A Notary Insurance Bond provides financial protection in case of errors or misconduct by a notary public. It ensures compensation for damages.

Notary services play a crucial role in legal and financial transactions. As a notary public, having an insurance bond is essential for safeguarding against potential risks and liabilities. In the event of errors or misconduct, the bond provides financial protection and ensures that affected parties receive compensation.

This added layer of security not only protects the notary public but also instills confidence in clients. Understanding the importance of a Notary Insurance Bond is key for notaries to operate with peace of mind and professionalism.

The Essence Of Notary Insurance Bonds

Notary insurance bonds are essential for protecting notaries against potential legal and financial risks. These bonds provide a layer of security for both the notary and their clients, ensuring that any potential errors or misconduct are covered. By obtaining notary insurance bonds, notaries can instill confidence in their clients and uphold professional standards.

As a notary public, it is crucial to have insurance coverage that protects you against potential liabilities arising from errors or omissions in notarizing documents. This is where notary insurance bonds come in. A notary insurance bond is a type of insurance policy that provides financial protection to notaries in the event of claims filed against them. In this article, we will discuss the key functions of a notary, the role of insurance bonds in notary work, and why notary insurance bonds are essential.

Key Functions Of A Notary

A notary public is a public official appointed by the state government to witness the signing of important documents and administer oaths. The following are the key functions of a notary:

- Verifying the identity of signatories

- Administering oaths and affirmations

- Witnessing the signing of documents

- Attesting to the authenticity of signatures and documents

- Keeping records of notarized documents

The Role Of Insurance Bonds In Notary Work

Notary insurance bonds play a crucial role in notary work. In essence, a notary insurance bond is a contract between the notary, the insurance company, and the state government. The bond ensures that the notary is financially responsible for any errors or omissions made while notarizing documents. This means that if a claim is filed against the notary, the bond will cover the damages up to the bond amount. The bond also provides protection to the public by ensuring that notaries are financially responsible for their actions. This helps to promote trust and confidence in the notarial process and ensures that notaries are held accountable for any mistakes made. In conclusion, notary insurance bonds are essential for notaries who want to protect themselves against potential liabilities. They provide financial protection to notaries and ensure that they are held accountable for their actions. As a notary public, it is important to have a clear understanding of the role of insurance bonds in notary work.

