SRP Auto Loan Rates are currently competitive and vary depending on the borrower’s creditworthiness and the type of vehicle being financed. If you have good credit and are looking to finance a new or used car, you may qualify for lower rates.

Auto loans can be a great option for those in need of a vehicle but don’t have the cash to pay for it upfront. SRP offers a variety of auto loan options, including new and used car loans, as well as refinancing options for those who already have an auto loan.

The interest rates on these loans are competitive and vary depending on the borrower’s creditworthiness and the type of vehicle being financed. To get the best rate possible, it’s important to have a good credit score and shop around for the best deal.

Credit: www.srpnet.com

Exploring Srp Auto Loan Rates

When it comes to financing a new or used vehicle, it’s essential to explore the different auto loan rates available in the market. One option to consider is the Salt River Project (SRP) auto loan rates, which may offer competitive rates and advantages for prospective car buyers. Let’s delve into the details of SRP auto loan rates to understand how they compare to market rates and the specific advantages they may offer.

Comparing Market Rates

Before committing to an auto loan, it’s crucial to compare the rates offered by different lenders in the market. By doing so, you can identify the most competitive and suitable option for your financial needs. When evaluating SRP auto loan rates, it’s important to benchmark them against prevailing market rates to determine their competitiveness and potential cost savings.

Srp Rate Advantages

Exploring SRP auto loan rates reveals potential advantages that borrowers may benefit from. Whether it’s lower interest rates, flexible repayment terms, or special financing offers, understanding the distinct advantages offered by SRP can help you make an informed decision when securing an auto loan. By leveraging the favorable aspects of SRP auto loan rates, you can potentially optimize your vehicle financing experience.

Eligibility Criteria For Srp Loans

When applying for an SRP auto loan, it’s important to understand the eligibility criteria. Meeting these requirements is essential for securing favorable loan rates and terms. The eligibility criteria for SRP loans encompass various factors, including credit score, income, and employment verification. By understanding these criteria, individuals can enhance their chances of obtaining an SRP auto loan.

Credit Score Requirements

To qualify for an SRP auto loan, applicants should have a credit score of at least 650. A higher credit score may lead to better loan rates and terms. However, individuals with lower credit scores may still be eligible for an SRP auto loan, albeit with less favorable terms.

Income And Employment Verification

Applicants are required to provide proof of income and employment verification. This ensures that they have a stable source of income to meet the loan obligations. Typically, recent pay stubs, W-2 forms, or tax returns are used to verify income, while employment verification may involve contacting the applicant’s employer directly.

Calculating Your Potential Savings

Calculate your potential savings by comparing SRP auto loan rates. Choose a lower interest rate and save money in the long run. It’s a smart financial decision that can pay off in the future.

Interest Rate Impact

Interest rates significantly impact the total cost of your auto loan. Comparing rates can help you save money.

Lower rates mean reduced costs over the loan term, resulting in substantial savings.

Loan Term Considerations

Longer terms may offer lower monthly payments but increase total interest paid over time.

Shorter terms often have higher payments but less interest, leading to quicker payoff and savings.

Credit: www.baywayvolvocars.com

The Application Process Simplified

When it comes to getting an auto loan, the application process can often feel daunting. However, at SRP Federal Credit Union, we strive to simplify the process, making it easier for you to get the auto loan you need. Our streamlined approach ensures that you can navigate through the application process with ease, allowing you to focus on finding the perfect vehicle.

Documents You’ll Need

Before starting the application process, it’s essential to gather the necessary documents. These include:

- Valid driver’s license

- Proof of income (pay stubs or tax returns)

- Proof of residence (utility bills or lease agreement)

- Vehicle information (if applicable)

Step-by-step Guide

The application process can be broken down into simple steps to help you navigate it smoothly:

- Visit our website or branch to begin the application

- Complete the online application or speak with a loan officer

- Submit the required documents for verification

- Wait for approval and receive your loan decision

- Finalize the loan terms and purchase your vehicle

Navigating Loan Approval And Disbursement

When it comes to securing an auto loan, understanding the process of loan approval and disbursement is essential. Navigating the journey from application to receiving funds can be straightforward if you know what to expect.

What To Expect After Application

After submitting your application for an auto loan, the lender will review your information to determine your eligibility. This process typically involves a credit check and assessment of your financial situation. Be prepared to provide additional documentation if required, such as proof of income or residency.

