Pest control insurance protects businesses from financial losses due to pest-related damage or lawsuits. It provides coverage for property damage and liability claims resulting from pest infestations.

As a business owner in the pest control industry, having the right insurance coverage is crucial to safeguard your company’s assets and reputation. Without adequate insurance, you could face significant financial risks in the event of a lawsuit or property damage caused by pests.

By investing in pest control insurance, you can ensure that your business is protected and prepared for any unforeseen circumstances that may arise. Understanding the importance of pest control insurance is essential for the long-term success and stability of your pest control business.

Credit: www.otterstedt.com

The Importance Of Pest Control Insurance

In the pest control industry, there are numerous risks that business owners need to be aware of. From property damage to liability claims, these risks can have a significant impact on the financial stability of your business. That’s why having pest control insurance is essential. This type of insurance provides financial protection and peace of mind, allowing you to focus on providing effective pest control services to your clients.

Risks In The Pest Control Industry

Pest control professionals face a variety of risks in their day-to-day operations. These risks include:

- Property damage: Accidents can happen, and if your pest control equipment or chemicals cause damage to a client’s property, you could be held liable for the costs of repairs.

- Health hazards: Exposure to certain pests and chemicals used in pest control can pose health risks to both your employees and clients. In the event of an illness or injury, you may be responsible for medical expenses and potential legal claims.

- Environmental impact: Improper use or disposal of pesticides can harm the environment and result in fines or legal action.

- Professional errors: Mistakes happen, and if your pest control treatment fails to eliminate the problem or causes additional damage, you could face claims for negligence.

Financial Protection For Your Business

Pest control insurance provides financial protection for your business by covering various risks and potential losses. Here are some key benefits:

- General liability coverage: This protects your business from claims of property damage or bodily injury caused by your operations.

- Professional liability coverage: Also known as errors and omissions insurance, this coverage safeguards your business in case of professional mistakes or failures.

- Product liability coverage: If a pest control product you use causes harm or damage, this coverage helps protect your business from resulting claims.

- Property coverage: This covers damage to your business property, including your office, equipment, and inventory.

- Workers’ compensation coverage: If an employee is injured on the job, this coverage helps cover medical expenses and lost wages.

By having pest control insurance, you can mitigate the financial risks associated with running a pest control business. It ensures that you have the necessary funds to cover unexpected expenses, legal fees, and potential settlements or judgments. Ultimately, having insurance gives you the confidence and peace of mind to focus on delivering high-quality pest control services to your clients.

Types Of Pest Control Insurance Policies

Pest control companies face various risks while providing their services. To mitigate these risks, it’s crucial for them to have the right insurance coverage. There are different types of pest control insurance policies that cater to the specific needs of these businesses.

General Liability Insurance

General liability insurance provides coverage for third-party bodily injury, property damage, and advertising injury. It protects pest control companies from potential lawsuits and related expenses.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, covers the costs associated with claims of negligence, errors, or omissions in the services provided. It’s essential for protecting pest control businesses from legal actions related to professional mistakes.

Commercial Auto Insurance

Commercial auto insurance is crucial for pest control companies that use vehicles for business operations. It provides coverage for vehicles used in the business, including liability, collision, and comprehensive protection.

How Pest Control Insurance Protects Your Business

If you own a pest control business, you understand the unique challenges and risks associated with your industry. From property damage to employee injuries, there are various threats that can potentially harm your business and its reputation. That’s where pest control insurance comes into play, providing essential protection and peace of mind for your business.

Coverage For Property Damage

When it comes to pest control, accidents can happen, and sometimes those accidents can result in property damage. Whether it’s damage to a client’s home or business premises, the costs of repairs and replacements can quickly add up. With pest control insurance, you can rest assured knowing that you have coverage for property damage caused by your operations.

Whether it’s accidental damage to a client’s property during a treatment or an unforeseen event like a fire or water damage caused by your equipment, your insurance policy can help cover the costs of repairs and any legal claims that may arise as a result.

Legal Defense And Settlements

Unfortunately, even with the best intentions and practices, disputes and legal issues can still arise in the pest control industry. Whether it’s a client claiming negligence or damage caused by your services, legal defense and settlements can be costly and time-consuming.

With pest control insurance, you have the necessary protection to handle legal challenges. Your policy can cover the costs of legal defense, including attorney fees, court expenses, and settlements, ensuring that your business can continue to operate smoothly without the burden of hefty legal costs.