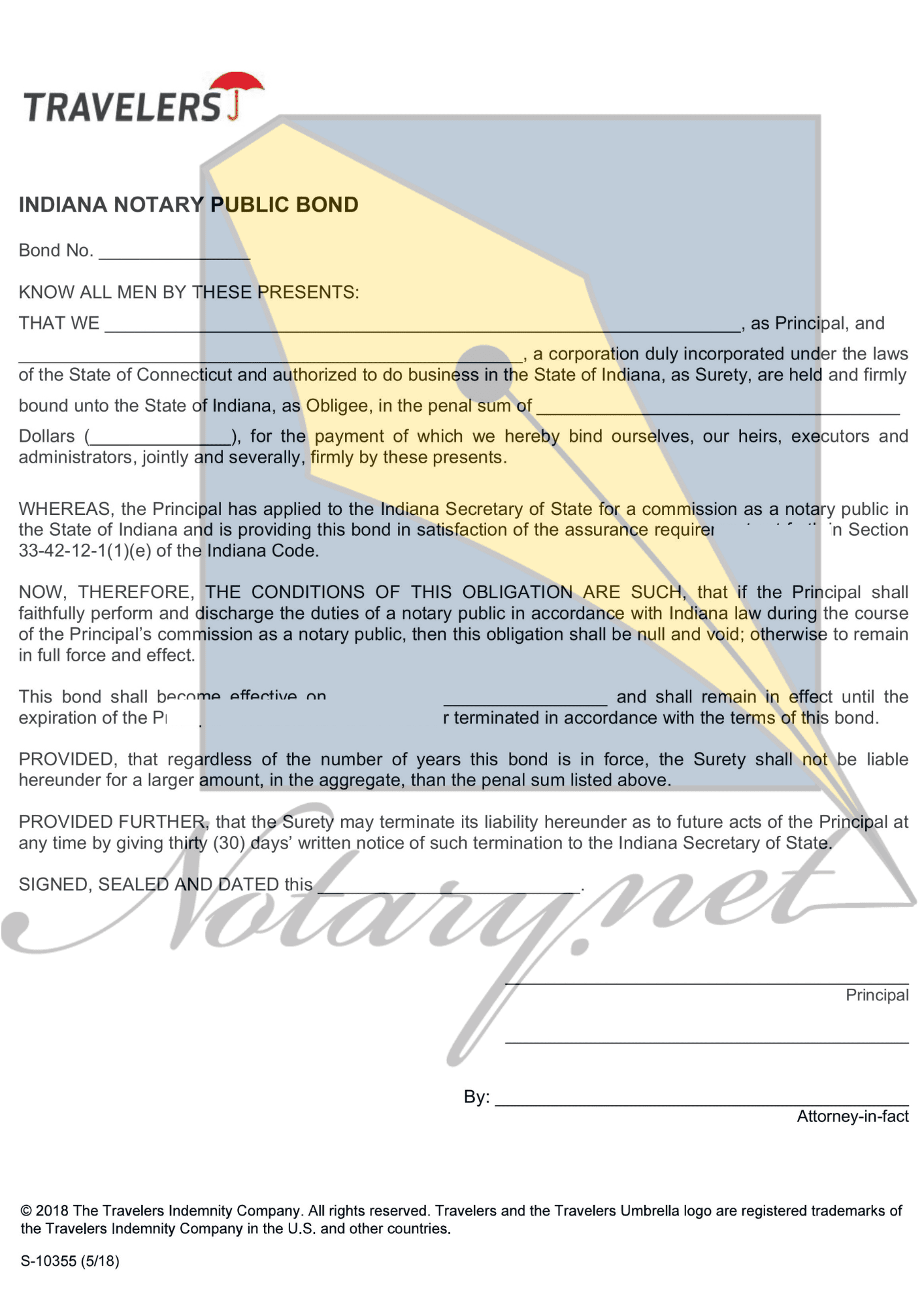

Credit: notary.net

Breaking Down Notary Bonds

Definition Of A Notary Bond

A Notary Bond is a type of surety bond that protects the public from financial loss due to improper actions by a notary.

How Notary Bonds Differ From Insurance

Notary Bonds specifically protect others, while insurance protects the policyholder.

Risks In The Notary Profession

Common Claims Against Notaries

Notaries are often faced with common claims that can arise from their professional activities. Errors in notarizing documents, failure to properly identify signers, and improper completion of notarial certificates are some of the common claims that notaries may encounter. These claims can lead to legal disputes and financial liabilities for notaries, making it essential for them to have adequate insurance coverage to protect themselves.

Real-world Consequences Of Uninsured Notary Activities

Uninsured notaries may face severe consequences in the event of legal claims or lawsuits. Without insurance coverage, notaries may be personally liable for legal fees, damages, and settlements, putting their financial security at risk. Additionally, uninsured notaries may suffer damage to their professional reputation and face regulatory sanctions, which can have long-term implications for their career.

Types Of Notary Bonds

Notary bonds are crucial for notaries to protect themselves and the public. Two common types of notary bonds are surety bonds and fidelity bonds.

