Safeguard Gap Insurance covers the difference between the actual cash value of a vehicle and what is owed on it. This type of insurance provides financial protection in case of a total loss or theft of the vehicle.

In today’s fast-paced world, unexpected events can happen, and having Safeguard Gap Insurance ensures you are financially secure. This insurance fills the gap between what your car is worth and what you owe on it, preventing you from facing a financial burden in case of an unfortunate incident.

By investing in Safeguard Gap Insurance, you can drive with peace of mind knowing that you are protected financially in unforeseen circumstances.

Credit: www.safe-guardproducts.com

Introduction To Safeguard Gap Insurance

When it comes to protecting your financial well-being, having the right insurance coverage is essential. However, even with comprehensive coverage, there can still be gaps that leave you vulnerable to unexpected expenses. That’s where Safeguard Gap Insurance comes in. This type of insurance provides an additional layer of protection by covering the “gap” between what your primary insurance covers and the actual value of your asset. Whether it’s a car, home, or other valuable asset, Safeguard Gap Insurance ensures that you won’t be left with a financial burden in the event of an accident, theft, or total loss.

Why Coverage Gaps Occur

Insurance coverage gaps can occur due to a variety of reasons. Here are a few common factors:

- Inadequate primary insurance coverage: Sometimes, the coverage provided by your primary insurance policy may not be sufficient to cover the full value of your asset. This can leave you responsible for paying out-of-pocket for the remaining amount.

- Depreciation: Over time, the value of your asset may decrease due to factors such as wear and tear, market fluctuations, or technological advancements. If your primary insurance policy only covers the current value of your asset, you may face a significant financial gap in the event of a claim.

- Loan or lease obligations: If you have a loan or lease on your asset, there may be specific requirements for insurance coverage. In some cases, the required coverage may not fully protect you in the event of a total loss, leaving you liable for the remaining balance.

The Role Of Safeguard Gap Insurance

Safeguard Gap Insurance plays a crucial role in bridging the coverage gaps left by your primary insurance policy. Here’s how it works:

- Protection against financial loss: Safeguard Gap Insurance provides an additional layer of financial protection by covering the difference between the actual value of your asset and the amount covered by your primary insurance policy. This ensures that you won’t be left with a significant financial burden in the event of a covered loss.

- Coverage for various assets: Safeguard Gap Insurance is available for a wide range of assets, including cars, homes, boats, motorcycles, and more. This means that regardless of the type of asset you own, you can benefit from the added peace of mind that comes with knowing you’re fully protected.

- Flexible coverage options: Safeguard Gap Insurance offers flexible coverage options to suit your specific needs. Whether you’re purchasing a new asset or already have existing coverage, there are customizable plans available to ensure you get the right level of protection.

By understanding why coverage gaps occur and the role of Safeguard Gap Insurance, you can make informed decisions to safeguard your financial future. Don’t leave gaps in your coverage—protect yourself with Safeguard Gap Insurance today.

Understanding Coverage Gaps

Common Causes

One of the most common causes of coverage gaps in auto insurance is the depreciation of the vehicle. As a vehicle loses value over time, the amount owed on a loan or lease may exceed the actual cash value in the event of a total loss. Additionally, changes in lifestyle or driving habits can lead to gaps in coverage. For example, failing to update your insurance after moving to a new address or using your vehicle for commercial purposes without the appropriate coverage can create significant gaps in protection.

Real-life Scenarios

In real-life scenarios, coverage gaps can have serious financial consequences. For instance, if a driver’s car is stolen and they do not have gap insurance, they may be left paying off a loan for a vehicle they no longer possess. Similarly, if a car is totaled in an accident and the insurance payout is insufficient to cover the outstanding loan balance, the driver could face significant financial hardship.

Key Benefits Of Safeguard Gap Insurance

Safeguard Gap Insurance offers essential financial protection by covering the shortfall between the vehicle’s value and the outstanding loan balance in the event of theft or total loss. This coverage provides peace of mind and helps avoid potential financial hardship.

When it comes to protecting your investment in a new vehicle, Safeguard Gap Insurance offers valuable benefits that can provide financial security and peace of mind. This type of insurance coverage is designed to bridge the gap between the actual cash value of your vehicle and the amount you owe on your loan or lease in the event of a total loss due to theft or accident.

Financial Security

Safeguard Gap Insurance offers unparalleled financial security by ensuring you are not left with a significant financial burden in the event of a total loss. In such unfortunate situations, standard auto insurance policies typically only cover the actual cash value of your vehicle, which may be significantly lower than what you owe on your loan or lease.

With Safeguard Gap Insurance, the difference between the insurance payout and the remaining balance on your loan or lease is covered. This means you won’t be left paying out of pocket for a vehicle that you no longer have, allowing you to maintain your financial stability and avoid unnecessary debt.

