For Ppp Loan Lookup California, visit the official SBA website and enter your details. Find out your loan information quickly and easily.

Are you a California resident who received a Paycheck Protection Program (PPP) loan and now want to look up your loan details? Understanding the terms and status of your PPP loan is crucial for managing your finances effectively. By utilizing the SBA’s online portal, you can conveniently access information regarding your loan, such as the approved amount, disbursement dates, and forgiveness status.

Let’s explore the simple steps to perform a Ppp Loan Lookup in California and gain valuable insights into your loan status.

Credit: www.reddit.com

Introduction To Ppp Loans In California

PPP loans have been a crucial lifeline for businesses in California, providing much-needed financial support during the COVID-19 pandemic. In this section, we will delve into the purpose and impact of PPP loans on local businesses, as well as provide a brief history of PPP loans in the state.

Purpose And Impact On Local Businesses

PPP loans in California were designed to help businesses retain their employees and cover essential expenses during the economic downturn caused by the pandemic. The funds provided through these loans have been instrumental in preventing widespread layoffs and business closures, thereby safeguarding jobs and sustaining economic activity within the state.

Brief History Of Ppp Loans In The State

California, like the rest of the United States, saw the implementation of PPP loans as part of the federal government’s response to the economic challenges posed by COVID-19. The program was rolled out in early 2020, aiming to provide relief to small businesses, independent contractors, and nonprofit organizations grappling with the impact of the pandemic. Since its inception, PPP loans have undergone several rounds of funding and eligibility criteria adjustments to better serve the evolving needs of California businesses.

Eligibility Criteria For Ppp Loans

The eligibility criteria for PPP loans in California can be checked through the PPP Loan Lookup tool. This tool allows businesses to easily verify their eligibility and access important loan information.

Qualifying Business Types

Businesses such as sole proprietors, independent contractors, and self-employed individuals are eligible.

Nonprofit organizations, veterans’ organizations, and tribal concerns can also apply.

Financial Requirements

- Businesses must have been operational before February 15, 2020.

- Must demonstrate a negative impact on revenue due to the COVID-19 pandemic.

- Have 500 or fewer employees (or meet the applicable industry size standard).

Navigating The Ppp Loan Application Process

Navigating the PPP loan application process in California can be complex. Using the PPP loan lookup tool can streamline the process and help you track your application status. Stay informed about the latest updates and requirements to ensure a successful loan application.

Step-by-step Guide

When navigating the PPP loan application process in California, it’s important to follow a step-by-step guide to ensure a smooth and successful application. By understanding each stage of the process, you can avoid common pitfalls and increase your chances of securing a PPP loan. Here is a simplified breakdown of the steps:

- Eligibility Check: Begin by confirming your eligibility for the PPP loan program. Review the requirements set by the Small Business Administration (SBA) to determine if your business qualifies.

- Documentation Gathering: Collect all the necessary documents required for the application. This may include payroll records, tax documents, financial statements, and other relevant information.

- Application Submission: Complete the PPP loan application form accurately and submit it through the designated channels. Ensure that you provide all the required information and double-check for any errors.

- Review and Verification: Once your application is submitted, it will go through a review and verification process by the SBA or the lender. This stage may involve additional document requests or clarifications.

- Funds Disbursement: If your application is approved, you will receive the funds directly into your designated bank account. It is important to monitor your account and communicate with your lender for any updates.

- Loan Forgiveness Application: After receiving the funds, you may be eligible for loan forgiveness. Familiarize yourself with the forgiveness criteria and submit the necessary documentation within the specified timeframe.

Common Pitfalls And How To Avoid Them

While navigating the PPP loan application process, it is essential to be aware of common pitfalls that can delay or jeopardize your application. By understanding these challenges, you can take proactive steps to avoid them. Here are some common pitfalls and how to avoid them:

- Incomplete Documentation: Ensure that you gather and submit all the required documents accurately. Missing or incomplete documentation can lead to delays or rejection of your application.

