A breast lift is usually not covered by insurance unless it is deemed medically necessary due to a severe deformity or functional impairment. Many insurance companies consider breast lift procedures to be cosmetic and therefore not covered.

However, some exceptions may apply in cases where the procedure is necessary to correct significant asymmetry or for reconstructive purposes after a mastectomy. Are you considering a breast lift and wondering if insurance will cover the cost? Many people inquire about this, as breast lift surgery can be a significant financial investment.

Insurance coverage for breast lift procedures can be a complex and confusing topic, with many factors influencing whether or not the surgery will be covered. In this blog post, we will explore the factors that determine if a breast lift can be covered by insurance and provide guidance for those considering this type of surgery.

Introduction To Breast Lift Procedures

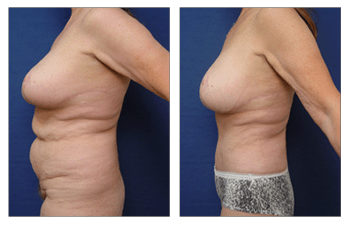

A breast lift, also known as mastopexy, is a surgical procedure designed to lift and reshape sagging breasts, restoring a more youthful and perky appearance. This procedure is popular among women who are looking to rejuvenate their breasts and enhance their overall body contour.

The Essence Of A Breast Lift

A breast lift is aimed at improving the shape and position of the breasts by removing excess skin and tightening the surrounding tissue to support the new breast contour. The procedure can also involve repositioning the nipple and areola to achieve a more aesthetically pleasing result.

Common Reasons For Considering Surgery

Many women consider a breast lift to address the effects of aging, pregnancy, breastfeeding, and significant weight loss, all of which can lead to sagging and loss of breast volume. By undergoing a breast lift, individuals can regain confidence and feel more comfortable in their bodies.

Insurance Basics: Coverage Explained

Breast lift surgery may or may not be covered by insurance depending on the reason for the surgery. If the surgery is deemed medically necessary due to breast asymmetry or other medical issues, it may be covered. However, if the surgery is purely cosmetic, it is unlikely to be covered by insurance.

Insurance Basics: Coverage Explained When considering a breast lift procedure, one of the common questions that arises is whether it can be covered by insurance. Understanding the basics of insurance coverage is essential to determine if your breast lift procedure may be covered. In this section, we will explore the types of procedures that may be covered, as well as the criteria insurance companies often use to determine coverage eligibility. H3: Types of procedures covered Insurance coverage for breast lift procedures can vary depending on the specific insurance plan and policy. Generally, insurance companies consider breast lifts as cosmetic procedures rather than medically necessary treatments. However, there are certain situations where a breast lift may be covered by insurance. These situations typically involve cases where the procedure is deemed medically necessary to address functional issues or health concerns. H3: Criteria for coverage Insurance companies have specific criteria that must be met for a breast lift procedure to be considered for coverage. These criteria often include: 1. Documented medical necessity: Insurance companies typically require evidence that the breast lift procedure is necessary to alleviate functional impairment or health issues. This may involve providing medical records, images, and reports from healthcare professionals that support the medical necessity of the procedure. 2. Symptoms affecting daily life: Insurance companies may require proof that the breast lift procedure is necessary to address symptoms that significantly impact a person’s daily life. This may include physical discomfort, difficulty performing daily activities, or emotional distress caused by the appearance of sagging breasts. 3. Failed conservative treatments: Insurance companies may require documentation that conservative treatments, such as physical therapy or alternative non-surgical interventions, have been attempted and failed to provide adequate relief or improvement. 4. Pre-authorization and medical review: Prior authorization from the insurance company may be necessary before undergoing a breast lift procedure. This often involves a comprehensive medical review to assess the medical necessity and eligibility for coverage. It’s important to note that meeting these criteria does not guarantee insurance coverage for a breast lift procedure. Each insurance plan may have its own unique requirements and limitations. Therefore, it is advisable to consult with your insurance provider directly to understand their specific coverage policies and requirements. In conclusion, while most breast lift procedures are considered cosmetic and not typically covered by insurance, there are circumstances where insurance coverage may be available. Understanding the types of procedures that may be covered and the criteria insurance companies use to determine coverage eligibility can help you navigate the insurance process more effectively. Always consult with your insurance provider to determine the coverage options available to you for a breast lift procedure.Breast Lift And Insurance: The Connection

Breast lifts are generally considered a cosmetic procedure and are not usually covered by insurance. However, if the surgery is deemed medically necessary due to breast ptosis or other health issues, insurance may cover some or all of the costs.