Peace Of Mind

One of the most significant benefits of Safeguard Gap Insurance is the peace of mind it provides. Knowing that you are protected from the financial implications of a total loss can alleviate stress and worry, allowing you to enjoy your new vehicle without fear of unforeseen circumstances.

Whether your vehicle is stolen or involved in a severe accident, Safeguard Gap Insurance ensures that you are not left with the burden of paying for a vehicle that no longer exists. This peace of mind allows you to focus on what’s important – enjoying your investment and feeling secure in your financial decisions.

In conclusion, Safeguard Gap Insurance offers key benefits that provide both financial security and peace of mind. By bridging the gap between the actual cash value of your vehicle and the remaining balance on your loan or lease, this insurance coverage ensures that you are protected from unforeseen financial hardships. Don’t leave your investment at risk – safeguard it with Safeguard Gap Insurance.

Credit: protectyourcar.ie

How Safeguard Gap Insurance Works

Understanding how Safeguard Gap Insurance works can provide peace of mind in protecting your financial investment. This insurance bridges the gap between what you owe on a vehicle and its actual cash value, ensuring you’re not left with a financial burden in case of a total loss.

Claim Process Simplified

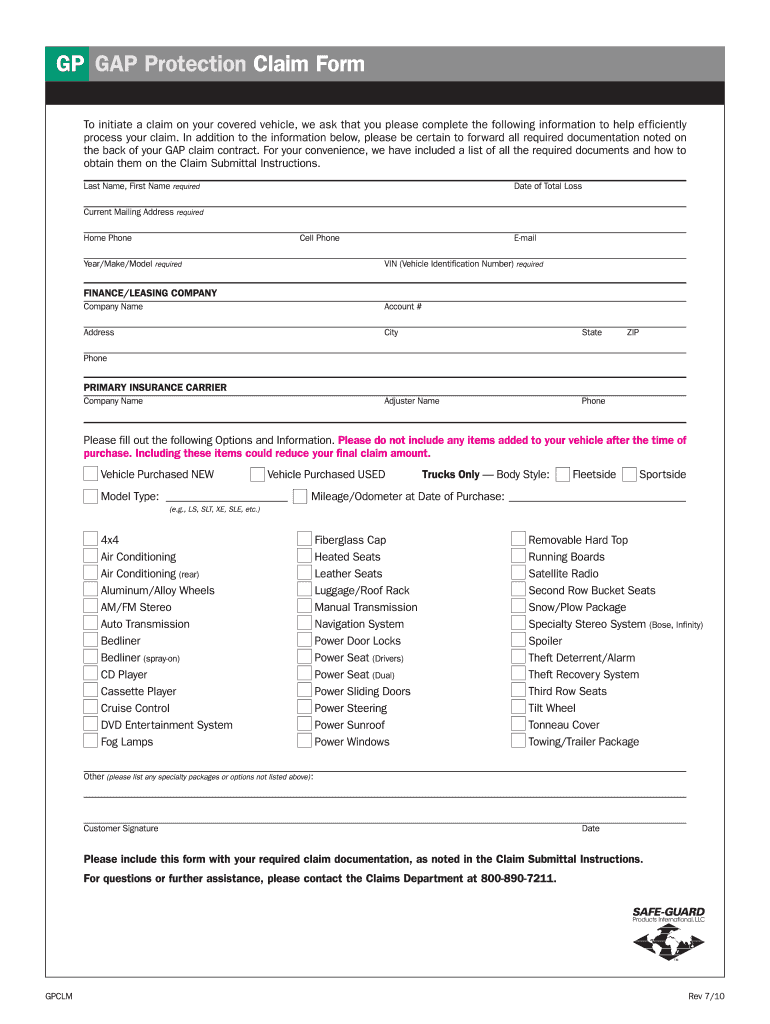

When you need to file a claim with Safeguard Gap Insurance, the process is straightforward. Simply contact the insurance provider and submit the required documentation, such as proof of the total loss of your vehicle and any relevant loan details.

Case Studies

Real-life examples illustrate the importance of Safeguard Gap Insurance. In one case, a policyholder’s car was totaled in an accident, and the insurance covered the remaining loan balance, saving the individual from financial strain.

Comparing Safeguard With Other Gap Insurance

When it comes to purchasing gap insurance, it’s important to choose the right provider. With so many options available, it can be challenging to know which one to choose. In this article, we’ll take a closer look at Safeguard gap insurance and compare it with other gap insurance providers.

