omissions in services provided.

How Much E&o Insurance Do I Need As A Notary Signing Agent In Texas?

As a notary signing agent in Texas, you typically need E&O insurance coverage of $25,000 to $100,000.

Who Should Carry Errors And Omissions Insurance?

Professionals in legal, medical, real estate, and financial fields should carry errors and omissions insurance.

How Much Is E And O Insurance In Texas?

The cost of E&O insurance in Texas varies based on factors like coverage limits and the nature of your business. Generally, it can range from a few hundred to several thousand dollars per year. To get an accurate quote, it’s best to contact insurance providers directly.

Conclusion

Protect your notary business with Errors And Omissions Insurance. Safeguard against potential liabilities and ensure peace of mind. Choose a comprehensive policy tailored to your needs. Stay covered and focused on your clients, knowing you have the right protection in place.

Trust in the security it provides.