It ultimately depends on the individual’s insurance plan and specific circumstances.

Medical Necessity Vs. Cosmetic Surgery

Insurance usually covers breast lift surgery if it’s deemed medically necessary.

Medical necessity criteria include chronic pain or health issues caused by sagging breasts.

Understanding Policy Exceptions

Policy exceptions might include strict criteria or prior authorization requirements.

Consulting with the insurance provider can clarify specific coverage details.

Credit: cosmeticplasticsurgeryinstitute.com

Navigating Insurance Policies

Insurance coverage for a breast lift can vary depending on the policy. It’s important to navigate through your insurance policy and understand the specific requirements and conditions for coverage.

Reading The Fine Print

When it comes to navigating insurance policies for a breast lift, it is crucial to start by reading the fine print. Insurance coverage can vary depending on your specific policy and provider. It is important to understand the terms and conditions outlined in your policy to determine if a breast lift can be covered.

Take the time to carefully review your insurance policy, paying close attention to any sections related to cosmetic procedures or breast surgeries. Look for any exclusions or limitations that may apply. Insurance policies often have specific criteria that must be met in order for a procedure to be covered.

Keep in mind that insurance companies typically consider breast lifts to be elective or cosmetic procedures, rather than medically necessary. However, there are instances where a breast lift may be deemed medically necessary, such as for individuals with significant breast asymmetry or breast ptosis (sagging) that causes physical discomfort or pain.

Consulting With Your Insurance Provider

Consulting with your insurance provider is essential when exploring the possibility of insurance coverage for a breast lift. Reach out to your insurance company directly to inquire about their specific policies regarding breast lifts and whether they offer any coverage for this procedure.

During your conversation with the insurance provider, be sure to ask about the documentation and evidence required to support a claim for a breast lift. In some cases, insurance companies may require letters of medical necessity from your healthcare provider or documentation of physical symptoms caused by breast ptosis or asymmetry.

It is also important to inquire about any pre-authorization requirements. Some insurance companies may require pre-authorization before approving coverage for a breast lift. Understanding these requirements ahead of time can help you navigate the insurance process more efficiently.

Remember that insurance coverage for a breast lift is not guaranteed, even if you meet the necessary criteria. Each insurance company has its own guidelines and policies, and coverage decisions are often made on a case-by-case basis.

In conclusion, navigating insurance policies when it comes to a breast lift requires careful reading of the fine print and consulting with your insurance provider. While coverage for a breast lift may be possible in certain cases, it is important to understand the specific criteria and requirements set forth by your insurance company.

Case Studies: When Insurance Covers Breast Lift

Insurance coverage for a breast lift varies; some cases may qualify for coverage based on medical necessity. Factors such as back pain or skin irritation may support insurance approval for the procedure. Discussing options with a healthcare provider and insurance company can provide clarity on coverage eligibility.

Successful Coverage Stories

Breast lift surgery, also known as mastopexy, is a cosmetic procedure that aims to lift and reshape sagging breasts. While this surgery is usually considered an elective cosmetic procedure, there are certain cases where insurance companies may cover the cost of breast lift surgery. Here are a few successful coverage stories:| Patient Name | Insurance Company | Reason for Coverage |

|---|---|---|

| Jane Doe | Blue Cross Blue Shield | Breast ptosis due to significant weight loss |

| John Smith | UnitedHealthcare | Breast asymmetry causing physical pain and discomfort |

| Sarah Johnson | Aetna | Breast sagging caused by pregnancy and breastfeeding |

Challenges Faced And Overcome

While insurance coverage for breast lift surgery is possible, there are certain challenges that patients may face. Here are a few challenges that patients have faced and overcome:- Denied Coverage: Insurance companies may deny coverage for breast lift surgery if they deem it to be a cosmetic procedure. However, patients can appeal the decision and provide documentation from their doctor showing that the surgery is medically necessary.

- Meeting Criteria: Insurance companies may have specific criteria that patients must meet in order to be eligible for coverage. For example, they may require that the patient has a certain degree of breast sagging or that they have attempted non-surgical treatments first.