- Inaccurate Information: Double-check all the information provided in your application to avoid any errors. Incorrect data can cause confusion and hinder the approval process.

- Missed Deadlines: Stay informed about the application deadlines and submission timelines. Missing these deadlines may result in your application being disregarded.

- Lack of Preparation: Adequate preparation is crucial for a successful application. Familiarize yourself with the requirements, gather the necessary documents in advance, and seek professional guidance if needed.

- Communication Issues: Maintain open communication with your lender throughout the process. Promptly respond to any requests for additional information or clarifications.

By following this step-by-step guide and being aware of common pitfalls, you can navigate the PPP loan application process in California with confidence. Remember to stay organized, accurate, and proactive throughout the entire process. Good luck!

Uncovering Hidden Opportunities

Lesser-known Benefits Of Ppp Loans

PPP loans in California offer various benefits beyond financial assistance, including tax benefits, extended coverage for utility payments, and assistance for employee retention.

- Opportunity to claim tax deductions for qualifying business expenses covered by the loan

- Extended coverage for utility payments, allowing businesses to allocate funds to other essential areas

- Employee retention credit for businesses significantly impacted by the pandemic

Tips For Maximizing Loan Forgiveness

Maximizing loan forgiveness involves strategic planning and adherence to the program’s guidelines. Consider the following tips to optimize the forgiveness of your PPP loan:

- Allocate at least 60% of the funds to payroll expenses to meet the forgiveness requirements

- Maintain accurate records of how the loan funds are utilized, ensuring compliance with forgiveness criteria

- Utilize the loan funds within the specified covered period to maximize forgiveness potential

Success Stories: California Businesses And Ppp Loans

California businesses have faced unprecedented challenges due to the COVID-19 pandemic. However, thanks to the Paycheck Protection Program (PPP) loans, many businesses have been able to navigate these difficult times and emerge stronger than ever. In this blog post, we will explore some inspiring success stories of California businesses that successfully applied for PPP loans and the positive impact these loans have had on their growth and stability.

Case Studies Of Successful Applications

Let’s dive into some real-life examples of California businesses that have successfully secured PPP loans. These case studies highlight the diverse range of businesses that have benefited from the program:

| Business | Industry | Loan Amount |

|---|---|---|

| ABC Bakery | Food & Beverage | $50,000 |

| XYZ Fitness Studio | Fitness & Wellness | $100,000 |

| 123 Design Agency | Creative Services | $75,000 |

These businesses were able to secure the necessary funds to cover payroll costs, rent, and other essential expenses, ensuring their survival during the challenging economic climate.

The Impact Of Ppp Loans On Growth And Stability

PPP loans have not only provided immediate relief to California businesses but have also played a crucial role in their long-term growth and stability. Here are some ways in which these loans have made a positive impact:

- Preserving Jobs: By providing financial assistance to businesses, PPP loans have helped preserve countless jobs, enabling employees to continue earning a steady income.

- Business Expansion: Some businesses have utilized PPP funds to invest in new equipment, expand their operations, and explore new market opportunities.

- Debt Relief: For businesses struggling with existing debts, PPP loans have provided much-needed relief, allowing them to restructure their finances and improve their financial health.

- Increased Confidence: The availability of PPP loans has instilled confidence in business owners, encouraging them to stay afloat and make strategic decisions for the future.

The impact of PPP loans extends beyond individual businesses, contributing to the overall economic recovery of California and fostering a sense of resilience within the business community.

Credit: helloskip.com

Navigating Loan Data And Transparency

When navigating loan data and transparency, understanding how to access PPP loan information is crucial for California businesses.