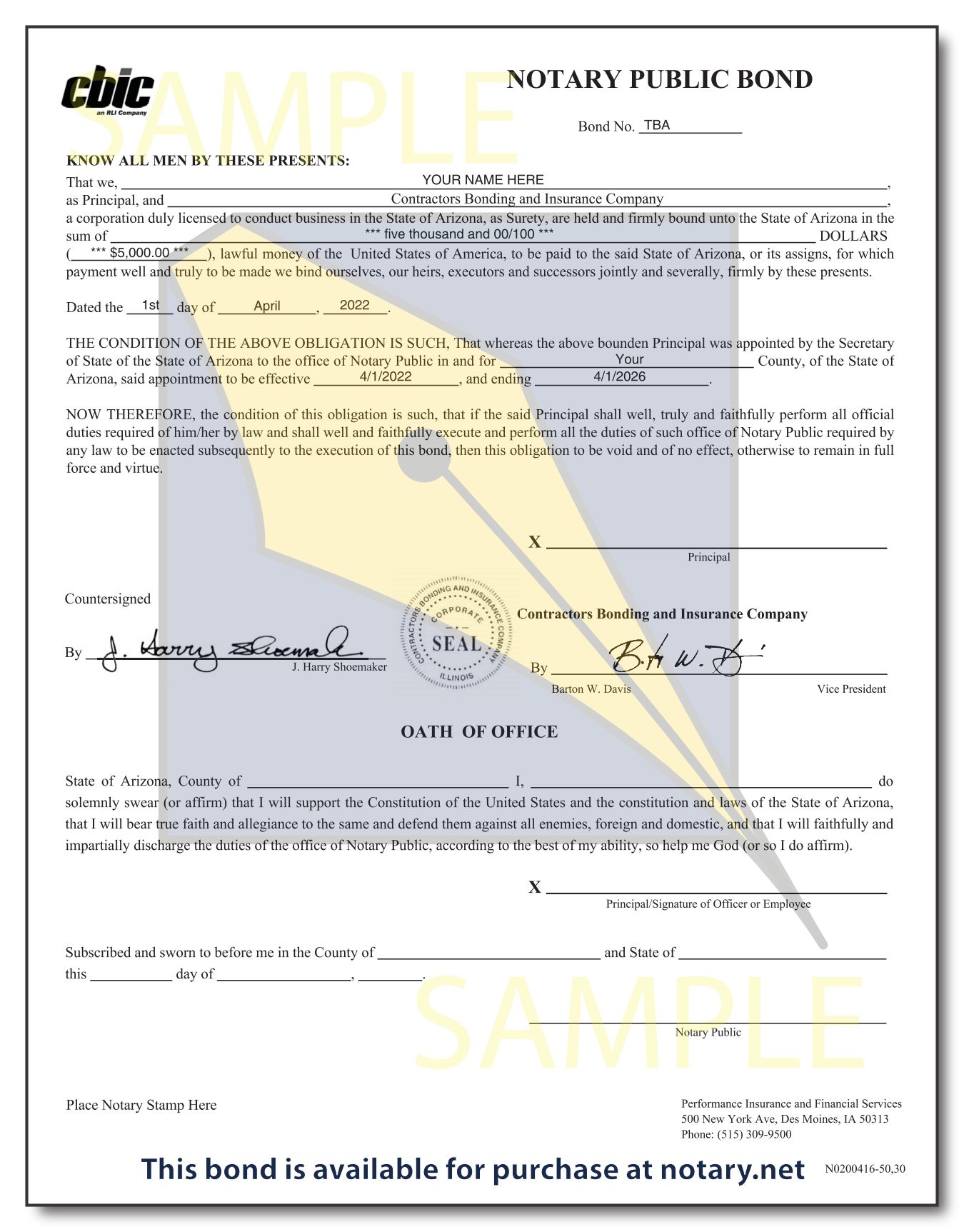

Surety Bonds Explained

Surety bonds guarantee that the notary will fulfill their duties ethically and lawfully. In case of negligence or misconduct, the bond provides financial protection for those affected.

Fidelity Bonds For Employee Protection

Fidelity bonds are designed to protect employers from dishonest acts committed by their employees. This type of bond ensures compensation for losses due to employee theft or fraud.

Acquiring Your Notary Bond

To acquire your notary insurance bond, contact a reputable surety company. Obtain the necessary bond to protect your clients. Fulfill this requirement to enhance your credibility as a notary public.

Steps To Obtain A Notary Bond

Acquiring your notary bond is a crucial step in becoming a notary public. Here are the steps to obtain your notary bond:

- Research reputable insurance providers offering notary bonds.

- Compare quotes and coverage options to select the most suitable bond.

- Fill out the application form with accurate information.

- Pay the required premium for the notary bond.

- Submit your application and await approval from the provider.

Cost Factors And Period Of Validity

The cost of a notary bond and its period of validity are important considerations. The cost factors and period of validity include:

| Cost Factors | Period of Validity |

|---|---|

| Varies based on the state and coverage amount. | Typically ranges from 4 to 10 years. |

| Good credit may lower the premium. | Renewal required upon expiration. |

Claims Process And Bond Coverage

When it comes to notary insurance bonds, understanding the claims process and bond coverage is crucial for notaries public. Knowing how to file a claim and the limits of coverage can provide peace of mind and ensure that notaries are adequately protected in the event of a claim.

How To File A Claim On A Notary Bond

Filing a claim on a notary bond involves specific steps to ensure a smooth and efficient process. Notaries must first gather all relevant documentation related to the claim, including the bond number, the date of the notarization, and any supporting evidence. The next step is to contact the bonding company and submit the claim with the required documentation. Once the claim is submitted, the bonding company will initiate an investigation to assess the validity of the claim and determine the appropriate course of action.

