Refinance a title loan to save money and get better terms. By refinancing, you can lower your monthly payments.

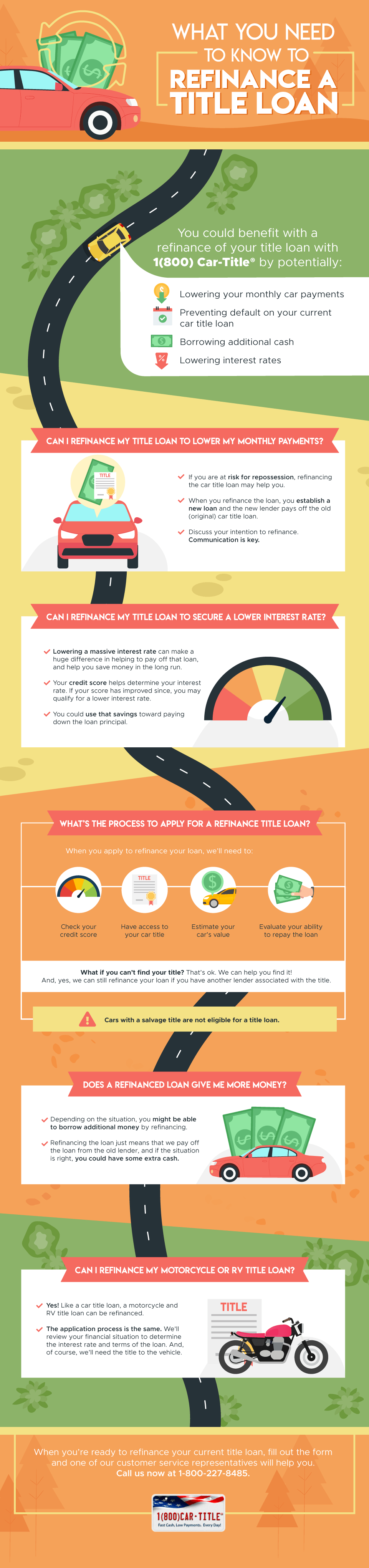

Looking to take control of your finances and reduce your monthly expenses? Refinancing your title loan could be a smart move. Title loans can often come with high interest rates, making them costly in the long run. Refinancing allows you to replace your current loan with a new one that has more favorable terms, such as a lower interest rate or longer repayment period.

This can help you save money each month and make managing your finances easier. Let’s explore the benefits and process of refinancing a title loan.

Credit: www.1800cartitleloan.com

Introduction To Refinancing Title Loans

Refinancing a title loan can be a smart financial move for individuals looking to save money and improve their financial situation. By understanding the potential benefits and reasons for considering refinancing, you can make an informed decision about whether it’s the right choice for you.

Why Consider Refinancing?

There are several compelling reasons to consider refinancing a title loan. Whether you’re looking to lower your interest rate, reduce your monthly payments, or obtain more favorable loan terms, refinancing can offer a range of potential benefits.

Potential Benefits

Refinancing a title loan can lead to various potential benefits, such as saving money on interest, improving your cash flow, and securing better loan terms. By exploring the potential benefits, you can determine whether refinancing is a viable option for your financial needs.

Qualifying For A Better Rate

Qualifying for a better rate on your refinance title loan can help you save money and ease your financial burden. By meeting certain criteria, you can secure a lower interest rate and more favorable terms, putting you on the path towards financial stability.

Credit Score Requirements

When refinancing your title loan, having a good credit score can significantly impact the interest rate you qualify for. Lenders typically prefer borrowers with credit scores above 600 as it demonstrates a history of responsible financial behavior. If your credit score has improved since you obtained your original title loan, you may now be eligible for a better rate.

Income Verification

Verifying your income is a crucial aspect of qualifying for a better rate on your refinance title loan. Lenders need assurance that you have a stable source of income to repay the loan. This can be demonstrated through pay stubs, bank statements, or tax returns. Providing evidence of a steady income can increase your chances of securing a lower interest rate.

Comparing Lenders For Refinancing

When it comes to refinancing a title loan, finding the right lender is crucial for securing favorable terms and conditions. Comparing lenders for refinancing allows you to evaluate different options and choose the one that best suits your needs. By carefully considering the terms and conditions offered by each lender, you can ensure that you are getting the most favorable deal for your refinanced title loan.

Finding The Right Lender

When evaluating lenders for refinancing a title loan, it’s essential to consider factors such as reputation, customer service, and interest rates. Reputable lenders with a track record of providing excellent customer service are more likely to offer favorable terms and a smooth refinancing process. Additionally, comparing interest rates from different lenders can help you find the most competitive option for your refinanced title loan.