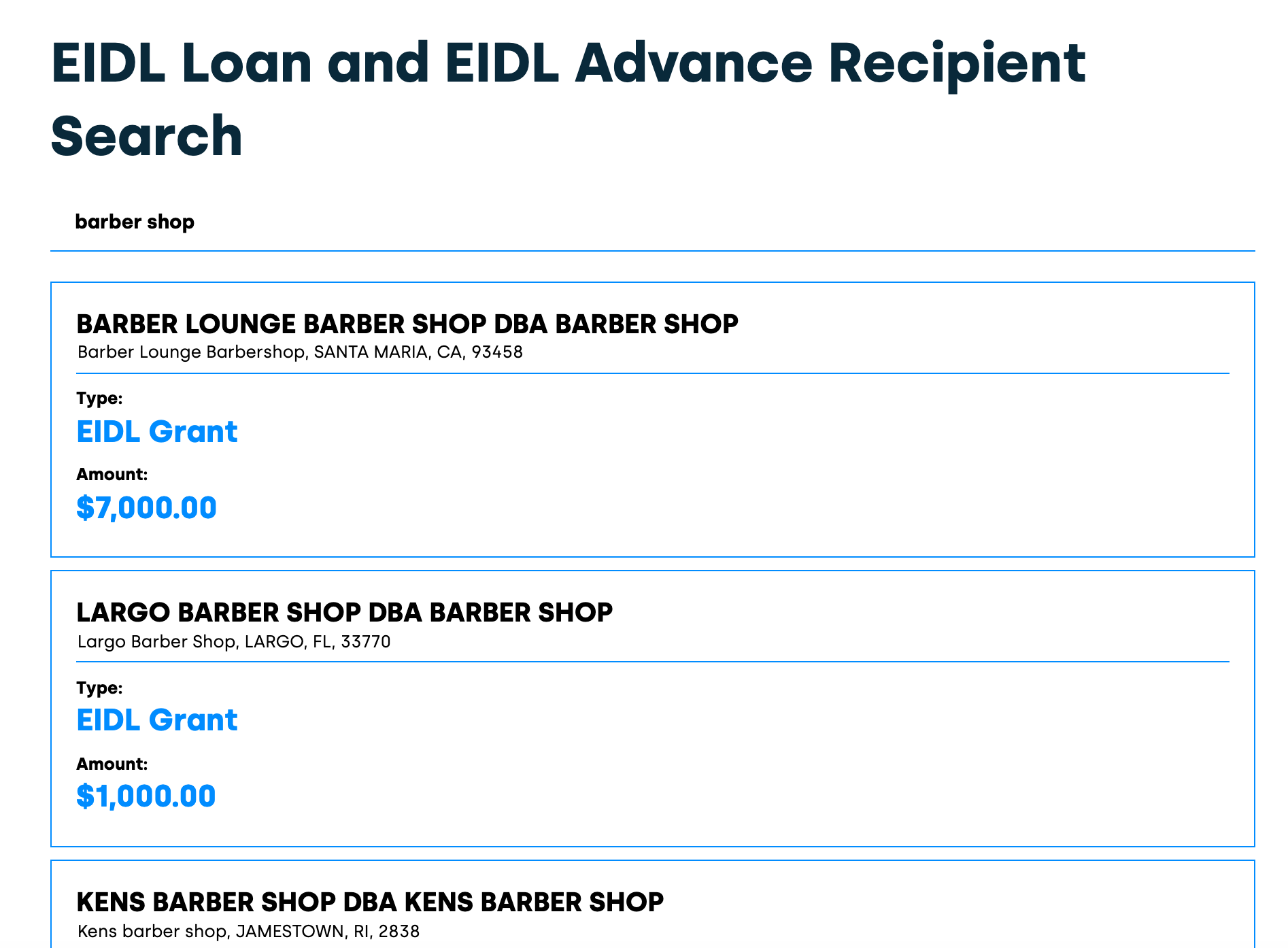

Public Access To Ppp Loan Data

Public access to PPP loan data provides insights into the distribution of funds.

Understanding Loan Data For California Businesses

Loan data for California businesses helps in evaluating financial support received.

Compliance And Legal Considerations

Compliance and legal considerations play a crucial role in the PPP loan lookup process in California. It is important to adhere to the necessary regulations and requirements to ensure a smooth and compliant loan application and approval process. Stay updated with the latest guidelines to avoid any legal complications.