- Out-of-Pocket Costs: Even if insurance covers the cost of breast lift surgery, patients may still be responsible for out-of-pocket costs such as deductibles and co-pays. Patients can work with their doctor and insurance company to determine the estimated cost of the surgery and plan accordingly.

Credit: m.youtube.com

Preparing Your Case For Coverage

Preparing Your Case for Coverage: Wondering if insurance will cover a breast lift? Understandably, this question may arise, and it’s important to navigate the process with care. From gathering necessary documentation to consulting with your insurance provider, taking proactive steps can increase your chances of receiving coverage.

Trust the experts to guide you through this intricate journey.

Gathering Necessary Medical Documentation

Before you submit your claim for a breast lift to your insurance company, it is important to gather all necessary medical documentation. This includes medical records, imaging studies, and a letter of medical necessity from your plastic surgeon. The letter should outline the reasons why a breast lift is medically necessary and detail any physical or emotional symptoms you are experiencing due to sagging breasts. It is also important to obtain a pre-authorization from your insurance company before proceeding with the surgery.Crafting A Compelling Argument

Crafting a compelling argument for insurance coverage of a breast lift is crucial to increasing your chances of approval. Your argument should focus on the medical necessity of the procedure and highlight any physical or emotional symptoms you are experiencing as a result of sagging breasts. You should also provide evidence that the procedure will improve your quality of life and prevent future medical problems. This can be done through personal statements, testimonials from healthcare professionals, and data from medical studies. In conclusion, preparing your case for coverage of a breast lift requires gathering the necessary medical documentation and crafting a compelling argument for insurance coverage. By doing so, you can increase your chances of approval and ensure that you receive the medical care you need to improve your quality of life.Alternatives And Options If Denied Coverage

Experiencing a denial of insurance coverage for a breast lift can be disheartening, but there are viable alternatives and options to consider. Understanding the potential alternatives and exploring other options can help navigate the situation effectively.

Financing Plans And Loans

If insurance coverage for a breast lift is denied, there are financing plans and loans available to help cover the expenses. Many plastic surgery practices offer financing options to make the procedure more affordable. Additionally, various financial institutions provide personal loans that can be utilized to cover the costs of the breast lift.

Exploring Other Surgical Options

If insurance coverage is denied, exploring alternative surgical options may be necessary. This could involve considering different types of breast lift procedures or combining the lift with other cosmetic surgeries that might be covered by insurance. Consulting with a board-certified plastic surgeon can provide insights into alternative surgical options that align with individual needs and financial circumstances.

Conclusion: Empowering Your Decision

Insurance coverage for a breast lift depends on specific criteria set by the insurance company. Generally, it may be covered if the procedure is deemed medically necessary, such as in cases of significant discomfort or pain. It’s important to consult with your insurance provider and plastic surgeon to make an informed decision.

Weighing The Pros And Cons

Before making a decision about a breast lift, it’s essential to carefully consider the advantages and disadvantages. On one hand, the procedure can provide a significant confidence boost and improve the overall appearance of the breasts. However, it’s important to bear in mind the potential risks and recovery time associated with surgery.

- Pros: Enhanced self-esteem, improved breast appearance

- Cons: Surgical risks, recovery period

Taking The Next Steps

Following a thorough evaluation of the pros and cons, the next crucial step is to consult with a qualified plastic surgeon. This professional can provide personalized guidance and recommendations based on individual circumstances. It’s also advisable to contact the insurance provider to understand the coverage options available for the breast lift procedure.

Credit: capizzimd.com

Frequently Asked Questions

What Makes A Breast Lift Medically Necessary?

A breast lift is medically necessary to correct sagging breasts causing physical discomfort or self-esteem issues.

Can Breast Lifts Be Covered?

Breast lifts may be covered by insurance if deemed medically necessary by a doctor.

What Age Should You Get A Breast Lift?

A breast lift is typically performed on women in their 30s or older. It’s best to wait until you’re done having children and breastfeeding, as these events can affect the results. It’s important to consult with a board-certified plastic surgeon to determine if you’re a good candidate.

How Likely Is It That Insurance Will Cover A Breast Reduction?

Insurance coverage for breast reduction varies, but it’s possible with medical necessity documentation and pre-authorization.

Conclusion

To sum up, while insurance coverage for a breast lift is rare, it can be possible in certain cases. Consulting with your insurance provider and surgeon is crucial to understand the options available. Remember to thoroughly research and document all information to increase your chances of coverage.