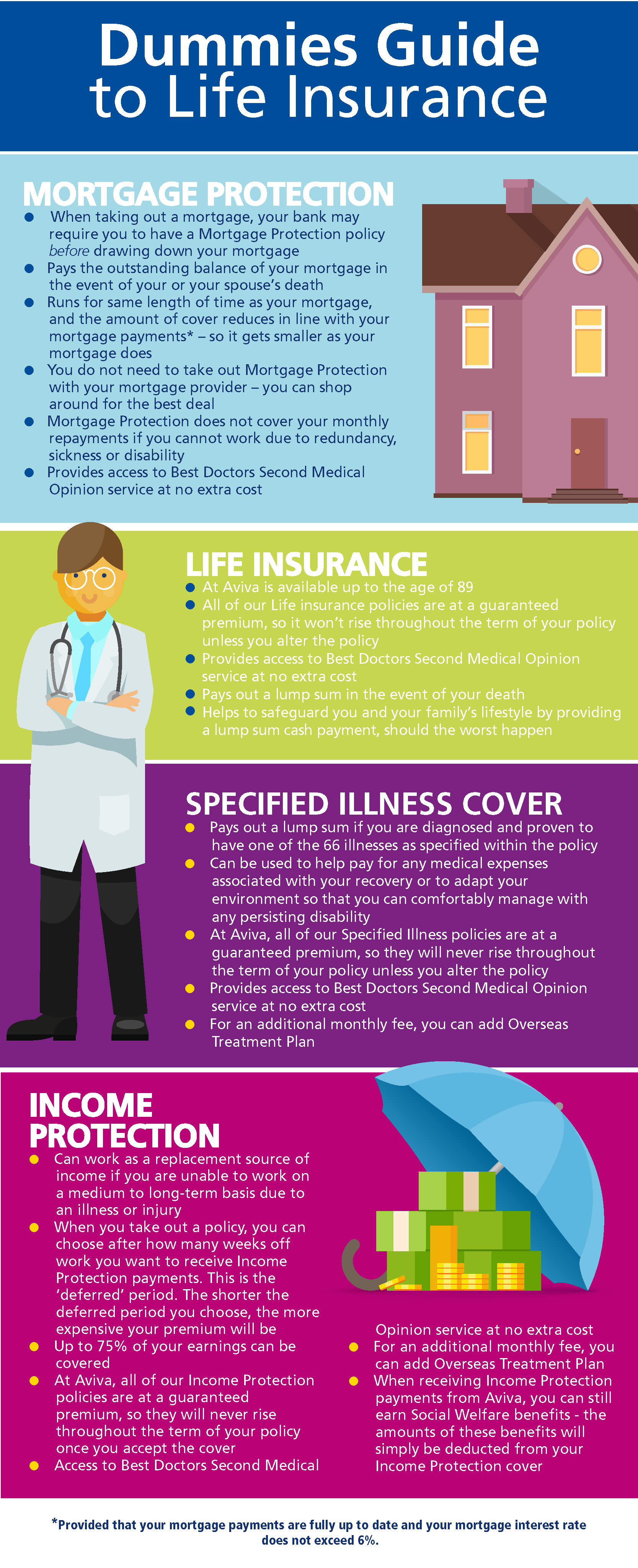

Life insurance provides financial protection to beneficiaries in the event of the policyholder’s death. It offers peace of mind.

Life insurance is a crucial financial tool that offers protection and security to your loved ones in case of your unexpected passing. This type of insurance ensures that your family is taken care of and has financial stability during difficult times.

Understanding the basics of life insurance can help you make informed decisions about your financial future. In this blog post, we will break down the complexities of life insurance into simple terms, making it easy for even beginners to grasp the concepts. Whether you are new to the world of insurance or looking to enhance your knowledge, this guide will provide you with valuable insights into the importance of life insurance and how it can benefit you and your family.