Receiving Your Funds

Once your loan is approved, the disbursement of funds will occur. The funds are typically sent directly to the seller or dealership where you are purchasing the vehicle. It’s important to ensure that all necessary paperwork is completed to facilitate a smooth transfer of funds.

Maximizing Benefits With Srp Loans

When it comes to securing an auto loan, SRP offers competitive rates and a range of benefits. Explore how you can make the most of your SRP auto loan with loyalty discounts and refinancing options.

Loyalty Discounts

Existing SRP customers can enjoy exclusive loyalty discounts on their auto loans, rewarding their continued relationship with the credit union.

Refinancing Options

SRP provides flexible refinancing options for borrowers looking to reduce their monthly payments or lower their interest rates.

Understanding Repayment Plans

Understanding repayment plans is crucial when it comes to SRP auto loan rates. By knowing your options and choosing the best plan for your financial situation, you can ensure timely payments and avoid late fees or penalties.

Understanding Repayment Plans When it comes to auto loan rates, understanding the repayment plans is crucial for making informed financial decisions. Flexible payment schedules and early repayment benefits are key aspects to consider when choosing an auto loan. Let’s delve into these factors in detail. Flexible Payment SchedulesFlexible Payment Schedules

A flexible payment schedule allows borrowers to manage their repayments in a way that aligns with their financial situation. Srp auto loan rates offer the flexibility of choosing from various payment frequencies, such as monthly, bi-weekly, or even accelerated payments. – Monthly payments provide a traditional approach, ensuring consistency and predictability. – Bi-weekly payments can help borrowers make an extra payment each year, reducing the overall interest paid. – Accelerated payments allow borrowers to pay off the loan faster, saving on interest costs. Early Repayment BenefitsEarly Repayment Benefits

Srp auto loan rates present attractive benefits for early repayment, empowering borrowers to save on interest and become debt-free sooner. By paying off the loan ahead of the schedule, borrowers can: – Reduce the total interest paid over the life of the loan. – Improve their credit score by demonstrating responsible financial behavior. – Gain financial freedom and allocate funds to other priorities. In conclusion, understanding repayment plans is essential when considering Srp auto loan rates. Flexible payment schedules and early repayment benefits can significantly impact the overall cost and duration of the loan, providing borrowers with the opportunity to manage their finances effectively.