Meeting Ppp Loan Requirements

To ensure compliance with the PPP loan requirements, businesses must keep accurate records of their expenses and payroll costs. This includes maintaining documentation of how the funds were used and providing proof of payroll expenditures. Additionally, businesses must meet the eligibility criteria and use the funds for authorized expenses, such as rent, utilities, and mortgage interest payments. Failure to comply with these requirements could lead to penalties and loss of loan forgiveness.Handling Audits And Reviews

PPP loans are subject to audits and reviews by the Small Business Administration (SBA) to ensure compliance with the program rules. Businesses should maintain accurate records and be prepared to provide documentation to support their loan forgiveness application. It is also important to respond promptly to any inquiries or requests for information from the SBA. Compliance with PPP loan requirements is crucial to ensure loan forgiveness and avoid penalties. By keeping accurate records and meeting eligibility criteria, businesses can successfully navigate the loan forgiveness process. Additionally, being prepared for audits and reviews can help businesses demonstrate compliance and avoid potential issues.Future Of Funding For Small Businesses In California

Discover the future of funding for small businesses in California with PPP Loan Lookup California, offering vital financial support. Secure your business’s growth and stability with accessible funding options tailored to your needs.

Post-ppp Loan Landscape

Small businesses in California have been hit hard by the pandemic, and many have relied on the Paycheck Protection Program (PPP) loans to stay afloat. However, as the PPP loan program comes to an end, it is essential to understand what the future holds for small business funding. The post-PPP loan landscape is uncertain, with many businesses struggling to find alternative sources of funding. While some small businesses may be eligible for additional PPP loans, others may need to look to alternative financing options.Alternative Financing Options

Small businesses in California have several alternative financing options to consider post-PPP loan program. These alternative financing options include:- Small Business Administration (SBA) Loans: The SBA offers several loan programs, including the 7(a) loan program, which can provide small businesses with financing for a variety of purposes.

- Community Development Financial Institutions (CDFIs): CDFIs are nonprofit lenders that focus on providing financing to underserved communities and small businesses.

- Online Lenders: Online lenders offer a quick and easy way for small businesses to access financing. However, these lenders may have higher interest rates and fees than traditional lenders.

- Invoice Financing: Invoice financing allows small businesses to receive an advance on outstanding invoices, providing them with immediate access to cash.

- Merchant Cash Advances: Merchant cash advances provide small businesses with an advance on future credit card sales.

Resources And Assistance For Applicants

For individuals seeking help with their PPP Loan Lookup in California, various resources and assistance are available to navigate the process smoothly.

Government And Nonprofit Support

Government agencies and nonprofits offer valuable aid to applicants:

- California Small Business Development Centers provide guidance.

- Local government offices offer application assistance.

- Nonprofit organizations give support for document preparation.

Professional Services For Loan Management

Professional services can assist in managing PPP loans:

- Accountants help with financial documentation.

- Consultants offer strategic advice for loan utilization.

- Legal experts provide guidance on compliance and regulations.

Credit: helloskip.com

Frequently Asked Questions

Can You Look Up Who Received Ppp?

You can’t look up individual PPP recipients, as the SBA doesn’t publicly disclose this information.

Can You Find Out If Someone Took Out A Ppp Loan?

Yes, you can find out if someone took out a PPP loan by searching the Small Business Administration’s public database of approved PPP loan applications. The database includes information about the borrower, loan amount, and lender.

Can Ppp Loans Be Tracked?

Yes, PPP loans can be tracked using the Small Business Administration’s online portal. Simply log in to track your loan status.

How To Check If A Ppp Loan Was Forgiven?

To check PPP loan forgiveness status, visit the SBA or your lender’s portal. Look for updates on your loan.

Conclusion

In light of the ongoing impact of the pandemic, accessing information about PPP loan lookup in California is crucial for businesses. By understanding the process and utilizing the available resources, entrepreneurs can navigate the challenges and make informed decisions. Keep abreast of updates to ensure compliance and maximize the benefits of the program.