Credit: www.aviva.ie

Introduction To Life Insurance

Life insurance is a fundamental financial tool that provides a crucial safety net for your loved ones in the event of your passing. Understanding the basics of life insurance and why it’s important can empower you to make informed decisions about your financial future.

The Basics Of Life Insurance

Life insurance is a contract between you and an insurance company. You pay a premium, and in exchange, the insurer guarantees a sum of money to your beneficiaries upon your death. This financial protection can help your loved ones cover expenses such as funeral costs, mortgage payments, and daily living expenses.

Why It’s Important

Life insurance is important because it provides financial security and peace of mind to your family and dependents. In the event of your passing, the death benefit from a life insurance policy can help your loved ones maintain their standard of living and achieve their long-term financial goals.

Types Of Life Insurance Policies

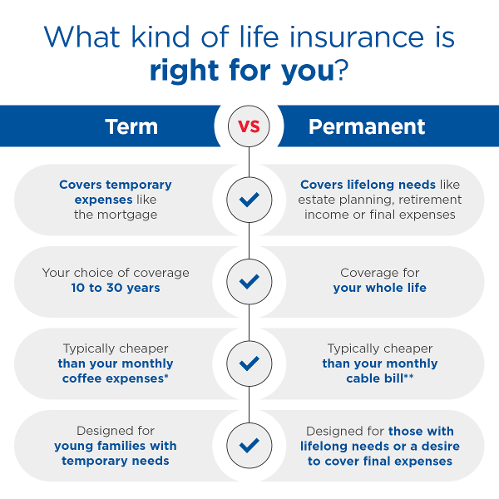

Understanding the different types of life insurance policies is crucial when it comes to protecting your loved ones financially. In this article, we will delve into the three main types of life insurance policies: term life insurance, whole life insurance, and universal life insurance.

Term Life Insurance Explained

Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years. This type of policy offers a death benefit to your beneficiaries if you pass away within the term. Term life insurance is often more affordable than other options, making it an attractive choice for those on a budget or looking for temporary coverage.

With term life insurance, the premiums remain fixed throughout the chosen term. If you outlive the policy, it will expire, and you will need to purchase a new one. While term life insurance does not accumulate cash value, it offers essential protection during the specified term.

Whole Life Insurance Insights

Whole life insurance, as the name suggests, provides coverage for your entire life. This type of policy offers both a death benefit and a cash value component, making it a popular choice for individuals seeking long-term financial security.

Unlike term life insurance, whole life insurance premiums are typically higher but remain consistent throughout your life. The cash value of the policy grows over time, allowing you to borrow against it or even surrender the policy for its accumulated cash value.

Whole life insurance also offers the opportunity to earn dividends, which can be used to increase the death benefit or accumulate as cash value. This type of policy provides peace of mind, knowing that your loved ones will be financially protected no matter when you pass away.

Universal Life Insurance Breakdown

Universal life insurance combines the benefits of both term and whole life insurance policies. This type of policy offers flexibility in terms of premium payments, death benefits, and cash value accumulation.

With universal life insurance, you have the ability to adjust your premium payments, within certain limits, based on your changing financial circumstances. This flexibility allows you to increase or decrease the death benefit and adjust the cash value accumulation as needed.

Universal life insurance policies also offer the potential for investment growth, as a portion of your premiums is invested in various accounts. This can provide additional financial security and potential cash value growth over time.

It’s important to carefully consider your financial goals and needs when choosing a life insurance policy. Whether you opt for term life insurance, whole life insurance, or universal life insurance, having the right coverage in place ensures your loved ones are protected in the event of your passing.

Determining Your Coverage Needs

When considering life insurance, it’s crucial to assess your financial situation to determine the coverage you need.

Assessing Your Financial Situation

Start by evaluating your current income, debts, and expenses to understand your financial responsibilities.

Future Planning And Life Insurance

Consider your long-term financial goals and how life insurance can protect your family in the future.

- Calculate your outstanding debts and future expenses.

- Estimate your family’s living costs in case of your absence.

Using an online life insurance calculator can help you determine the right coverage amount based on your inputs.