Features And Benefits

Safeguard gap insurance offers a variety of features and benefits that make it a popular choice among car owners. Some of the key features and benefits include:

- Up to 5 years of coverage

- Coverage for vehicles up to $100,000 in value

- Protection against depreciation

- Flexible payment options

- 24/7 claims service

One of the standout features of Safeguard gap insurance is its flexibility. With a variety of payment options available, you can choose a plan that fits your budget and meets your needs.

Choosing The Right Provider

When it comes to choosing a gap insurance provider, there are a few key factors to consider. These include:

- Price

- Coverage options

- Customer service

- Claims process

Price is often a major consideration when it comes to purchasing gap insurance. However, it’s important to remember that the cheapest option may not always be the best. When comparing providers, be sure to look at the coverage options and customer service as well.

Ultimately, the right gap insurance provider will depend on your specific needs and budget. By comparing Safeguard gap insurance with other providers, you can make an informed decision and choose the coverage that works best for you.

Credit: www.pdffiller.com

Eligibility And Enrollment

To enroll in Safeguard Gap Insurance, individuals must meet eligibility requirements such as being under 65 and enrolled in a Medicare Advantage plan. Enrollment is available during open enrollment periods or when experiencing certain life events such as losing employer coverage.

Who Qualifies?

Safeguard Gap Insurance is available to individuals who have purchased a new or used vehicle and have an existing auto insurance policy. Eligible vehicles include cars, trucks, SUVs, motorcycles, and RVs. The policyholder must also be the registered owner or lessee of the vehicle.Step-by-step Guide

Enrolling in Safeguard Gap Insurance is a simple process. Here’s a step-by-step guide to help you get started:- Contact your local dealer or lender to determine if Safeguard Gap Insurance is available.

- Review the policy details and pricing to ensure it meets your needs and budget.

- Complete the enrollment form and provide any necessary documentation, such as proof of insurance and vehicle registration.

- Make your first premium payment.

- Receive your policy documents and enjoy the peace of mind that comes with knowing your vehicle is protected.

Benefits Of Safeguard Gap Insurance

Safeguard Gap Insurance provides valuable protection in the event of a total loss or theft of your vehicle. It covers the difference between your auto insurance payout and the amount you owe on your vehicle loan or lease, up to the policy limit. This can save you thousands of dollars and help you avoid financial hardship. In summary, Safeguard Gap Insurance is a smart investment for anyone who wants to protect their vehicle and their finances. With a simple enrollment process and valuable benefits, it’s a wise choice for any vehicle owner or lessee.Customer Experiences

Customer Experiences are at the heart of Safeguard Gap Insurance. We take pride in the positive impact our products have had on our customers’ lives. Below are some real-life stories and testimonials that demonstrate the value and peace of mind that Safeguard Gap Insurance provides.

Testimonials

Here are a few testimonials from our satisfied customers:

- “Safeguard Gap Insurance gave me the confidence to drive knowing that I’m protected in case of any unforeseen circumstances. It’s a true lifesaver!” – John D.

- “After my car was totaled in an accident, Safeguard Gap Insurance covered the shortfall between the remaining loan amount and the actual cash value of the vehicle. I couldn’t be more grateful!” – Sarah M.

Success Stories

Our success stories speak for themselves:

- Tom R. was involved in a major collision and his car was deemed a total loss. Thanks to Safeguard Gap Insurance, he was able to settle his outstanding loan without any financial strain.

- Emily S. faced a similar situation but was relieved to have Safeguard Gap Insurance, which covered the substantial gap between her insurance payout and the remaining loan balance.

Frequently Asked Questions

What Does Safeguard Gap Insurance Cover?

Safeguard Gap insurance covers the difference between the amount you owe on your car loan and the car’s actual cash value if it is totaled or stolen. It can also cover deductibles up to $1,000. This insurance is designed to protect you from financial loss in case of an accident.

Is Gap Protection Worth It?

Yes, gap protection is worth it as it covers the difference between what you owe on your car and its actual value in case of theft or an accident.

How Do I Check My Gap Claim?

To check your gap claim, follow these steps: 1. Visit the website or platform where you made the claim. 2. Log in to your account using your credentials. 3. Look for a section specifically dedicated to claims or status updates.

4. Click on the relevant section to view the status of your gap claim. 5. If you encounter any issues, contact customer support for assistance.

How Do I File A Claim With Safeguard?

To file a claim with Safeguard, visit their website and locate the claims section. Fill out the required information and submit the claim form. You can also contact Safeguard’s customer service for assistance with the claims process.

Conclusion

Safeguard Gap Insurance provides peace of mind and financial protection for car owners. With its comprehensive coverage, policyholders can avoid unexpected expenses and maintain their vehicles without worry. Choosing Safeguard Gap Insurance is a smart investment for safeguarding your vehicle and your finances.