Protection Against Employee Injuries

Your employees play a vital role in the success of your pest control business. However, their work also exposes them to potential risks and hazards. From slips and falls to exposure to harmful chemicals, accidents can happen, leading to injuries and potential workers’ compensation claims.

Pest control insurance provides protection against employee injuries, covering medical expenses, lost wages, and rehabilitation costs. By having this coverage in place, you can demonstrate your commitment to your employees’ well-being and safeguard your business from financial strain.

In conclusion, pest control insurance is an essential investment for your business. It offers coverage for property damage, legal defense, and settlements, as well as protection against employee injuries. By having the right insurance in place, you can ensure the long-term success and sustainability of your pest control business.

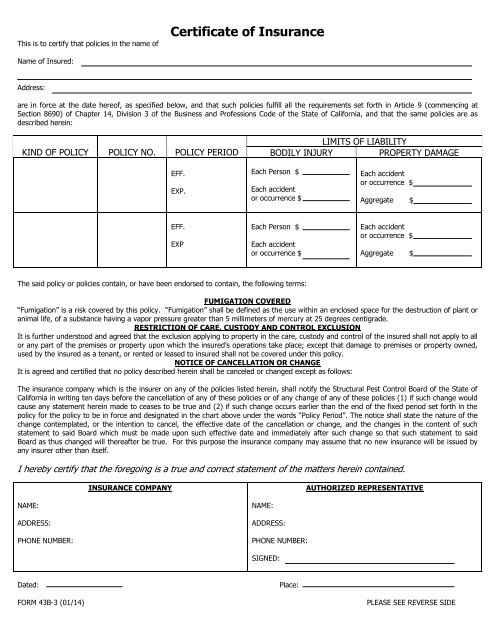

Credit: www.yumpu.com

Calculating The Cost Of Pest Control Insurance

Calculating the cost of pest control insurance involves considering various factors, such as the type of pests being controlled, the size of the business, and the coverage needed. It is important to work with an experienced insurance agent to determine the appropriate policy for your pest control business.

Factors Influencing Insurance Premiums

Factors like business size, location, coverage limits, and claims history impact insurance costs.

Tips For Reducing Insurance Costs

Implement pest control best practices, maintain records, and invest in safety measures.

Calculating the Cost of Pest Control Insurance can be influenced by various factors. Factors such as business size, location, coverage limits, and claims history all play a role in determining the insurance premiums. To make sure you are getting the best deal possible, it is essential to understand these factors and how they impact your insurance costs.

Factors Influencing Insurance Premiums

– Business Size: Larger businesses may have higher premiums due to increased risk.

– Location: Areas prone to specific pests may have higher premiums.

– Coverage Limits: Higher coverage limits can lead to higher premiums.

– Claims History: Past claims can impact current insurance costs.

Tips For Reducing Insurance Costs

– Implement Pest Control Best Practices: Regular maintenance and preventive measures.

– Maintain Records: Keep detailed records of pest control activities and inspections.

– Invest in Safety Measures: Implement safety protocols to reduce risks.

Navigating The Claims Process

Navigating the claims process for pest control insurance can be a complex and overwhelming task. It is important to understand the coverage, documentation requirements, and timelines for filing a claim. Working with a knowledgeable insurance agent can help streamline the process and ensure a successful claim outcome.

Navigating the Claims Process

Pest infestations can cause significant damage to properties, leading to high repair costs. Fortunately, with pest control insurance, property owners can file claims to cover the expenses. However, navigating the claims process can be overwhelming, especially for those who have never done it before. In this article, we will guide you through the steps to file a claim and what to expect during the claims process.

Steps to File a Claim

Filing a pest control insurance claim is a straightforward process. Here are the steps you need to follow:

1. Contact your insurance provider: The first step is to contact your insurance provider and inform them of the pest infestation. The insurance company will assign a claims adjuster to assess the damage and determine the coverage.

2. Provide evidence: The claims adjuster will require evidence of the infestation, including photos and videos of the damage. Make sure to document all the damage caused by the pests.

3. Get an estimate: You will need to get an estimate of the repair costs from a licensed pest control company. The insurance company will cover the costs up to the policy limits.

4. Review the policy: Before filing a claim, review your insurance policy to ensure that the pest infestation is covered. Some policies may have exclusions or limitations.

What to Expect During the Claims Process

The claims process can take several weeks to complete, depending on the complexity of the case. Here is what you can expect during the claims process:

1. Investigation: The claims adjuster will investigate the pest infestation and assess the damage. They will also review your insurance policy to determine the coverage.