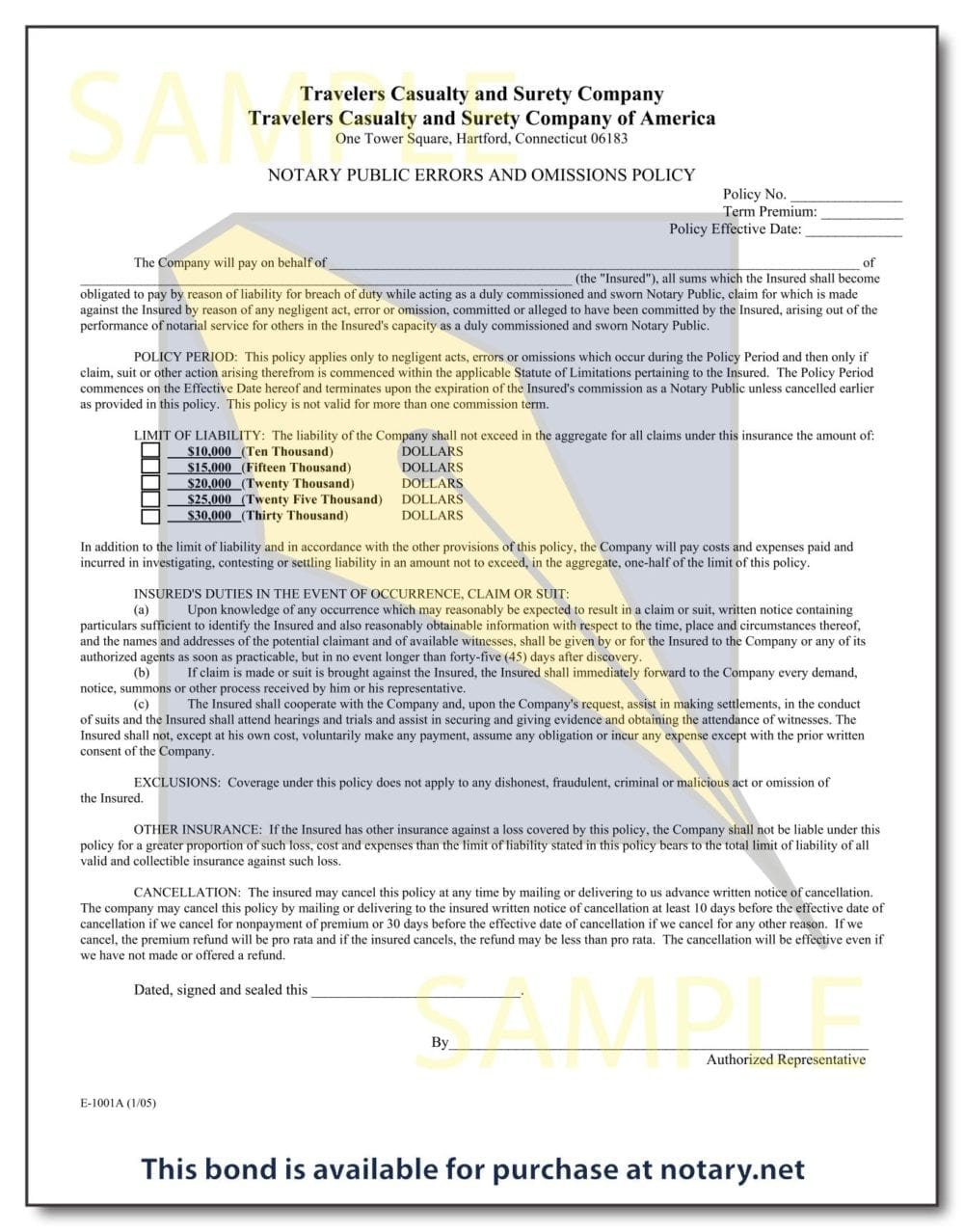

Understanding The Limits Of Coverage

Notary insurance bonds have limits of coverage that notaries should be aware of. These limits typically include a maximum aggregate limit and a per-claim limit. The maximum aggregate limit is the total amount of coverage available for all claims during the bond term, while the per-claim limit is the maximum amount payable for each individual claim. It’s important for notaries to understand these limits to ensure they have adequate coverage for potential claims.