Ensuring Each Heading Adheres To Html Syntax

It’s important to structure your content correctly using HTML syntax to improve readability and SEO.

| Assessing your financial situation |

|---|

| Evaluate income, debts, and expenses |

| Future planning and life insurance | |

|---|---|

| Consider long-term financial goals | Protect family with life insurance |

By understanding your coverage needs through financial assessment and future planning, you can choose the right life insurance policy for your family’s financial security.

The Application Process Simplified

Applying for life insurance may seem like a daunting task, but it doesn’t have to be. Understanding the application process and the documents required can help simplify the journey towards securing the right life insurance policy for you and your loved ones. In this guide, we break down the steps to apply for life insurance and provide you with a checklist of the necessary documents.

Steps To Apply For Life Insurance

- Research and compare insurance providers: Start by researching different insurance providers to find the one that offers the coverage and benefits that align with your needs. Compare their policies, premiums, customer reviews, and financial stability to make an informed decision.

- Choose the right type and amount of coverage: Determine the type of life insurance that suits your circumstances, whether it’s term life insurance, whole life insurance, or a combination of both. Assess your financial obligations, such as mortgage payments, debts, and future expenses, to determine the appropriate coverage amount.

- Request quotes and speak to insurance agents: Reach out to insurance companies or agents to request quotes based on your desired coverage. Discuss your specific requirements and ask any questions you may have to ensure you fully understand the terms and conditions of the policy.

- Complete the application form: Once you have chosen an insurance provider, you will need to fill out an application form. Provide accurate and detailed information about your personal details, medical history, lifestyle habits, and any other relevant information. Remember to review the form carefully before submitting it.

- Undergo a medical examination, if required: Depending on the type and amount of coverage you apply for, you may be required to undergo a medical examination. This helps the insurance company assess your overall health and determine the risk associated with insuring you.

- Review and sign the policy: After the insurance company reviews your application, they will provide you with a policy offer. Take the time to carefully review the policy document, including the coverage details, premiums, exclusions, and any additional riders or benefits. If you are satisfied with the terms, sign the policy to initiate coverage.

- Pay the premium: Once you have accepted the policy offer, you will need to pay the premium amount as specified by the insurance company. Ensure you make the payments on time to maintain the validity of your policy.

Documents Required

When applying for life insurance, you will typically need to provide certain documents to support your application. Here is a checklist of the commonly required documents:

| Document | Description |

|---|---|

| Identification proof | A copy of your valid passport, driver’s license, or government-issued identification card. |

| Proof of address | A recent utility bill, bank statement, or any official document that displays your current residential address. |

| Income proof | Salary slips, income tax returns, or bank statements that demonstrate your income and financial stability. |

| Medical records | Medical reports, prescriptions, and details of any pre-existing medical conditions or treatments. |

| Beneficiary information | Details of the individuals who will receive the insurance proceeds in the event of your demise. |

Keep these documents handy during the application process to ensure a smooth and efficient experience. Remember to provide accurate and truthful information to avoid any complications or discrepancies in the future.

Understanding Premiums

Understanding premiums is a key aspect of life insurance for beginners. Premiums are the amount paid by policyholders to keep their coverage active, and they can vary depending on the type of policy and the individual’s risk factors. By understanding premiums, individuals can make informed decisions about their life insurance coverage.

