Tower Auto Loan offers competitive rates and flexible terms for all types of car financing needs. Whether you’re purchasing a new or used vehicle, they provide personalized solutions to help you secure the loan you need.

With Tower Auto Loan, you can drive away with confidence knowing you’ve found a reliable partner for your auto financing journey. Are you in the market for a new car but need assistance with financing? Look no further than Tower Auto Loan.

They specialize in providing tailored loan options to suit your specific needs, ensuring a seamless and stress-free borrowing experience. Whether you have good credit, bad credit, or no credit, Tower Auto Loan is committed to helping you get behind the wheel of your dream car.

Introduction To Tower Auto Loan

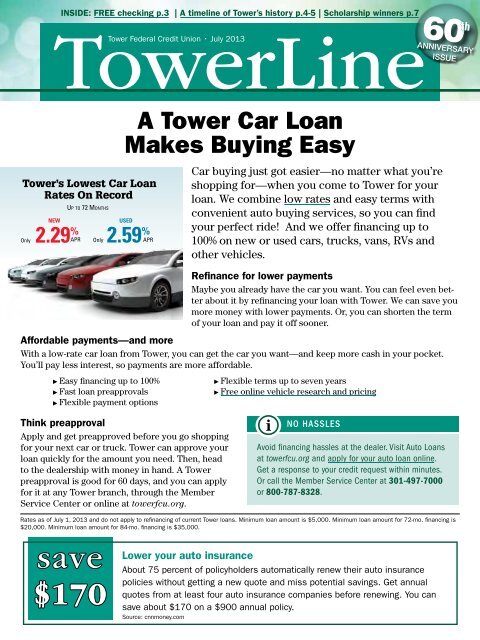

Tower Auto Loan offers flexible financing solutions for individuals looking to purchase a new or used vehicle. With competitive interest rates and customizable repayment plans, Tower Auto Loan provides a seamless borrowing experience. The company’s commitment to customer satisfaction is evident in its quick approval process and personalized customer service. Tower Auto Loan’s unique approach sets it apart from traditional lenders, making it an ideal choice for anyone in need of auto financing. This innovative loan provider values transparency and simplicity, ensuring that borrowers fully understand the terms and conditions of their loan. Tower Auto Loan’s dedication to empowering customers with financial freedom makes it a standout option in the auto loan industry.

Eligibility Criteria For Approval

Eligibility Criteria for Approval: To qualify for a Tower Auto Loan, applicants must have a minimum credit score of 600. Additionally, they must provide proof of a steady income and a valid driver’s license. Key Requirements: Applicants should be at least 18 years old and have a stable employment history. Credit Score Considerations: Tower Auto Loan places significant emphasis on credit history and may require a higher score for more favorable terms. Maintaining a clean credit report is crucial for loan approval.

Preparing Your Application

When applying for a Tower Auto Loan, it’s crucial to gather necessary documents. This includes recent pay stubs, tax returns, and bank statements. Additionally, understanding your budget is vital. Be sure to calculate your monthly income and expenses. This will help you determine how much you can afford to borrow. Moreover, consider checking your credit score beforehand. This will give you an idea of the interest rate you may qualify for. In addition, it’s important to review and organize your financial documents. This will streamline the application process and ensure a smooth experience.

Navigating The Application Process

Applying for a Tower Auto Loan is a straightforward process. To begin, visit the Tower Federal Credit Union website and fill out the online application form. Be sure to have all necessary information handy, including your personal information, employment history, and income details.

Once you have submitted your application, Tower Federal Credit Union will review it and get back to you within a few business days. To increase your chances of approval, ensure that all information provided is accurate and up-to-date.