Legal Implications Of Notary Bonds

Notary bonds play a crucial role in ensuring trust and legality in various transactions. Understanding the legal implications of notary bonds is essential for both notaries and the individuals they serve.

State Requirements And Regulations

Each state has specific requirements and regulations for notary bonds. Notaries must comply with these regulations to legally operate within their jurisdiction.

Consequences Of Not Having A Bond

Failure to have a notary bond can result in severe consequences, including legal penalties and potential loss of notary privileges. It is vital for notaries to maintain an active bond to protect themselves and their clients.

Credit: notary.net

Enhancing Your Notary Practice

Enhance your notary practice with a Notary Insurance Bond, providing protection and credibility for your services. Safeguard your clients and business with this essential coverage.

As a notary, you play an essential role in legal transactions by verifying the authenticity of signatures and preventing fraud. However, even the most diligent notaries can face legal challenges. That’s why it’s crucial to have notary insurance bond coverage to protect yourself and your clients. In this blog post, we’ll discuss how additional insurance can enhance your notary practice, and best practices for risk management.

Additional Insurance For Notaries

While notary bonds are required by law, they only offer limited coverage. Additional insurance can provide extra protection for your notary practice. For example, errors and omissions (E&O) insurance can cover legal expenses and damages if you make a mistake or omission during a notarization. Cyber liability insurance can protect you from data breaches and cyberattacks that compromise sensitive client information. General liability insurance can provide coverage for accidents or injuries that occur on your business premises.

Best Practices For Risk Management

Insurance is just one aspect of risk management for notaries. Here are some best practices to minimize the risk of legal challenges:

- Thoroughly review documents before notarizing them to ensure they’re complete and accurate.

- Verify the identity of signers with proper identification documents.

- Keep detailed records of all notarial acts, including the date, time, and location.

- Use a journal to record all notarial acts, including the type of document, the signer’s name, and the type of identification used.

- Never notarize a document that you have a personal interest in or that involves a family member.

- Stay up-to-date on notary laws and regulations in your state.

By following these best practices and having additional insurance coverage, you can enhance your notary practice and protect yourself from legal challenges. Don’t wait until it’s too late to invest in notary insurance bond coverage and risk management strategies.

Future Of Notary Bonds

The future of notary bonds is constantly evolving to meet the changing needs of the industry and the professionals within it. As technology advances and regulations shift, the landscape of notary bonds is expected to undergo significant transformations. Understanding the trends in notary legislation and the innovations in notary bond products will be crucial for notaries and insurance providers alike.

Trends In Notary Legislation

Notary legislation is continuously adapting to address the complexities of modern business transactions. States are introducing new laws and regulations to enhance the security and validity of notarized documents. In response to these changes, notaries must stay informed and compliant with the latest legislative requirements to ensure the protection of all parties involved.

Innovations In Notary Bond Products

Innovations in notary bond products are revolutionizing the way notaries obtain and maintain the necessary coverage. Insurance providers are developing specialized bond solutions tailored to the unique needs of notaries, offering enhanced convenience and flexibility. These innovative products aim to streamline the bonding process and provide comprehensive protection for notaries and their clients.

Credit: notary.net

Frequently Asked Questions

How Much Does A $10,000 Surety Bond Cost In Texas?

The cost of a $10,000 surety bond in Texas varies, but typically ranges from $100 to $500. Factors such as credit score and business financials may also influence the final price.

Do I Need A Bond To Be A Notary In Texas?

Yes, in Texas, you are required to obtain a surety bond to become a notary.

How Much Is A Notary Bond In Texas?

The cost of a notary bond in Texas varies depending on the bond amount required. For a $10,000 bond, the cost can be around $50, while a $100,000 bond can cost around $500. It’s best to check with a licensed surety bond provider for exact pricing.

How Do I Get A Surety Bond In Texas?

To get a surety bond in Texas, contact a licensed surety bond provider, complete the application, and pay the premium.

Conclusion

A notary insurance bond is a crucial protection for notaries. It provides financial security and reassurance to clients. By obtaining this bond, notaries can demonstrate their commitment to ethical and professional conduct. This added layer of security can help notaries build trust and credibility with their clients, ultimately benefiting their business.