Understanding Premiums When it comes to life insurance, premiums are the amount you pay to the insurance company to keep your policy in force. Understanding how premiums are calculated and ways to save on them is crucial when selecting a life insurance policy. In this article, we will discuss how premiums are calculated and ways to save on them. How premiums are calculated Premiums for life insurance policies are calculated based on several factors, including: 1. Age: The younger you are when you purchase a policy, the lower your premiums will be. 2. Health: Your overall health plays a crucial role in determining your premiums. If you have any pre-existing medical conditions or a family history of health problems, your premiums will be higher. 3. Lifestyle: If you engage in risky behaviors such as smoking or skydiving, your premiums will be higher. 4. Coverage amount: The higher the coverage amount you choose, the higher your premiums will be. 5. Policy term: The longer the policy term, the higher your premiums will be. 6. Insurance company: Different insurance companies have different pricing structures, so it’s essential to compare quotes from multiple providers to find the best premium rates. Ways to save on premiums While premiums are an essential factor to consider when purchasing life insurance, there are ways to save on them. Here are some tips: 1. Quit smoking: If you quit smoking, your premiums will decrease significantly. 2. Maintain a healthy lifestyle: Maintaining a healthy lifestyle by exercising regularly and eating a balanced diet can lower your premiums. 3. Choose a shorter policy term: If you don’t need coverage for an extended period, choosing a shorter policy term can lower your premiums. 4. Shop around: Comparing quotes from different insurance providers can help you find the most affordable premiums. 5. Bundle policies: Some insurance companies offer discounts if you bundle your life insurance policy with other insurance policies such as home or auto insurance. In conclusion, understanding how premiums are calculated and ways to save on them is crucial when selecting a life insurance policy. By implementing the tips mentioned above, you can save money on your premiums while still getting the coverage you need.Key Features And Riders

Life insurance is a crucial investment that provides financial security to your family in the event of your untimely demise. It is designed to pay out a lump sum or regular payments to your beneficiaries. However, selecting the right policy can be confusing, which is why understanding the key features and riders is essential. In this blog post, we will explore the benefits of riders and common riders explained.

Benefit Of Riders In A Policy

Riders are optional benefits that you can add to your life insurance policy for an additional premium. They provide extra protection and benefits that are not included in the standard policy. Here are some benefits of adding riders to your policy:

- Customization: Riders allow you to tailor your policy to suit your specific needs and requirements.

- Cost-effective: Adding riders to your policy is generally cheaper than buying a separate policy.

- Flexibility: Riders provide flexibility to adjust your policy as your circumstances change.

- Peace of mind: Riders offer additional protection and security, providing peace of mind for you and your family.

Common Riders Explained

Now that we know the benefits of adding riders to your policy, let’s take a look at some common riders and what they offer:

| Rider | Explanation |

|---|---|

| Accidental Death Benefit | Provides an additional lump sum payment if you die due to an accident. |

| Child Rider | Covers the life of your child and provides a death benefit if the child dies. |

| Disability Waiver of Premium | If you become disabled, this rider waives your premium payments while keeping your policy in force. |

| Long-Term Care Rider | Allows you to access your death benefit to pay for long-term care expenses if you become chronically ill. |

| Term Conversion Rider | Allows you to convert your term life insurance policy into a permanent policy without undergoing a medical exam. |

Adding riders to your life insurance policy can provide additional protection and benefits that are not included in the standard policy. Understanding the benefits of riders and common riders will help you make an informed decision when selecting a life insurance policy.

Comparing Life Insurance Companies

When it comes to securing the right life insurance policy, comparing different insurers is crucial. It’s essential to evaluate various factors to ensure you choose a reputable company that meets your needs. Here’s a breakdown of the criteria for comparing insurers and a look at some top life insurance providers.

Criteria For Comparing Insurers

When comparing life insurance companies, several important factors should be considered. These criteria can help you make an informed decision when selecting the right insurer for your needs:

- Financial Strength: Assess the insurer’s financial ratings to ensure they have the stability to fulfill their obligations.

- Policy Options: Look for a company that offers a range of policy options to meet your specific needs, such as term life, whole life, or universal life insurance.

- Customer Service: Consider the insurer’s reputation for customer service, as well as their responsiveness to claims and inquiries.

- Cost and Value: Compare premiums and benefits to determine the overall value offered by each insurer.

- Underwriting Process: Evaluate the ease and transparency of the underwriting process for obtaining a policy.