When applying for a Tower Auto Loan, it is important to avoid common pitfalls such as providing false information, applying for multiple loans at once, and not having a solid credit history. Be sure to review your credit report and address any issues before applying for a loan.

| Steps to Apply: | Common Pitfalls to Avoid: |

|---|---|

| 1. Visit the Tower Federal Credit Union website | 1. Providing false information |

| 2. Fill out the online application form | 2. Applying for multiple loans at once |

| 3. Submit your application and wait for a response | 3. Not having a solid credit history |

Interest Rates And Terms

| Interest Rates and Terms |

|---|

|

Tower Auto Loan offers competitive interest rates based on various factors such as credit score, loan amount, and loan term. The interest rates are determined by Tower Auto Loan’s underwriting team, who will review your application and credit score to determine your eligibility. If you have a good credit score, you are more likely to receive a lower interest rate. On the other hand, if you have a poor credit score, you may be offered a higher interest rate to compensate for the increased risk. It is important to note that Tower Auto Loan allows for negotiating loan terms, including interest rates. Negotiating can lead to more favorable terms, such as a lower interest rate, longer loan term, or lower monthly payments. If you are interested in Tower Auto Loan, it is recommended to fill out an application and speak with a representative to discuss your options and negotiate favorable terms. |

Credit: www.towerhonda.com

The Impact Of Credit History

Tower Auto Loan considers credit history crucial in evaluating loan applications, impacting approval chances and interest rates. Maintaining a positive credit record enhances the likelihood of securing favorable auto loan terms.

| The Impact of Credit History |

|---|

| Credit History’s Role A strong credit history plays a crucial role in obtaining favorable auto loan terms. Lenders assess credit history to determine the level of risk associated with the borrower. |

| Improving Your Credit Score Taking proactive steps to improve credit scores can enhance the likelihood of securing a better auto loan. Timely payments and reducing outstanding debts are key factors in this process. |

Tips For Quick Approval

When applying for Tower Auto Loan, follow these best practices for quick approval:

- Provide accurate information: Double-check all details on your application to avoid delays.

- Maintain stable employment: Consistent employment history is favorable for approval.

- Manage debt responsibly: Keep your debt-to-income ratio low to strengthen your application.

- Ensure a good credit score: Aim for a high credit score to increase your chances of approval.

Additionally, avoid mistakes that can delay approval, such as:

- Providing inaccurate information: Double-check all details before submission.

- Changing jobs frequently: Stability in employment history is crucial.

- Applying for multiple loans simultaneously: This can negatively impact your credit score.

Credit: www.yumpu.com

Post-approval Process

The post-approval process for Tower Auto Loan involves thorough verification of applicant information to ensure eligibility. Applicants can expect efficient processing and timely communication regarding their loan status.

| Post-Approval Process |

| After the approval of your Tower Auto Loan, it’s time to finalize the details. Review the loan terms and ensure they align with your expectations. |

| Make sure to understand the payment schedule and any additional charges. Once everything is clear, proceed with signing the necessary documents. |

| Once the loan is finalized, it’s time to take delivery of your vehicle. Coordinate with the dealer to schedule a convenient time for the handover. |

Managing Your Auto Loan

Tower Auto Loan offers valuable tips on effectively managing your auto loan, helping you stay on track with payments and avoid unnecessary fees. Understanding your loan terms and creating a budget are key steps to successful loan management.

| When managing your Tower Auto Loan, setting up payments is crucial. |

| Dealing with financial hurdles may require adjusting payment schedules or seeking assistance. |

Refinancing Options

Tower Auto Loan offers refinancing options for customers. Consider refinancing when seeking lower interest rates. Benefits include reduced monthly payments and saving money in the long run.

Credit: www.mapquest.com

Frequently Asked Questions

Who Gives The Best Auto Loan?

Credit unions and online lenders often offer the best auto loan rates. Shop around for the lowest rates.

Is My Auto Loan A Legit Company?

To verify the legitimacy of your auto loan company, check its licensing and accreditation. Look for customer reviews and ratings to gauge its credibility. Consider consulting with a financial advisor for further guidance.

Is Tower Loan A Bank?

No, Tower Loan is not a bank. It is a financial services company that offers personal and installment loans.

What Is The Highest Auto Loan Rate?

The highest auto loan rate can vary, but it’s typically around 20% APR. This rate depends on factors like credit score and lender policies.

Conclusion

Tower Auto Loan offers accessible financing solutions for purchasing vehicles. With competitive rates and flexible terms, customers can secure auto loans hassle-free. By prioritizing customer satisfaction and convenience, Tower Auto Loan stands out as a reliable choice in the competitive auto loan market.

Apply now for a seamless car buying experience.