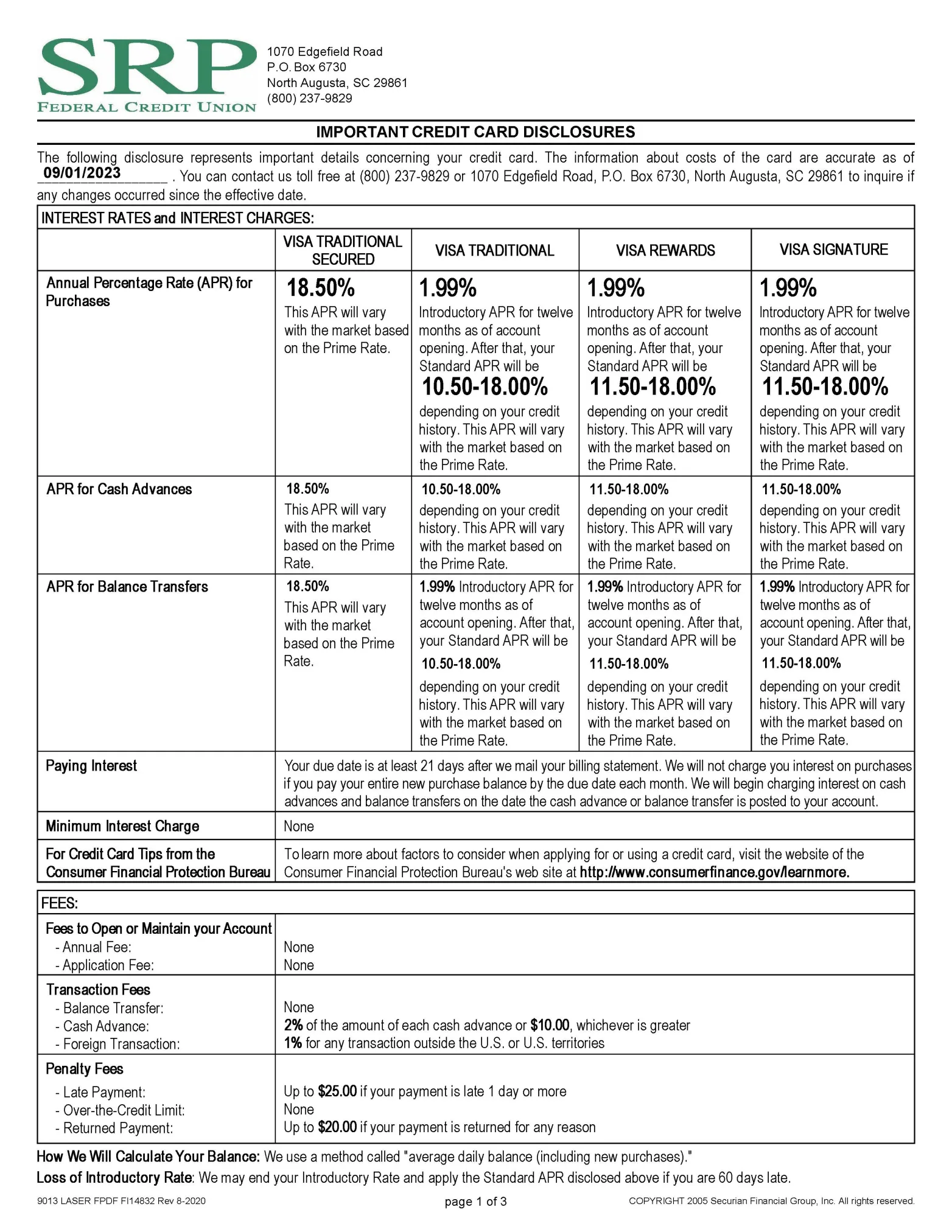

Credit: srpfcu.org

Protecting Your Investment

Protecting your investment is crucial when it comes to securing an auto loan. While it’s important to find the best rates for your SRP auto loan, it’s equally essential to safeguard your investment against unforeseen circumstances. Understanding the insurance requirements and considering gap coverage are essential steps to ensure that your investment in a vehicle is well-protected.

Insurance Requirements

When financing a vehicle, most lenders will require you to maintain comprehensive and collision insurance. This protects the vehicle in the event of damage or theft. The coverage limits for comprehensive and collision insurance may be specified by the lender, so it’s important to ensure that your policy meets these requirements.

Gap Coverage

Gap coverage is a valuable addition to your insurance policy, especially for those who are financing a vehicle. In the event of a total loss, gap coverage helps bridge the gap between the insurance payout and the remaining balance on your loan. This can prevent you from being left with a significant financial burden in the event of a total loss.

Tips For Maintaining Good Credit

Make sure to pay your bills on time every month to avoid negative impacts on your credit score.

Avoid maxing out your credit cards and aim to keep your credit utilization ratio below 30%.

Srp Loans Vs. Leasing

Considering SRP auto loan rates? Let’s delve into the comparison between SRP loans and leasing to help you make an informed decision.

Cost Analysis Over Time

When you opt for an SRP auto loan, you gradually build equity in the vehicle. This means you own the car at the end of the loan term. Leasing, on the other hand, involves lower monthly payments but you don’t own the vehicle.

Ownership Vs. Leasing Benefits

- Owning a vehicle through an SRP loan gives you the freedom to customize and sell it.

- Leasing offers lower upfront costs and the chance to drive a new car more frequently.

Ultimately, the decision between SRP loans and leasing comes down to your priorities and financial goals.

Frequently Asked Questions

What Is The Best Auto Loan Rate Right Now?

The best auto loan rate right now varies but is typically around 2% to 4% APR.

Is 6% A Good Auto Loan Interest Rate?

Yes, a 6% auto loan interest rate is considered good, especially for those with strong credit.

Are Auto Loan Rates Negotiable?

Yes, auto loan rates are negotiable. You can negotiate the rate with the lender to potentially get a better deal.

What Auto Interest Rate Should I Expect?

Auto interest rates vary, but factors like credit score, loan term, and lender influence them. Generally, rates range from 3% to 10%. It’s best to shop around for the most competitive rate based on your financial situation.

Conclusion

When considering an auto loan, SRP offers competitive rates and flexible terms. Securing financing that fits your budget is essential. By exploring SRP’s options, you can find a solution that meets your needs and helps you purchase your dream car.

Make informed decisions and drive away with confidence.