Top Life Insurance Providers

There are several reputable life insurance providers that consistently rank among the top in the industry. These companies are known for their financial stability, diverse policy options, and exceptional customer service:

| Insurance Company | Financial Strength Rating | Policy Options |

|---|---|---|

| XYZ Insurance | A++ | Term, Whole, Universal |

| ABC Life | A+ | Term, Whole |

| 123 Insure | A | Term, Universal |

Credit: www.aaalife.com

Making A Claim

When it comes to securing your family’s financial future, having a life insurance policy in place is crucial. But knowing how to navigate the process of making a claim can be daunting, especially during a difficult time. Understanding the steps to file a claim and tips for a smooth claim process can help simplify the procedure and ensure that your loved ones receive the support they need when it matters most.

Steps To File A Claim

- Notify the insurance company: As soon as possible, inform the insurance company of the policyholder’s passing.

- Complete the claim forms: Gather the necessary documents and fill out the required claim forms accurately.

- Provide supporting documents: Submit the death certificate and any other requested documents to support the claim.

- Wait for processing: After submitting the necessary paperwork, allow the insurance company time to review and process the claim.

- Receive the benefit: Once the claim is approved, the beneficiaries will receive the life insurance benefit.

Tips For A Smooth Claim Process

- Keep records: Maintain organized records of the policy details, premiums paid, and any communication with the insurance company.

- Understand the policy: Familiarize yourself with the terms and conditions of the policy to ensure compliance with the requirements for a successful claim.

- Communicate effectively: Stay in touch with the insurance company, and promptly respond to any requests for additional information or documentation.

- Seek assistance if needed: If you encounter any challenges, consider seeking guidance from a legal or financial professional to navigate the claim process effectively.

Maintaining Your Policy

Maintaining your life insurance policy is crucial for beginners who want to secure their future. By regularly reviewing your coverage, paying premiums on time, and keeping your policy updated, you can ensure that your loved ones are protected financially in the event of your passing.

Stay proactive and make informed decisions to maximize the benefits of your life insurance.

Maintaining Your Policy Regular review and updates To ensure that you have adequate coverage, you need to review your life insurance policy regularly. Life circumstances change, and you want to make sure that your policy keeps up with these changes. For example, if you have a new child or grandchild, you may want to increase your coverage. Similarly, if you have paid off your mortgage or other debts, you may be able to reduce your coverage. Regular reviews help you stay on top of any changes and ensure that you always have the appropriate level of coverage. Managing your policy online In today’s digital age, managing your life insurance policy has never been easier. Most insurance companies offer online portals where you can view and manage your policy. This includes updating your personal information, reviewing your coverage, and making payments. By managing your policy online, you can save time and ensure that your information is always up-to-date. In conclusion, maintaining your life insurance policy is essential to ensure that you have the right level of coverage. Regular reviews and updates allow you to keep up with any changes in your life and adjust your coverage accordingly. Additionally, managing your policy online makes it easier and more convenient to stay on top of your coverage. By taking these steps, you can have peace of mind knowing that your loved ones will be protected in the event of your passing.

Credit: www.dummies.com

Frequently Asked Questions

What Is The Simplest Way To Understand Life Insurance?

Life insurance provides financial protection to your loved ones if you pass away. Pay premiums, and in return, they receive a lump sum payout.

What Is Life Insurance For Beginners?

Life insurance is a financial safety net that provides a payout to your loved ones in the event of your death. It offers peace of mind by ensuring that your family is financially protected and can cover expenses like funeral costs, debts, and daily living expenses.

It’s a crucial step to safeguard your family’s future.

What Are The Three Main Types Of Life Insurance?

The three main types of life insurance are term life, whole life, and universal life. Term life provides coverage for a specific period. Whole life offers lifelong coverage with a cash value component. Universal life offers flexibility in premium payments and coverage.

What Is The Best Age To Start Life Insurance?

The best age to start life insurance is in your 20s or 30s for lower premiums and better coverage.

Conclusion

Life insurance is a crucial financial tool that provides security and peace of mind for you and your loved ones. Understanding the basics and choosing the right policy can seem overwhelming, but with the right knowledge, you can make informed decisions.

Remember to regularly review and update your policy as your life circumstances change.