Evaluating Terms And Conditions

Before committing to a lender for refinancing your title loan, it’s crucial to carefully evaluate the terms and conditions they offer. Comparing factors such as loan duration, repayment schedule, and any additional fees or charges can help you determine which lender offers the most favorable terms for your refinanced title loan. Additionally, paying attention to the flexibility of the repayment terms can ensure that you choose a lender that accommodates your financial situation.

Credit: www.loancenter.com

Calculating Potential Savings

When considering a refinance title loan, it’s crucial to analyze the potential savings you could achieve. Calculating these savings involves understanding the numbers and utilizing online calculators.

Using Online Calculators

Online calculators streamline the process of estimating your potential savings. By inputting data such as current loan amount, interest rate, and new terms, these tools provide a quick snapshot of how much you could save through refinancing.

Understanding The Numbers

Ensure you comprehend the figures presented by the calculator. Key metrics to focus on include the monthly payment reduction and total interest saved. This understanding will help you make an informed decision about whether refinancing your title loan is financially beneficial.

The Refinancing Process

Refinancing a title loan can be a strategic move to secure better terms and reduce financial burden. The process involves several steps and the submission of specific documents to facilitate a smooth transition from the original loan to the refinanced one.

Steps To Apply

When considering refinancing your title loan, the first step is to research and compare various lenders to find the best terms and rates. Once you’ve identified a suitable lender, the application process typically involves the following steps:

- Fill out the refinancing application form online or in person.

- Provide details about your existing title loan, including the current balance and terms.

- Submit necessary documentation, such as proof of income and vehicle ownership.

- Wait for the lender to review your application and provide a decision.

- If approved, review the new loan terms and finalize the refinancing process.

Required Documents

When applying for a refinance title loan, you will typically need to provide the following documents to the lender:

- Valid government-issued ID

- Title to the vehicle being used as collateral

- Proof of income, such as pay stubs or bank statements

- Proof of residence, such as a utility bill or lease agreement

- Current vehicle registration and insurance documents

Having these documents ready and organized can expedite the refinancing process and help you secure better terms for your title loan.

Credit: www.viptitleloans.com

Common Pitfalls In Refinancing

Refinancing a title loan can be a smart move to lower interest rates or monthly payments. However, there are common pitfalls that borrowers should be aware of to avoid financial setbacks.

Prepayment Penalties

Some lenders impose prepayment penalties on borrowers who pay off their loan early. These fees can offset the benefits of refinancing, making it important to review the terms carefully.

Hidden Fees

When refinancing a title loan, borrowers should watch out for hidden fees that may not be clearly disclosed upfront. These fees can add up quickly and surprise borrowers, impacting the overall cost of refinancing.

Real-life Success Stories

Case Studies

One of the most compelling aspects of refinancing a title loan is the real-life success stories that have emerged from this financial strategy. Let’s take a look at a few case studies that illustrate how individuals have benefited from refinancing their title loans.

Testimonials From Borrowers

Reading testimonials from borrowers who have gone through the process of refinancing their title loans can provide valuable insights and inspiration. Here are some testimonials that highlight the positive impact of refinance title loans on real people’s lives.

Future Financial Planning

Refinancing a title loan can be a smart move to improve your financial situation, but it’s equally important to plan for the future to maintain your financial health. By implementing effective strategies, you can avoid future debt and secure a stable financial future.

Maintaining Financial Health Post-refinance

After refinancing your title loan, it’s crucial to take proactive steps to maintain your financial well-being. This includes creating a realistic budget, building an emergency fund, and exploring investment opportunities to grow your wealth.

Moreover, staying informed about the current financial market trends and seeking professional financial advice can help you make sound financial decisions.

Strategies To Avoid Future Debt

Preventing future debt is essential to safeguard your financial stability. Implementing strategies such as regularly reviewing your budget, limiting unnecessary expenses, and prioritizing debt payments can help you avoid falling back into a cycle of financial strain.

Furthermore, establishing a savings plan and maintaining a good credit score can provide a solid foundation for your future financial security.

Frequently Asked Questions

Do You Get More Money When You Refinance A Title Loan?

Refinancing a title loan may or may not result in more money, as it depends on various factors such as the value of your vehicle, your credit score, and the terms of the new loan. However, refinancing can potentially lower your monthly payments or interest rate, which can save you money in the long run.

When You Refinance A Car Loan, What Happens To The Title?

When you refinance a car loan, the title is transferred to the new lender temporarily.

Can You Refinance A Title Loan In Texas?

Yes, you can refinance a title loan in Texas. It allows you to replace your current loan with a new one, often with better terms.

How Long Do You Have To Wait To Refinance A Car?

You can refinance a car after about 6 months to 1 year of consistent payments.

Conclusion

Refinancing a title loan can provide financial relief and lower monthly payments. By exploring this option, borrowers can save money and improve their overall financial situation. Consider refinancing to secure better terms and alleviate any financial stress associated with your current title loan.

Make a wise financial decision today.