2. Claim evaluation: After assessing the damage, the claims adjuster will evaluate the claim and determine the amount of coverage. They will also review the estimate from the pest control company.

3. Settlement: Once the claim is evaluated, the insurance company will offer a settlement. If you agree to the settlement, the insurance company will pay for the repair costs.

4. Appeal: If you disagree with the settlement amount, you can appeal the decision. You will need to provide additional evidence to support your claim.

In conclusion, navigating the claims process for pest control insurance can be stressful, but it doesn’t have to be. By following the steps outlined in this article and understanding what to expect during the claims process, you can file a claim and get the coverage you need to repair the damage caused by pests.

Choosing The Right Insurance Provider

As a pest control business owner, protecting your business and clients is essential. One way to do this is by having the right insurance coverage. However, choosing the right insurance provider can be a daunting task. With so many options available, it can be challenging to know which one is the best fit for your business needs. In this section, we will discuss the criteria for selecting an insurer and how to compare quotes and coverage.

Criteria For Selecting An Insurer

When choosing an insurance provider for your pest control business, there are several factors to consider:

| Criteria | Description |

|---|---|

| Experience and Reputation | Choose an insurer with experience and a good reputation in the pest control industry. |

| Financial Strength | Choose an insurer with strong financial ratings to ensure they can pay out claims. |

| Coverage Options | Choose an insurer that offers coverage options that meet your business needs. |

| Customer Service | Choose an insurer with excellent customer service that can assist you in the event of a claim. |

Comparing Quotes And Coverage

Once you have identified potential insurance providers, it’s essential to compare their quotes and coverage options. Here are some tips to help you:

- Request quotes from at least three insurance providers.

- Compare coverage options to ensure they meet your business needs.

- Consider the cost of premiums and deductibles.

- Review the terms and conditions of the policy carefully.

- Ask questions and clarify any doubts before making a decision.

Choosing the right insurance provider for your pest control business can be time-consuming, but it’s worth the effort. By selecting an insurer that meets your business needs, you can protect your business and clients from potential risks and liabilities.

Common Misconceptions About Pest Control Insurance

Common misconceptions about pest control insurance can lead to inadequate coverage and financial risks for businesses. It is important to debunk these myths and understand the policy limitations to ensure comprehensive protection against potential liabilities.

Myths Debunked

There are several misconceptions surrounding pest control insurance that need to be addressed. Understanding the truth behind these myths can help businesses make informed decisions and avoid unnecessary exposure to risks.

Understanding Policy Limitations

It’s crucial to comprehend the limitations of pest control insurance policies to prevent gaps in coverage. By understanding the scope and restrictions of the policy, businesses can effectively mitigate potential financial losses resulting from pest-related incidents.

Preparing Your Business For The Future

As a pest control business owner, preparing for the future involves safeguarding your operations against unforeseen risks. One crucial aspect of this is ensuring that your business is adequately protected with the right insurance coverage. Pest control insurance not only provides financial protection but also offers peace of mind, allowing you to focus on growing your business. To ensure your business is well-equipped for the future, consider the following strategies:

Regular Policy Review And Updates

Periodically reviewing and updating your insurance policies is essential to ensure that your coverage aligns with the current needs and risks of your business. By staying proactive in reviewing your policies, you can identify any gaps in coverage and make necessary adjustments to avoid potential financial setbacks in the future.

Staying Informed On Industry Changes

Staying informed about changes in the pest control industry is crucial for maintaining an effective insurance strategy. This includes being aware of new regulations, emerging pest control technologies, and industry trends that may impact your business’s risk exposure. By staying updated, you can make informed decisions about your insurance coverage to adapt to evolving industry dynamics.

Credit: www.clarkeandsampson.com

Frequently Asked Questions

Are Pest Control Plans Worth It?

Yes, pest control plans are worth it as they prevent infestations, protect property, and ensure peace of mind.

How Much Is Pest Control Service Per Year?

The cost of pest control service per year varies depending on factors like the size of the property and the type of pests. It typically ranges from $300 to $700. Regular maintenance plans may be available at discounted rates. Hiring a professional pest control service ensures effective treatment and prevention of pests.

What Is Pest Control Insurance?

Pest control insurance provides coverage for pest-related damage and liability, protecting businesses and homeowners from financial losses.

Why Is Pest Control Insurance Important?

Pest control insurance is important as it covers property damage, protects against liability claims, and ensures financial security in case of infestation.

Conclusion

Ensure your pest control business is protected with comprehensive insurance coverage. Stay proactive and secure. Choose wisely!